|

Payroll takes a lot of time and energy out of small business employers. As anyone who regularly runs payroll will tell you, it’s not a simple matter of paying employees a check for the same amount every week or two. You have to make sure you take overtime, breaks, and tips into account so you don’t upset team members. And you need to stay on top of taxes and compliance to avoid getting fined by the Internal Revenue Service (IRS) for late or insufficient payments. That’s why it’s not surprising that many businesses use small business payroll software to help streamline their processes and make sure they’re error-free. We’ve created this guide to help you understand the top features and pros and cons of the best payroll tools available in 2023.** Plus, we give you tips on how to buy small business payroll software and the pitfalls to avoid. That way, you can start running payroll safely in the knowledge that you’ll stay on the right side of your employees — and the law.

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. Key features to look for in small business payroll softwareChoosing a payroll software solution can be overwhelming. But depending on the provider you select, the platform can take you from the beginning to the end of the payroll process — from the moment employees fill out and e-sign their tax documents to when you have to file payments and reports. So, let’s take a look at some elements you should prioritize while making the best choice for your business:

Our top pick for small business payroll software in 2023 (+ the rest ranked)Homebase is our top recommendation for small business owners who want to simplify payroll in 2023 — and integrate it with their other staff management tasks. Why? We offer:

And unlike many other tools we’ve included on this list, our pricing is transparent, so you can easily compare our paid plans before you make your decision. But Homebase isn’t the only payroll software solution out there. Here are the rest of our best picks for 2023:

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. Comparison chart: Top 10 small business payroll software in 2023

A breakdown of the 10 best small business payroll softwareNow you’ve seen a side-by-side comparison of the top payroll providers for small businesses, let’s look at each one in more detail to see what makes them stand out. 1. Best all-in-one solution: Homebase

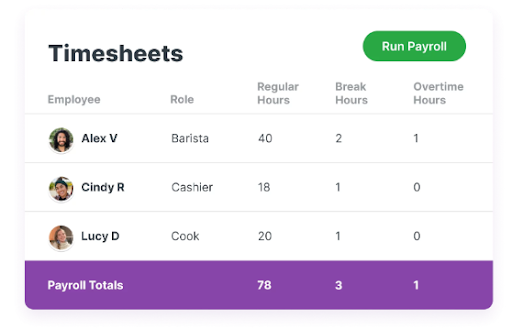

Source: https://joinhomebase.com/payroll/Caption: Homebase automates your payroll process so you can pay team members quickly and easily.Top features

Pros and consUnlike many other payroll tools on this list, Homebase’s free plan includes an unlimited number of employees. And while you have to pay most platforms for services like scheduling and time clocks, Homebase offers scheduling, time tracking, messaging, and hiring tools without having to upgrade. Homebase is also an all-in-one solution, which makes it perfect for small business owners who want to access all the tools they need in one place — and don’t have the budget for multiple platforms. And both managers and employees will love the fact that they can access almost all of Homebase’s features on the mobile app, too. However, Homebase doesn’t offer features for performance management or training and development. So if that’s what you’re interested in, it might not be the right fit for you. PricingHomebase offers:

You can add payroll onto any of those plans for $39/month and $6/month per active employee.

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. 2. Best for fast payroll processing: Run Powered by ADP

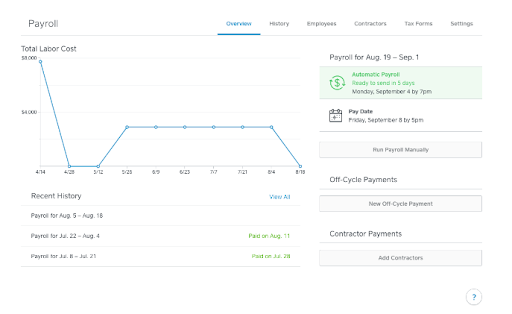

Source: https://www.adp.com/what-we-offer/products/run-powered-by-adp.aspxCaption: Run Powered by ADP helps small businesses schedule payroll and calculate and file taxes.Top features

Pros and consUsers find the feature to easily track and change employee addresses and direct deposit data very handy. Plus, it requests additional data that helps you maintain compliance and stay on top of taxes. However, its performance management and benefits mean it’s more suitable for companies with salaried employees, like accountancy firms, rather than agile teams in the restaurant or retail industries that employ hourly workers. Additionally, you have to switch to an ADP Workforce plan if you want to access ADP RUN’s features on its dedicated ADP RUN mobile app. PricingPricing information isn’t readily available on ADP’s website, but users say the Essentials plan starts at $79/month plus $4 per employee. 3. Best for direct deposits: QuickBooks Payroll

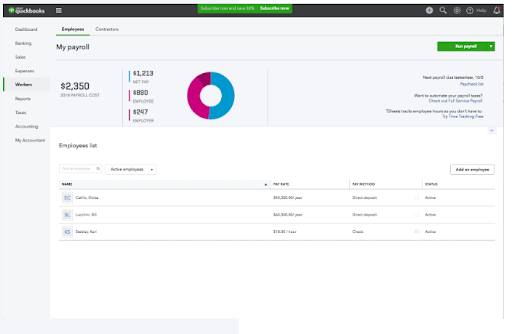

Source: https://quickbooks.intuit.com/accountants/products-solutions/payroll/Caption: QuickBooks Payroll lets you streamline your accounting, payroll, and HR workflows.Top features

Pros and consQuickBooks Payroll is an intuitive platform that lets you process payroll quickly and easily, even if you don’t have any accounting experience. The tool is regularly updated to comply with federal and state payroll tax laws, saving time and reducing the risk of errors. It also offers multiple payment options, including direct deposit, paper checks, and pay cards, making it easy for businesses to pay their employees. However, QuickBooks can be expensive, especially if companies need to upgrade to a higher plan as they grow. Another potential issue is the limited functionality of the mobile app, which may be inconvenient if users want to access payroll information on the go. PricingQuickBooks plans include:

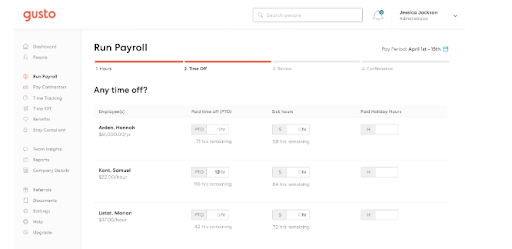

4. Best for accounting firms: Gusto

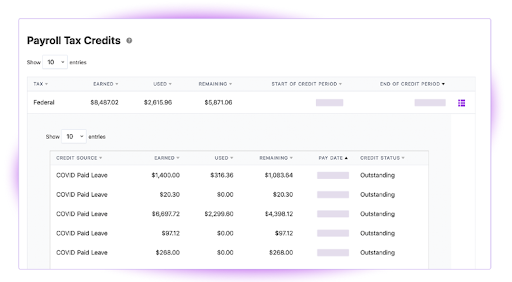

Source: https://gusto.com/Caption: Gusto is a payroll, benefits, and HR management software solution that helps you automate payments and file taxes.Top features

Pros and consGusto is ideal for small business owners in the accounting and personal finance industries since it offers benefits like revenue sharing, client discounts, and continuing professional education (CPE) credits. Another Gusto benefit is the Gusto Wallet app for employees, which lets them access, track, budget, and spend their paychecks. However, one drawback of choosing Gusto is that your costs will increase as you hire more staff. So, if your business has the potential to grow quickly, it might not be the best choice for you. PricingHere are Gusto’s plan options:

Businesses with more than 25 employees can contact Gusto’s sales team for a custom Premium plan quote. 5. Best value for money: Square Payroll

Source: https://squareup.com/help/us/en/article/6083-set-up-automatic-payrollCaption: With Square Payroll, you can run payroll, manage employee benefits, file payroll taxes automatically, and understand how your labor costs change over time.Top features

Pros and consSquare’s affordable, flat-rate pricing makes it great value and affordable for small businesses. Its payroll tool is easy to use and has time-saving features like automatic tax filing and compliance. It also integrates with Square POS so you can streamline data entry and reduce the chance of errors. However, Square has fewer customization options than some other payroll systems, and it doesn’t have HR features like performance management or benefits administration. So, while it’s a solid option for small businesses that require basic payroll management services, it may not be the best fit for those with more complex payroll needs. Pricing

6. Best for CPAs and bookkeepers: Patriot

Source: https://www.patriotsoftware.com/payroll/Caption: Patriot is an accounting and payroll platform with functions for accounting, payroll, time and attendance, and self-service HR management.Top features

Pros and consPatriot is easy to navigate, even for users with little payroll management experience. It’s also competitively priced, which makes it a good option for small businesses. Even better, it offers customization options that let users tailor the system to their needs and provides excellent customer service support via phone, email, or live chat. However, Patriot Payroll has limited integrations with other software tools, which might be a disadvantage for businesses that need it to fit with the rest of their systems. Additionally, it doesn’t offer HR features and only lets users pay workers through automated clearing house (ACH) or direct deposit, which could be inconvenient for those that use other payment methods. PricingPatriot’s pricing plans include:

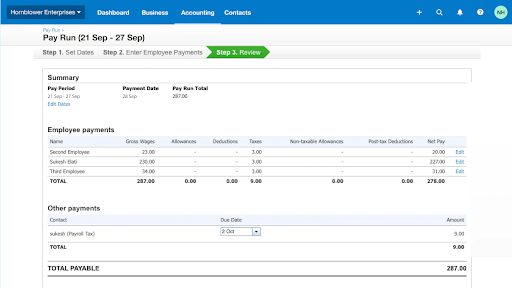

7. Best simple solution: Xero Payroll

Source: https://www.xero.com/my/accounting-software/payroll/Caption: Use Xero’s integrated Pay Run feature to pay employees, run pay reports, and manage basic staff information.Top features

Pros and consXero Payroll is ideal for small businesses who already use Xero as their accounting software as there’s no additional cost for using their payroll features. This is especially useful for growing companies that would otherwise have to pay an extra fee for each new team member. It’s also an easy-to-use tool that requires minimal training and setup. However, for more sophisticated payroll functionality, it’s better to integrate with another platform like OnPay or Gusto to take advantage of more advanced features. Additionally, its reporting could also be more visual and in the form of graphs and charts to make it easier to understand. PricingXero’s pricing plans all include free payroll software:

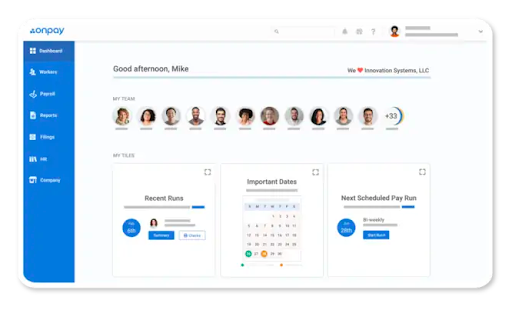

8. Best one-size-fits-all pricing plan: OnPay

Source: https://onpay.com/payroll/softwareCaption: OnPay handles day-to-day payroll processes quickly and easily.Top features

Pros and consOnPay is easy to use and offers excellent help center support. It also saves businesses time since employees create their own personal profiles within the tool, which they can then use to access their own tax documents and paystubs. And its specialized payroll services for companies like restaurants, farms, nonprofits, and churches make it ideal for organizations in those sectors. However, the lack of built-in time tracking means OnPay users need to integrate with another platform, which might deter those who want to stick with a simple solution. PricingOnPay offers a single paid plan with the same monthly fee of $40 (plus $6 PEPM) for all business sizes. 9. Best for tax calculations: Paychex

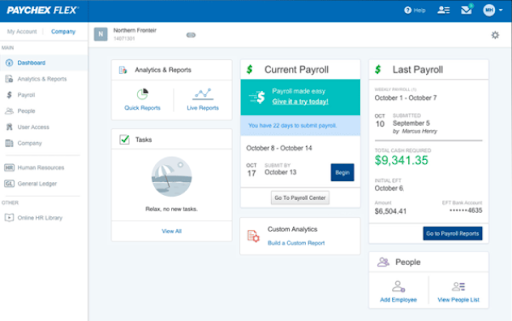

Source: https://www.paychex.com/Caption: Paychex lets you choose your payroll plan based on your company sizeTop features

Pros and consThe Paychex platform and customer support features make business owners’ lives easier since, in addition to self-service tools, it provides analytics on what employees use the app for most frequently. Paychex also offers a number of pricing packages, but it bundles HR, payroll, and time and attendance features separately, making it hard to work out the true cost of each tool. For small business owners who employ hourly teams or offsite workers on the move, the platform could do with more scheduling and communication tools. Pricing

10. Best for integrations: Rippling

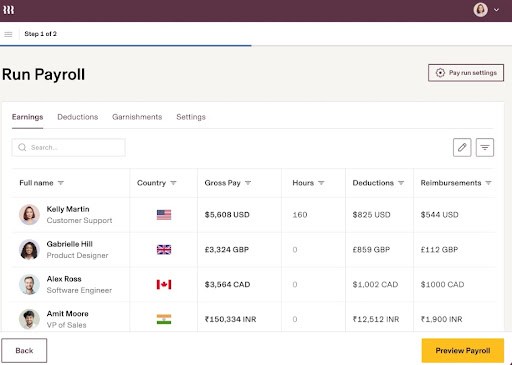

Source: https://www.rippling.com/payrollCaption: Rippling syncs all your HR data with payroll so you don’t have to manually enter data like hours or deductions.Top features

Pros and consRippling gives businesses a single space to manage all aspects of HR, IT, and finance, which helps prevent knowledge silos and miscommunication between departments. Its ability to pay employees in their local currency (following applicable compliance laws) is great for remote teams dispersed across the globe. Plus, the platform is very fast — it only takes 90 seconds to generate payroll. However, it’s not the cheapest solution on the market, and there’s no free trial, so customers don’t get the chance to try it out before making a final decision. It can also take a while to set up all the automation wizards, although they’re very useful and speed things up once you have them installed. PricingRippling’s pricing starts at $8 per user per month, but you’ll have to contact the sales team to get a custom quote based on the services you need. How to buy small business payroll softwareNow that you’ve read our breakdown of popular platforms for small business payroll, we hope you’re closer to making your decision. Here are a few other considerations to keep in mind. Determine your business’s payroll needsThis includes factors like the number of employees you have and where they’re located. If you have fewer than 20 staff members in just one state, you’ll have more options to choose from than if you have a bigger team spread across the US (or even worldwide). It’s also a good idea to think about whether you need to track employee hours and convert them into wages and timesheets or mainly work with salaried staff members. Research and compare available optionsUse the comparison table above to help you weigh up some of the best options on the market. For instance, not all payroll platforms have features like messaging or mobile apps for all users, which might be important factors for you. Consider the cost and pricing optionsThink about what your budget for a payroll tool is. Not all payroll software solutions have free plans available, and the more employees you have, the higher your monthly cost will be in most cases. If you have a dedicated team member responsible for payroll, you might only need a simple tool to help them work more efficiently. But if you’re wearing a lot of hats and doing payroll alongside other tasks (like the day-to-day management of your store), you might want a more advanced platform that makes your life as easy as possible. Evaluate customer support and security measuresNot all tools offer 24/7 customer assistance. If you’re a technical or accounting whiz, this might not matter. But having access to great customer support will improve your confidence as you set up, automate, and run your payroll processes. Security-wise, you want an absolutely water-tight system that keeps your employee data and bank details safe. Common pitfalls to avoid when using small business payroll softwareAs anyone who has processed payroll before can tell you, there are several unseen pitfalls you need to be aware of. To make sure your bases are covered when you’re working with a new payroll solution, keep the following potential errors in mind:

How Homebase takes the pain out of payrollRunning payroll can be a pain for small businesses, especially when you have a dozen other things to do — from managing staff to keeping customers happy and thinking about how you can grow sustainably. It’s no wonder small businesses look for payroll software to lend a helping hand. We’ve had a look at the ten best small business payroll software available in 2023 and found that Run by ADP is the standout choice for fast payroll options, while Gusto is best for accounting firms. For employee turnover, we recommend Xero Payroll. And Quickbooks is great for direct deposits. But for small business owners, Homebase is our number one pick. As well as offering a free plan, it’s easy to set up and use. Plus, our scheduling, time tracking, team communication, and hiring tools interact seamlessly with our payroll product, giving you an all-in-one team management solution that truly makes your life easier. With Homebase payroll, you can let us do the heavy lifting of figuring out payments, overtime, taxes, and compliance, which gives you back the time you need to focus on what really matters.

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. **The information above is based on our research on small business payroll software. All user feedback referenced in the text has been sourced from independent software review platforms, such as G2 and Capterra, in March 2023. The post 10 best small business payroll software in 2023 appeared first on Homebase. via Homebase https://joinhomebase.com/blog/best-smb-payroll-software/

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed