|

There are few things as frustrating to a small business as a poorly managed work schedule. Finding the best work schedule for your team is an integral part of your business’ success—not to mention your employees’ happiness—and creating a work schedule template using Microsoft Word is one of the simplest solutions you can choose. Here’s how to go about using Word in your scheduling (including our downloadable template), as well as other alternatives you may want to consider. But first, let’s dive into what makes a work schedule work for you. What is a work schedule?A work schedule is a list, calendar or table detailing the days and times when an employee is expected to work, and (in some businesses) which tasks they’ll be performing. A well-designed work schedule keeps your business properly staffed at all times, without overburdening any one person with too many hours and causing burnout. Work schedules can include flexible work hours, rotating shifts, fixed or split schedules and are used for both full-time and part-time work. There’s a lot of variety in work schedules across different kinds of businesses and industries. Where many customer-facing businesses will use standard schedules to operate five days a week and eight hours a day, other businesses will opt for an alternative schedule to maximize profitability, putting in time or offering services outside of typical hours. Work schedules reset either weekly, monthly, or with a different system, depending on which will best meet the needs of a business and its employees. Most common types of work schedules for small businessesWhile you can certainly go off-book, we’ve outlined some of the most common ways of working and shifts for small businesses below. 1. Hourly work schedulesAn hourly schedule template, sometimes called a daily planner template, plans out an employee’s day on an hourly basis. People working from home can especially benefit from using this scheduling approach, as can service businesses that assign people to specific tasks throughout the day and want to specify breaks. 2. Weekly work schedulesA weekly work schedule details a team’s work organization over a period of one week. A classic weekly work schedule template will include a column for employee names and assignments and columns for each day of the week, with or without weekend days depending on when a business operates. 3. Monthly work schedulesA monthly work schedule is a plan that lays out the tasks and goals that a team needs to accomplish within a given month. It visualizes the team’s priorities and is often used as a management tool to help supervisors allocate staff in the most effective way. 4. 24/7 work schedulesA 24/7 work schedule template keeps track of employees throughout an entire seven-day workweek. This kind of schedule is typically used in service businesses like manufacturing firms, senior care providers and security agencies, and ensures shift coverage at all times of the day. 5. Flexible work schedulesAlso known as flextime or flex schedules, flexible work is a work arrangement designed to give employees more control over their work-life balance and promote job satisfaction, while still meeting the needs of your company. Business owners or managers can set the minimum number of work hours expected, but employees can choose to clock in or clock out earlier or later than the set hours, as long as they fulfill the required total hours for a given period. And these days, of course, in-office businesses may let their employees choose a combination of in-person and remote work, approving people’s remote work requests for a certain number of hours or days each week. What are the benefits of creating a work schedule?Using a structured work scheduling system benefits both small business owners and their teams in several important ways. Here’s how effective employee scheduling keeps your business running successfully and smoothly: Streamline your business operationsBusinesses just can’t function effectively without everyone being in the right place at the right time. With a well-designed schedule, no tasks get overlooked or forgotten—you’ll always have the right people available, and the customer experience will remain consistently smooth. With less time wasted fixing problems like shift conflicts, you can put more of your time and attention into other parts of your business. Promote time blockingUnlike traditional to-do lists and planners, work schedules encourage time blocking—a way of managing tasks by chunking time into blocks, which are then allocated to an activity. Time blocking helps employees improve their focus and reasonably estimate the tasks they can do on a given day. Boost employee productivityEmployees perform best when they know what’s expected of them. When people are uncertain about their schedules, they’re apt to show up early, late, or not at all. Inconsistent or unpredictable schedules negatively impact employee morale, making it more likely that people feel like they’re failing at their jobs. Properly designed work schedules lead to a better work–life balance and measurably higher productivity. Increase employee satisfaction and decrease turnoverWith fair, predictable, and transparent scheduling, employees feel more satisfied that their needs are being met. They understand why they have the schedules they do, and they won’t end up feeling resentful about perceived favoritism if they get a less desirable shift at times. When you’re systematic about organizing shifts, you’re helping establish higher employee morale and correspondingly higher retention rates. Manage attendance issuesWhen you have unpredictable schedules, attendance issues are harder to spot: it’s not as easy to see patterns like an employee being consistently late on a certain day. An established work scheduling system means you’ll notice a team member who’s struggling to start on time—and take action to resolve punctuality issues—much sooner. Why use a work schedule template in Word?The moment you add a scheduling template to your scheduling process, you’ll find that the entire process of managing everyone’s shifts and tasks is much speedier. All forms of work schedule templates will help you make the process faster and more accurate than when you were starting from scratch. The familiarity, ease-of-use, and affordability of Microsoft Word makes it a great basic tool for creating your schedule templates. For small business owners looking to keep costs down, Word may be an especially appealing option. Sample work schedule template in WordTo create your work schedule template using Microsoft Word, get started by following these simple steps:

When making your initial template, be sure to include headings with the following basic information:

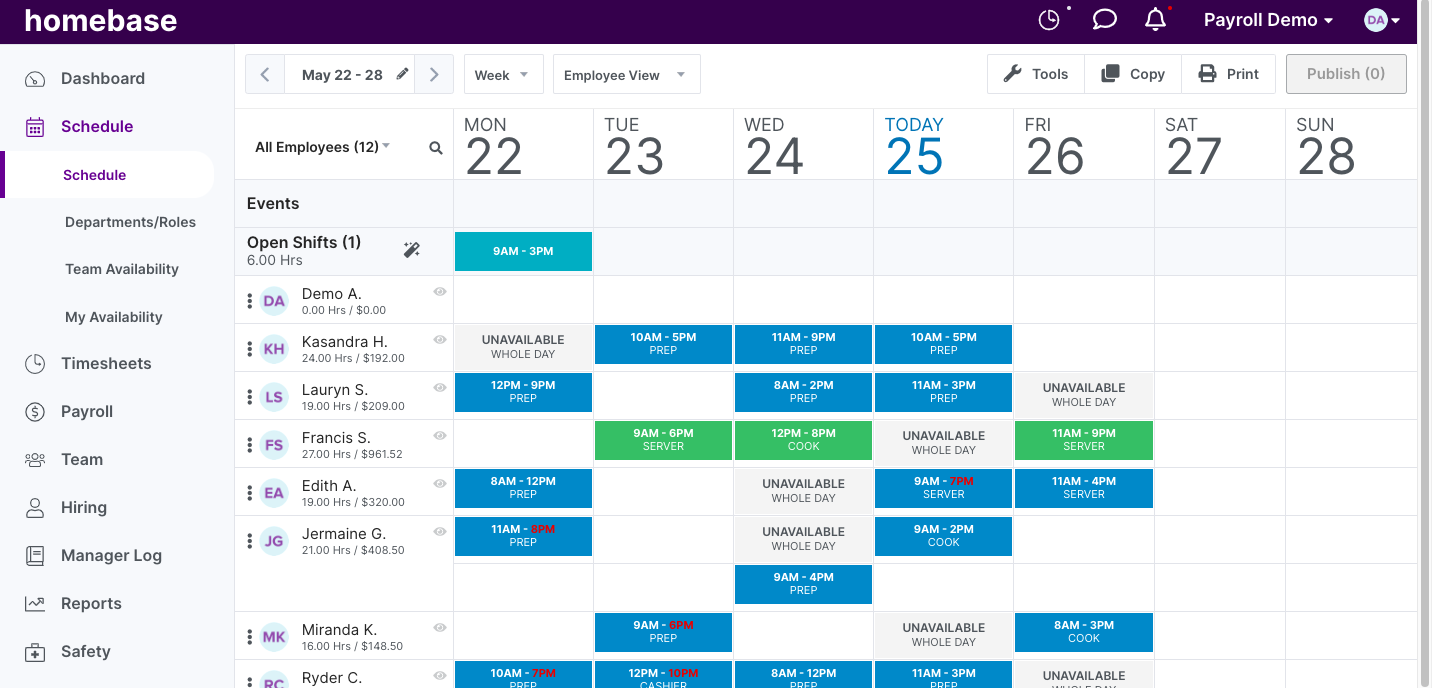

Once you’ve created your work schedule template in Word, store the custom-made template on your computer. When it’s time to make a new one, just open the file, fill it out, and save it by date under a new filename. Download a sample Word-based work schedule template here. The best types of work schedule tools beyond WordBeyond Microsoft Word, another kind of software or interface could also be a good fit for your small business. Alternative work schedule template tools include Excel, Sheets, and Google Docs. While manually created templates are a significant improvement to an ad hoc scheduling system, they’re still time-consuming and error prone. Plus, you can’t make quick edits or notify your team if rescheduling occurs. You’ll need to re-share info or let your team know in someway. Then you’ve got to ensure everyone’s actually seen the changes. A hassle? You bet. Tracing older spreadsheet versions can also become a hassle. As spreadsheets can be edited by anyone with access, it can be hard to see which team member made the most recent changes. Even if your online spreadsheets have a version history, they’re usually downloaded and then forwarded using email. Another thing to consider is technology preferences and user-friendliness. More and more, mobile devices are the expectation, and manual templates can quickly start to feel like an inconvenience. Work schedule templates using Word and similar tools may accommodate the needs of a single-location business or a small team… But once your team expands, or you begin scheduling workers across multiple locations, you may find they no longer meet your needs. Schedule your hourly workers with HomebaseThat’s where Homebase’s employee scheduling tool comes in—starting with our free weekly schedule template. Making the switch away from old-school spreadsheets may seem daunting. Luckily, Homebase was built with small business owners like you in mind. Homebase is quick to onboard and intuitive enough to learn with minimal guidance. Once you input your team members’ roles, availability and preferences, Homebase’s free employee scheduling feature lets you create weekly schedule templates automatically. By automating your schedules with Homebase, you’ll easily avoid shift conflicts. You’ll reduce the time and effort you put into your scheduling process. And it’s easy to make smooth last-minute changes when someone calls in sick. What’s more? Our free plan also includes tools for time tracking and clocking in and out. Plus, keep your team in sync with our free, in-app team communication tool. For small businesses looking for an efficient, affordable way to approach scheduling strategically, Homebase is the ideal scheduling solution to optimize your business and keep your team happy. The post How to Create a Work Schedule Using Word appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-employee-work-schedule-template-in-microsoft-word/

0 Comments

Keeping employees engaged, organized, and productive on a daily basis can be a major challenge for small businesses. And it’s not necessarily the employee’s fault. Some 48% of employees questioned in a recent Wrike survey report that they’re productive less than 75% of their working day. While it might be tempting to blame the employees for a lack of productivity, the issue often stems from a lack of organization and direction from the business and managers. Employees need—and want—to be given direction and structure in their daily work. This means giving them a north star and a goal to work towards, even if their tasks are fairly similar day-after-day. One way to do this is by providing daily schedules that highlight and assign priority and recurring tasks to employees. This article will walk you through the concept of a daily schedule, and offer actionable advice and guidelines for how to create your own. What is a daily schedule template?A daily schedule template is a pre-built document that can be used to schedule daily tasks for your employees during their designated shifts. It outlines everything that needs to be accomplished during a work day and assigns those tasks to each on-duty employee, making it easier to plan tasks and manage time efficiently. Daily work schedule templates include information like:

The goal of a daily shift schedule is to highlight all important to-dos and milestones in the work day, and ensure essential tasks are assigned to the appropriate workers. This helps employees stay organized and focused on the most important tasks during their respective shifts. There are two ways to organize daily schedules. First is to create a single, master daily schedule that applies to all workers during a given day. Second is to create individual daily schedules for each employee that contains tasks that are specific to that worker. Ideally, both options should roll up into a single master schedule that ticks off all required to-dos for a given week or month. Daily work schedule templates can be created in a simple Word or Excel document, or they can be created through digital scheduling platforms that employees can access and review at any time. What are the benefits of daily schedules for hourly workers?Organization, predictability, and better time management are the three main benefits of daily schedules for hourly workers. They ensure all workers know what is expected of them during a shift, and that they have a clear understanding of what a complete day of work looks like. Depending on the specific job, this level of organization and predictability is essential to remaining productive. According to Quickbooks, about 62% of U.S. workers and 96% of Canadian workers who track their time categorize it by job, task, project, client, or miles traveled. This indicates a significant amount of variability in what is expected of workers on a daily and weekly basis. Scheduling this helps to ensure that all workers know what is expected of them, and when. Benefits of daily schedules for hourly workers

As a result of the above, employees are empowered to be more productive and accountable during their respective work shifts, helping them become more focused and impactful. This, of course, benefits the business as well by ensuring that all workers are achieving what’s required to move the business forward. Ensuring all employees have visibility into a master daily schedule is important. Add in the individual schedules for their co-workers and compound these benefits even further. By doing so, employees can coordinate and resource share to ensure tasks are completed on time. They can help to find redundancies in the work schedule, overlapped efforts, and collectively ensure that no essential tasks are missed. How to effectively use daily schedules for your teamWhatever daily schedule template you use should effectively communicate and track daily tasks that your team needs to complete. That means that it both needs to be structured in a way that’s clear and easy-to-ready, but also thorough enough that it includes all relevant information. More specifically, daily schedule templates:

Achieving the above is easier said than done, which is why a template is so important. This gives you a consistent and reliable framework for organizing and assigning tasks that all workers intuitively understand. Templates cover the presentation piece, but not the time management side of the equation. This requires effective time management and workforce scheduling skills that can take some time to perfect. Effective workforce scheduling requires the following: Identifying and defining available timeThe opening and closing times for the business comprise the daily time block that you have to work with. This is segmented into specific shifts for each worker, who has their own individual time blocks to complete their assigned tasks. Scheduling essential actionsRecord all must-do tasks during the day. This includes all recurring tasks, and one-offs that need to be covered during the day (like a product delivery). Estimate how long each of these tasks will take. Assigning time blocksTake those tasks and completion times, and assign them to specific employees to cover during their shifts. Ensure time-sensitive tasks—or those with a specific time stamp—are covered by the appropriate shift worker. Scheduling contingency timeEnsure that there are blocks of time during the shift that are available for standard customer support, emergencies, or a surge in customers. Try not to overload employees with to-dos, since they also need to maintain great customer service. You can also schedule discretionary or “free” time that employees can use to complete work they’ve either fallen behind on, or that helps to move the business forward. Analyzing performance and seeking feedbackScheduling is an ever-evolving and fluid operation. It helps to keep communication open with your team to identify opportunities for improvement. Adapt the schedule as problems rise. Armed with these tips, you can begin to create a daily schedule that you can test in the wild with your team. Steps to creating a daily scheduleNow that we’ve talked about best practices and key considerations for creating a daily schedule, let’s walk through the steps sequentially.

The above steps outline how to create a daily schedule that’s prioritized by time. It spreads tasks evenly over the course of the day, ensuring that all staff have specific to-dos to complete. Priority vs. deadline task managementTwo other options that you can consider include:

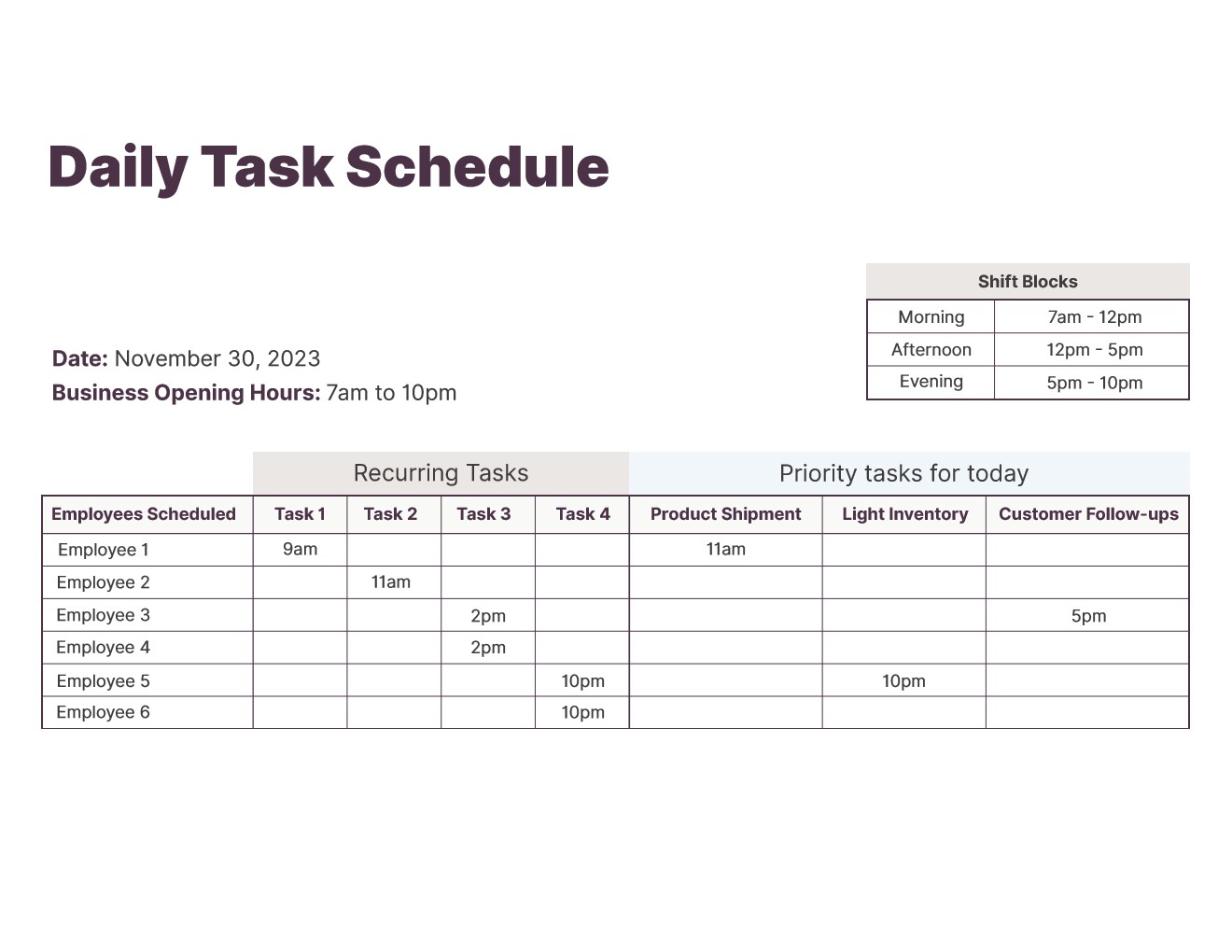

Every business is a little different, which means every daily schedule strategy will vary. It’s important to experiment with different daily schedule templates and frameworks to ensure that you are optimizing your workforce as effectively as possible. Templates are a great place to start, but they often require refinement as you discover what works, and what doesn’t. Sample daily schedule templateDaily schedules can be created using a variety of tools, including Word, Excel, Google Sheets or Docs, PDF templates, or an employee scheduling software like Homebase. Regardless of the tool, daily schedules should include the following information. We’ve filled out some time blocks and shifts to illustrate how each column and row comes together.

This is an example of a free daily schedule template that chunks out the day into time blocks. Then, you can assign tasks based on who’s working. An alternative approach is to start with a list of priority tasks, then assign from highest to lowest based on who’s working early versus later in the day. This template can be built out of the platform of your choice. Or, use a scheduling platform like Homebase to build structured and easy-to-follow daily schedules for your team. Use Homebase to create your daily schedulesWith Homebase, managers and business owners can build and update their daily schedules from anywhere for any number of employees. Because the schedules are available through an online application, employees can access and view their daily schedules at all times. Want to try Homebase for daily scheduling? Get started for free. The post Improve Productivity with this Free Daily Schedule Template appeared first on Homebase. via Homebase https://joinhomebase.com/blog/free-daily-schedule-template/ The information recorded on a time card is more than just data. It adds up to real cash for employees, and an expense for the business. That clock-in and clock-out data informs timesheets that track employee working hours and tasks completed, which in turn informs payroll and compliance with labor laws and performance expectations. It matters to your business how that data is collected, and what tools you use to do so. And all of that starts with an unassuming time card. This article will walk you through why these little “cards” are important, and how you can make the most out of them.

What is a time cardA time card is a tool used to track and record the hours that employees work—specifically, when they clock in and out for their shift. A time card is either a physical card or device, or can be built into a software application. Time cards are designed to keep a record of an employee’s working hours. This record is then synced to a timesheet, informing payroll, shift scheduling, and general workforce management. This is an essential process and tool for businesses who employ hourly workers. It helps them track when employees arrive and leave, how many hours they’ve worked, and who was absent for their shifts. All of this helps businesses properly manage their workforce and financial obligations. Time cards, and the associated time clocks or timesheets, have been around for centuries (not quite as far back as the Flintstones would have you believe, but not far off). And that’s with good reason. They’re an effective way to track and manage hourly and shift workers, and are a popular tool in industries like construction, manufacturing, retail, hospitality, and more. How does a time card work?Time cards work by tracking the amount of time an employee spends working. When an employee arrives for their shift, they clock in. That starts the timer on their shift. When they leave, they clock out. They may also clock out for breaks during their shift. Once a clock in and out is in the records, a time clock or time sheet then calculates how long that employee worked for, and when. An identification assigned to the card makes a connection between that time data on the card, and the employee files in the payroll and scheduling system. This data is used to calculate payroll for the defined pay period, track how long each employee has worked in a given week, and to identify any absences that occurred. It also helps companies ensure that employees are arriving and leaving on time, and that they’re taking the required breaks. What data is on a time card?Time cards contain both variable and constant data. That is, each card contains information about an employee that does not change over time, and variable data related to specific shifts and pay periods. Variable data found on time cards includes:

Constant data on a time card includes:

This data coincides with fields in the timesheet or time clock, allowing administrators to easily populate their records with the appropriate variable data for each individual employee. 4 types of time cardsYour time clock largely dictates the type of time card you use for your business. Or, more specifically, how you get the information that’s on the time card into your time clock. Back in the day, employees or employers would physically input information onto a card, and then manually add that to a time clock or timesheet. As technology progressed, that process became digitized, allowing for immediate syncing between the time card and associated applications. Here are the four main types of time cards that small businesses have used over time:

While the technology behind time cards has changed significantly over time, the general concept remains pretty much the same—employees clock in, and out, and that information is recorded into the company’s systems. 5 benefits of time cardsTime cards are a valuable and reliable tool for both employers and employees. They help both parties keep tabs on time spent at work, ensuring clear and transparent payment. Here are some specific benefits of time cards for small businesses. 1. Improved employee productivityAs mentioned, time cards allow employers to track and monitor how long employees are working, and during what times. This helps them ensure they’re adequately staffing their businesses to maintain peak capacity and productivity at all times. In some cases—such as time cards for contractors—employers can also track how long specific tasks and projects are taking. Again, this data allows employers to adjust their staffing levels and employee scheduling accordingly. Armed with data, employers can flag instances where tasks or outcomes aren’t attained, despite adequate hours being worked. This is a useful rudder to help manage employee productivity. Lastly, time cards help to ensure that employees are accountable for the number of hours they work by creating an objective record of clock in and out times. This, combined with tracking task completions and employee impact, ensures that workers aren’t taking unsanctioned overtime hours to complete their work. 2. Easier attendance trackingHaving a clear record of when employees start and end their shifts encourages workers to be punctual and accountable for their own shift schedule. Employers receive a clear record of how often employees arrive on time or late, and how often they leave early or late. This information can be used to inform disciplinary action, to adjust workforce scheduling, or to offer flexible scheduling options for those employees who may be struggling with multiple commitments. For the employee, this record also ensures that they have a clear “paper” record of when they worked, ensuring they can hold their employer accountable in instances of inaccurate pay or other disputes. 3. Proven compliance with regulationsEach region, state, and country has their own labor laws related to the total number of hours employees are allowed to work in a day and week. These laws also dictate breaks and overtime. Time cards help employers collect all relevant data about employee working hours to ensure they are in compliance with all relevant labor laws and regulations. This data is invaluable in the case of an audit, lawsuit, or other inquiry. But, it’s also helpful to ensure all employees are working within the regulatory requirements for your region at all times. 4. Informed scheduling and labor planningYou can take the records from a time card and cross-reference them with sales and customer foot traffic data (or any other relevant performance and productivity metric). This helps inform intelligent workforce scheduling. For example, retailers can use their point of sales platform to identify their peak time periods during a given week. They can then cross-reference that data with their time card information to see if they are scheduling the appropriate number of employees during those times. If not, the company can adjust their schedules accordingly. 5. More accurate payroll and invoicingAs we’ve mentioned a few times so far, time cards help employees and employers keep an accurate tab on total hours worked. Once you have the data, apply it against the employee’s pay rate—and within a defined pay period—to inform how much money they’ll receive on the upcoming payday. Drawbacks of using physical time cardsOf course, time cards aren’t without their faults. This is especially true when using physical time cards that require a manual process to upload data to timesheets and payroll documentation. Not only does this require additional time and resources—both of which cost the company money—the process is inherently prone to human errors. Potential issues associated with physical time cards:

While time cards are a tried and tested solution for track employee hours, they’re not perfect. Technology has progressed to the point where all of the best parts of time cards are available within a holistic platform that makes this process easier and more centralized. The ideal time tracking platform integrates all of the functions outlined in this article so far with your payroll, accounting, and scheduling software to help make end-to-end employee time management and compensation easier. Why businesses should consider a time card appTime cards apps typically double as time clocks, ensuring all data is integrated and centralized. In addition to allowing employees to clock in and out from their own devices—and tether that data to the employee’s file—time clock apps also offer the following benefits.

All of these above helps make time tracking more accurate, secure, and streamlined than traditional time cards. Try Homebase: your all-in-one time card and time clock appHomebase is the best free time clock app for small businesses and hourly teams. It’s an all-in-one team management tools that includes and integrates:

With the Homebase time tracking app, employees can either clock in or out from their mobile devices once they arrive at work, or use a tablet, computer, or POS device that you have set up for this purpose. From there, you’ll have everything you need to track their hours, breaks, overtime, time off, and pay. Ready to try Homebase for time tracking? Start now for free. The post What are time cards? And why should small businesses use them? appeared first on Homebase. via Homebase https://joinhomebase.com/blog/time-card/ As a small business owner, you may be bogged down by your to-do list. From managing your team’s schedule to ensuring your workers get paid on time, it can feel overwhelming to handle all the moving parts of your business. Fortunately, there are now more apps than ever to help streamline day-to-day tasks—but choosing the best options can be challenging. So: how can you narrow down the best apps for your small business? We’ve rounded up the most useful apps for small businesses and arranged them by category, making it easier for you to choose the tools you need most. Follow this guide to find out how you can lean on technology to run your small business, all from the convenience of your mobile device. Best apps for small business accountingFor some small business owners, accounting can be nothing but a headache. But with these user-friendly apps, keeping track of invoicing, expenses, and payroll has never been easier, making your business’ bookkeeping a breeze. QuickBooks OnlineQuickBooks Online has become a household name for a reason. Making Forbes’ list of Best Accounting Software For Small Business in 2023, this comprehensive accounting app is as straightforward as they come. With four monthly subscription options starting from $9 per month, there’s a customizable plan to suit every small business’ needs. The cloud-based accounting software provides the flexibility to manage all accounting tasks from anywhere with internet access, keeping your business’ books at your fingertips. Key features

If you’re new to the accounting world and need some guidance, Quickbooks Online provides a free onboarding call with one of their experts, as well as a free 30-day trial to see if it checks all your bookkeeping boxes. But when you subscribe, look out for extra costs once you surpass the 3-month introductory period. FreshBooksKnown for its ease-of-use and outstanding customer service, FreshBooks is a must-have accounting app for small businesses. According to NerdWallet, this cloud-based accounting tool is best suited to freelancers and independent contractors. It offers customizable invoicing features and automatic time tracking that comes with all four plans, ranging from $17 to $55 per month. If you’re juggling many clients, payment deadlines, and more, this intuitive online tool can streamline your accounting tasks without the steep learning curve. Key features

With substantial functionality and an intuitive interface that’s easy to navigate, this app is perfect for small business accounting. But it’s not the best fit for larger companies and teams due to some feature limitations. Best invoice app for small businessUsing an invoice app will simplify your small business’ billing processes. Keep your accounts receivables organized and ensure you and your team get paid on time. WaveAs one of the only free invoice apps on the market, Wave will save your small business time and money, especially if you’re just starting out. This straightforward mobile app offers all the benefits of hiring an accountant without the overhead costs. Key features

If you’re a freelancer with multiple clients but only require basic invoicing features, Wave’s free tier is a great fit. The mobile app also offers optional paid features like payroll software and personalized guidance from in-house advisors when you’re ready to level up. Best payment app for small businessThe ability to send and accept online payments quickly and securely is a key requirement for most small businesses. The best payment app offers lower transaction fees, improved efficiency, and robust security features. PayPalNamed as TechRadar’s best online payments app, PayPal is like a trusted friend when it comes to making and receiving electronic payments. It’s free to open a business account, but this accessible platform also offers paid features when your business is ready to grow, making it one of the top options for startups. With a user-friendly interface and strong encryption technology to keep your data protected, PayPal is best used for securely processing credit card payments and streamlining the daily operations of your small business. Key features

Keep in mind, there are some fees when business owners accept payments through PayPal: 1.9%–3.5% per transaction, plus a fixed fee of between 5–49 cents, as well as a bank account instant transfer fee of 1.75% ($25 maximum). Best time management apps for small businessManaging your team’s time can be overwhelming, especially when dealing with multiple schedules. The best time management apps help your small business maximize productivity, ensuring you meet deadlines while reducing the stress of your team. TeamdeckTeamdeck is a resource management app known to be easy-to-use. With a streamlined scheduling tool and a distraction-free interface, this app offers an employee-friendly experience. Ideal for small businesses in the tech and creative industries, this platform is priced as low as $3.99 per team member per month, including access to a simple resource calendar without the hassle of manual tracking. Key features

Teamdeck’s comprehensive time management solutions can help generate scheduling stability for your small business, but some users find the app lags while using certain features, and the onboarding process can be time-consuming. HomebaseWhen it comes to time management apps, Homebase is one of the most user-friendly options for your small business, whether you’re in the retail, hospitality, education, or beauty industry. Their Basic plan includes timesheets, time clocks, scheduling, and a messaging feature for up to 20 employees—and is completely free! If you’re ready to take the hassle out of managing your team’s hours, Homebase is your all-in-one tool. Simplify hourly work with a time-saving solution for business owners who dread paperwork. Key features

Best time tracking apps for small businessIn the business world, time is money, so choosing the best time tracking app is a crucial decision. Gone are the days of manually tracking your employees’ time on the job. These apps decrease the margin of error, while simplifying overall operations. ClockifyClockify is a solid option for small businesses looking for a full-featured, cloud-based time tracking app that also handles attendance and project tracking. It’s free to sign up for their most basic features, but if your business requires more time tracking solutions as it grows, the paid tier starts at $3.99 per month per user, billed on an annual basis (and $4.99 for monthly billed subscriptions). Key features

While Clockify offers comprehensive access to core features for free, the mobile app comes with some challenges, such as slower processing times, glitches while in offline mode, and risk of losing data due to synchronization issues. HomebaseAs a workforce management app designed for small businesses, Homebase is the top choice for time tracking. Free online timesheets take the guesswork off your plate while saving you money, automatically calculating hours, breaks, overtime, and wages. Plus, Homebase’s built-in labor law alerts ensure your schedule complies with federal, state, and city laws. Key features

Homebase’s user-friendly interface and option to ask a certified HR Pro for guidance when you’re stumped will help optimize your small business. Best marketing app for small businessEffective and strategic marketing is key for the growth of any small business. To cut through the online noise of saturated markets and stand out in the crowd, your small business should lean on the support of a marketing app. MailchimpIf your small business wants to level up its marketing strategy through an email campaign, look no further than Mailchimp. This all-in-one marketing platform allows you to create newsletters to boost your reach, distributing them to audiences you curate. Mailchimp offers a free tier to get your foot in the door, plus 3 paid plans with more advanced features, starting at $13 per month. Key features

Since its launch in 2001, Mailchimp has had time to work out kinks and optimize functionality. But keep in mind that they limit the number of emails users can send per month, depending on the tier. Best scheduling apps for small businessA chaotic scheduling system can be a barrier to the growth of your small business. Finding the best scheduling app to suit your team’s needs will not only boost the efficiency of your operations, it will also keep your employees organized and happy. SlingFor employee scheduling made easy, Sling helps you create, update, and manage various types of shift schedules. Thanks to its practical design and effective time tracking features, Sling is a great option to schedule hourly workers in industries like retail and hospitality. Key features

Sling’s free tier offers basic scheduling functionality, with their premium package starting at $1.70 per user per month, and their business package at $3.40 per user per month. HomebaseFor a go-to tool that prioritizes employees, try Homebase as your scheduling app, named one of the best free employee scheduling softwares of 2023. Homebase is free for unlimited employees (one location), with plenty of integration options. The platform will also send updates to your team through in-app, text, or email alerts when schedules are adjusted. Key features

Best inventory app for small businessChoosing the best inventory app for your small business will make it easier to manage operations on the go. If you need to scan incoming and outgoing products, check stock levels, and generate sales and purchase orders, you’ll need to defer to the right inventory app. SortlyThe Sortly inventory management app offers barcode scanning and supports QR codes, giving your small business more flexibility. As a full-featured inventory control system, prices start with a free Basic plan, going up to $59/month for their Ultra package. Key features

Summary: Best small business management appThe best small business apps offer simplicity and efficiency so you can improve your productivity, regulate your operations, and relieve your burdens, even from your mobile device. Whether you’re running your business from a remote office on a Bali beach, or you’re in the thick of things on site, it’s beneficial to lean on technological solutions. Apps will automate your processes while saving you valuable time and money. Homebase can help carve the way to success for any small business. With a diverse range of solutions to clean up your processes, you can focus on running an efficient team, all while keeping your employees on track. By simplifying time management, streamlining time tracking, and organizing your team’s schedules, Homebase is a vital tool for all small business owners. Elevate your small business with Homebase. Get started for free today. The post 2024’s Best Apps for Small Business appeared first on Homebase. via Homebase https://joinhomebase.com/blog/best-small-business-apps-2024/ With a limited number of hours each day, making the most of your time as a small business owner is crucial to your success. That’s why more and more businesses are turning to scheduling apps to streamline operations and minimize human error. The best part? Many scheduling apps offer all the necessary features to run your business efficiently, without costing you a dime. Whether you’re looking for seamless scheduling, precise time tracking, or improved team coordination, these free scheduling apps will help you get there.

What is a scheduling app?A scheduling app is a digital tool that helps small businesses manage and organize appointments, meetings, employee shifts, and other noteworthy dates. These apps eliminate manual scheduling processes prone to human error, enhance customer experience, optimize employee scheduling, and streamline operations. Why should small businesses use a scheduling app?Small businesses often operate with lean teams, meaning they understand the crucial role of operational efficiency. Despite having a small but dedicated workforce, there’s only so much time in a day. Scheduling apps can ensure your team makes the most of every hour. Take a moment to consider how much time the following scenarios take out your team’s day and you’ll understand just how indispensable a scheduling app can be for your small business. Appointment bookingWhether your business is a salon, spa, medical clinic, or restaurant, a scheduling app will simplify the entire booking process. Without any involvement from your team, your clients can easily view your availability, book or reschedule appointments, meetings, or reservations, and even cancel, if necessary. Putting the power of scheduling in the hands of your employees not only improves the customer experience, but also frees your team up to work on more important tasks. Employee shift managementManaging the schedule of hourly employees across healthcare facilities, retail stores, and restaurants is no easy feat. Luckily, scheduling apps simplify this process by allowing you to effortlessly allocate shifts, monitor attendance, process time-off requests, and efficiently manage your workforce—all from the convenience of your mobile device. Team coordinationWhether you have multiple team members working on distinct projects or need to delegate tasks and appointments, scheduling apps with team collaboration features guarantee everyone stays on the same page. Keeping these conversations within the app promotes organization and establishes a clear separation between work and personal discussions, ensuring things stay professional. Data-driven decision-makingScheduling apps aren’t just crucial for efficient time management, they also provide valuable analytics. From tracking customer trends to evaluating workforce efficiency, these apps offer a wealth of data-driven opportunities to enhance your business. Small businesses can utilize these insights to optimize resource allocation, enhance overall performance, and make informed decisions. Types of scheduling apps to considerEvery small business is unique and comes with its own set of specific requirements, which is why scheduling apps come with a variety of features. Below are the three primary types of scheduling apps for small businesses to consider. Employee scheduling apps

Appointment scheduling apps

Personal scheduling apps

What to look for in a scheduling app for a small businessAs you sift through the available scheduling apps, it’s important to choose one that aligns with your business’s unique needs. While the specific requirements may differ, scheduling apps equipped with these essential features will help your business achieve its full potential. User-friendly interfaceWhether you’re looking for a solution to help with employee scheduling, appointments, or both, your scheduling app needs to be easy to navigate for both your team and customers. Otherwise, you’ll be fielding endless calls with questions, which defeats the purpose of utilizing a scheduling app in the first place. Most apps have a free trial period, so take the time to test it out before launching it across your business. Appointment remindersService-based businesses should also ensure that their scheduling app of choice sends automated reminders through email or SMS. Not only are SMS reminders convenient and personable, but they also reduce missed appointments. Team collaborationFor effective coordination, employee scheduling apps should also provide some form of team communication. This enables you to assign shifts, tasks, and appointments (even on short notice), without leaving the app. Payment processingAlong with appointment reminders, service-based businesses should opt for a scheduling app with online payment processing or payment integrations. By implementing a system that requires clients to provide payment information in the app, you can streamline the payment process and safeguard your business against no-shows, which cost the average small business over 21% of its total revenue. Integration capabilitiesTo streamline workflow and enhance efficiency, ensure the app you choose integrates with the business tools you already use, like your POS system and payroll processing. By ensuring compatibility with your existing systems, you can supercharge your workflow and significantly enhance overall efficiency. 5 best free scheduling apps for 20241. CalendlyCalendly is a versatile scheduling and appointment booking app for individuals and businesses. It streamlines appointment and meeting scheduling by allowing users to share their availability, making it an ideal tool for small businesses. Pros

Cons

Key features

Overall impressionWhile the free plan covers basics, paid plans offer advanced features that can benefit small businesses. Overall, Calendly is a valuable asset for small businesses aiming to enhance scheduling efficiency and reduce administrative tasks. 2. SetmoreSetmore is a scheduling app designed to simplify the booking process for businesses. Its simple online scheduling platform allows businesses to conveniently connect with their customers and manage appointments. Pros

Cons

Key features

Overall impressionSetmore is a solid choice for small businesses looking to enhance their scheduling and appointment management. However, its free version comes with limitations, and premium features may not be budget-friendly for some users. 3. SimplyBook.meSimplyBook.me is a comprehensive appointment scheduling app designed to streamline reservation processes for a wide range of service-based businesses. Pros

Cons

Key features

Overall impression

|

| Scheduling app | Features | Considerations | Pricing |

|---|---|---|---|

| 1. Homebase | • One click auto-scheduling • Unlimited schedule templates • Robust free communication tools • Self-scheduling features (the ability to post open shifts and allow for shift swaps) • Integrations with time tracking and payroll features |

Best all-in-one solution that prioritizes employees, but not a comprehensive HR management tool. | Free plan for one location; paid plans range from $24.95 to $99.95 per month. |

| 2. Deputy | • An all-in-one employee scheduling, timesheets, tasking, and communication platform • A focus on analyzing staffing data |

Good for small to midsize businesses who prioritize efficiency, but who lack skills/ time to analyze scheduling trends themselves. | Paid plans range from $3.50 to $4.90 per user per month. |

| 3. Planday | • Granular hierarchy options to structure employees into groups/departments • Visualize and organize your employee management with sections, positions, shifts, and shift types |

Ideal for businesses with multiple departments or locations. | Paid plans start at $2.49 per user per month for one location and basic scheduling features; Plus plan starts at $94.80 per month. |

| 4. Sling | • Employee directory • Team newsfeed • Self-scheduling (with options for first come, first served or admin approval policies) |

Suitable for basic day-to-day employee management. | Free plan with unlimited employees and locations; paid plans range from $2 to $4 per employee per month. |

| 5. ZoomShift | • Good capability for a smaller workforce • Group announcements, push notifications, and Intuit QuickBooks integration |

Works for managers who want a minimalist, reliable scheduling app with a minimal learning curve. | Plans start at $2 per user per month for basic scheduling features and unlimited locations; the Premium plan is $4 per user per month. |

| 6. Connecteam | • Strong all-in-one employee scheduling app Highly granular settings • Task management • Custom forms and checklists |

A top all-in-one solution, but costs rise as your team grows. | Free plan for up to ten users; paid plans range from $35 to $119 per month (for the first 30 users, then additional fees apply). |

| 7. Clockify | • Calendar management • Time tracker with a range of web integrations • Idle detection and timed reminders |

Range of features available in free plan, but requires you to export to payroll software and fix errors manually. | Free plan for time tracking features; paid plans range from $3.99 to $14.99 per user per month. |

The best employee scheduling app

Looking for an employee scheduling app that ticks all the boxes for your small business? Look no further than Homebase. Our free plan offers you a range of scheduling and time tracking features to optimize your schedule and keep your team in sync. Planning on growing your team, or want more control and flexibility over staff management? We have affordable plans that are priced per location, ensuring that your costs stay low.

Run a better team with smarter scheduling. Try Homebase Scheduling for free.

The post 2024’s Best Scheduling Apps for your Small Business appeared first on Homebase.

via Homebase https://joinhomebase.com/blog/best-employee-scheduling-apps-2024/

Running—and funding—a small business isn’t for the faint of heart. For over 82% of American entrepreneurs, funding their business means using personal savings, credit cards, or leveraging other assets. While it’s common, dipping into your personal savings isn’t something any small business owner wants to do.

Yet only 16.5% of entrepreneurs rely on small business loans from banks or other financial institutions to fund their business. While it may seem intimidating to turn to a small business loan to help you grow or expand your business, it’s an option more small business owners can—and should—consider.

If you’ve got questions about small business loans, we’ve got answers. We’re sharing everything you need to know about qualifying for a small business loan, plus giving you all the details about the 11 best small business loans to help you get the most out of your business in 2024.

What’s a small business loan?

A small business loan gives you access to capital that you can use to invest in your business. Small business loans define “small business” differently, but generally it’s described as having fewer employees, lower revenue, and operating independently of larger businesses.

The funds from a small business loan can be used for various purposes, including working capital (money available to meet your short-term financial obligations), renovations, technology improvements, real estate purchases, or staffing needs.

Depending on what kind of small business loan you’re applying for, the requirements, terms, and interest rates vary. Before accepting your application, lenders will ensure you’re eligible by looking at the condition of your business, available collateral, your cash flow, and your personal financial situation.

Who can apply for a small business loan?

Business loan requirements vary from lender to lender. However, knowing what lenders are generally looking for can help you decide whether you qualify for a loan. Here are seven factors that most lenders look at when determining if you’re eligible for a small business loan.

1. Personal and business credit scores

Most lenders will look at your personal and business credit scores to see if you can repay your debts. Traditional small business loans and government-backed SBA loans look for good personal credit (think 690 or higher) or excellent business credit to qualify. Online lenders are more likely to be lenient with credit scores, often accepting a personal credit score of 600.

2. Annual revenue

Many lenders have a minimum monthly or annual revenue to ensure you have enough cash flow to cover the cost of your loan. How much revenue you need will depend on the specific lender.

3. Business industry and size

Each industry comes with its level of risk—restaurants, for example, can have variable revenue, and therefore are seen as high risk. This can affect the terms of your loan. There are some industries that lenders won’t lend to, including adult entertainment, gambling, or money services. Additionally, the size of your business affects if you’re eligible for a small business loan. Each lender will have a definition for what makes a business “small,” so be sure to read the fine print.

4. Years in business

Most traditional business loans require that you’ve been in business for a minimum of two years. Some online lenders have less strict rules and accept businesses as young as six months.

5. Business plan

Lenders want to know that you have a plan on how to use the funds they lend you and see that you’ve got a solid plan to repay. A business plan that explains your goals and how you plan to reach them can help lenders feel confident. Some lenders might require a loan proposal specifically designed to show how you’d use the funds and how you plan to repay them.

6. Collateral

To get a small business loan, you may be required to provide collateral to back the loan. Business collateral is an asset—equipment, inventory, or real estate—that can be seized if you default on your loan. Some loans will accept a personal guarantee, which requires you to repay the amount from your personal assets if the business defaults on payments.

7. Business and financial documentation

There’s a lot of paperwork that comes with applying for a small business loan. If you’re hoping to get your ducks in a row, here’s a list of what most traditional lenders will want to see when you apply:

-

- Personal and business income tax returns

- Profit and loss statements, balance sheets, and cash flow statements

- Personal and business bank statements

- Commercial leases

- Business licenses

- Articles of incorporation, if applicable

- Proof of collateral

- Business plan or loan proposal

- Any existing debt schedule

- Legal contracts and agreements

- Financial projections

Remember, each lender will have different specific requirements, but these guidelines are a great place to start.

The 11 best small business loans you can get in 2024

Whether you’re just starting or trying to expand your business, a small business loan can help you access much-needed financing—without dipping into your personal savings.

With a small business loan, you can hire the staff, buy the real estate, and do everything to help your business grow. Finding the best small business loan for your biz will depend on various factors, but these twelve loans are a great place to start your search.

Government small business loans

The U.S. Small Business Administration has a set of loans great for many small businesses in America. Their loans are designed to reduce lender risk and make it easier for small businesses like yours to access the funding they need.

All SBA-guaranteed loans have competitive terms that are comparable to non-guaranteed loans. Some of their loans come with ongoing counseling and education to help support you while you start and run your business.

Eligibility for an SBA loan is based on what a business does, the character of its ownership, and the location of the business. Additionally, you must meet their size standards (find out if you qualify here), be able to repay, and have a sound business purpose. They even have loans for those with bad credit.

1. 7(a) loans

The 7(a) Loan Program is the SBA’s primary business loan program. The maximum amount for a 7(a) loan is $5 million. Funds can be used for:

- Acquiring, refinancing, or improving real estate and buildings

- Short- and long-term working capital

- Refinancing current business debt

- Purchasing and installing machinery and equipment

- Purchasing furniture, fixtures, and supplies

- Changes of ownership (complete or partial)

- Any mix of the above

7(a) loans are available as a term loan, or you can use it as a line of credit. They cap interest rates, and you can choose long repayment terms if that works best for you and your business.

2. 504 loans

504 loans are another group of SBA loans. The 504 Loan Program provides long-term, fixed-rate financing for major fixed assets that promote business growth and job creation. The maximum funding amount for a 504 loan is $5.5 million, but certain energy projects can receive up to three loans of $5.5 million—one loan per project.

If you want to buy real estate, equipment, machinery, furniture, or fixtures, the 504 Loan Program may be a good fit.

3. Microloans

Microloans are the SBA’s smallest loan program, offering funding of $50,000 or less to help you start or expand your business. The average microloan is approximately $13,000 and can be used for a variety of purposes to help you expand your small business:

- Working capital

- Inventory

- Supplies

- Furniture

- Fixtures

- Machinery

- Equipment

A note: microloans can’t be used to pay down existing debts or buy real estate.

Small business bank loans

Most banks offer some form of small business loan program. Every loan will come with different eligibility requirements and conditions, so do your research. Below, you’ll find some of the best small business loans and lines of credit available from banks.

4. Bank of America

Bank of America has the most commercial and industrial loans of any U.S. bank. They offer several types of small business loans, including SBA loans, term loans, and business lines of credit.

If you’re already a Bank of America customer, you’ll benefit from discounted interest rates and other perks. Your business needs to be at least two years old for most Bank of America funding options, but their competitive interest rates and flexible repayment terms make it a great choice.

The maximum funding you can receive is $100,000, and you must have a minimum credit score of 670.

5. Wells Fargo

Another excellent option for small business bank loans is Wells Fargo. It’s one of the most active SBA loan lenders with three different lines of credit ranging from $5,000 to $1 million.

Wells Fargo’s lines of credit offer competitive interest rates and require no collateral to qualify. It does need your business to be at least two years old and have a credit score of 680 or higher to qualify.

6. PNC

If you’ve been in business for at least three years, PNC has options for unsecured and secured loans. Unsecured loans require no collateral, range from $20,000 to $100,000, and come with fixed interest rates and terms of up to five years.

PNC-secured loans start at $100,001, can be fixed or variable interest rates, and have terms of up to seven years.

7. U.S. Bank

For new businesses, take note: you can qualify for some U.S. Bank small business loans with less than a year in business under your belt. The fast-term business loan has a $250,000 maximum but has a quick application process compared to their larger loans (up to $1 million). It’s these fast-term business loans that only need a minimum of six months in business to apply.

8. Chase Bank

If you are looking for a smaller loan, Chase Bank offers fixed- and adjustable-rate loans starting at $5,000 with repayment terms of up to seven years. It also offers business lines of credit from $10,000 to $500,000, renewable every five years.

If you want to purchase real estate for your business, Chase has commercial real estate loans with fixed or variable rates starting at $50,000.

Online small business loans

Online small business lenders offer loans from the comfort of your home. What are the benefits of going with an online lender? Online lenders tend to accept lower credit scores and have quicker turnaround times. You may find that online lenders have less favorable interest rates and terms, but it all depends on the lender. Let’s look at the three best online lenders for small businesses.

9. OnDeck

Founded in 2006, OnDeck is one of the leading online lenders in the U.S. It offers term loans from $5,000 to $250,000 with payment terms of up to two years. They have a quick turnaround time, with some funding available as quickly as the same day. And, you qualify with a minimum of 625 credit score.

You do need to have a minimum of $100,000 in annual revenue to qualify, and must be operating for at least one year. OnDeck doesn’t lend to businesses in Nevada, North Dakota, or South Dakota, and can’t lend to businesses in certain industries.

10. Bluevine

An online lender offering lines of credit, Bluevine gives small business owners access to a line of credit that can be used on an as-needed basis. With funds ranging from $6,000 to $250,000, there’s flexibility to get a line of credit that matches your financial needs. You only need a minimum credit score of 625, and you must have been in business for two years to be eligible.

Bluevine doesn’t support businesses in North and South Dakota, Puerto Rico, and U.S. territories.

11. Fundbox

Are you looking for funding quickly? How about in just three minutes? Fundbox is an AI-powered lending platform that makes it quick and easy to access funding. In just three minutes, you’ll know if you’ve been approved for a line of credit between $1,000 and $150,000. And, the funds can be available as soon as the next business day.

Fundbox only requires a 600 credit score to qualify. But the repayment terms are quite short—only 12 or 24 weeks. So, if that timeline isn’t realistic for your business, look elsewhere for a financial solution.

What to do once you’ve secured a small business loan

Once you’ve secured a small business loan, it’s time to invest in your growth. Whether you’re using your funds for a new location, more employees, or better equipment, when you grow your business, you need to be ready to support it with the right tools.

Homebase gives you everything you need to take control of your growing business. Simplify scheduling, streamline payroll, and keep your team connected in one app built to help small businesses thrive.

The post 11 Small Business Loans to Give Your Business A Boost in 2024 appeared first on Homebase.

via Homebase https://joinhomebase.com/blog/best-small-business-loans-2024/

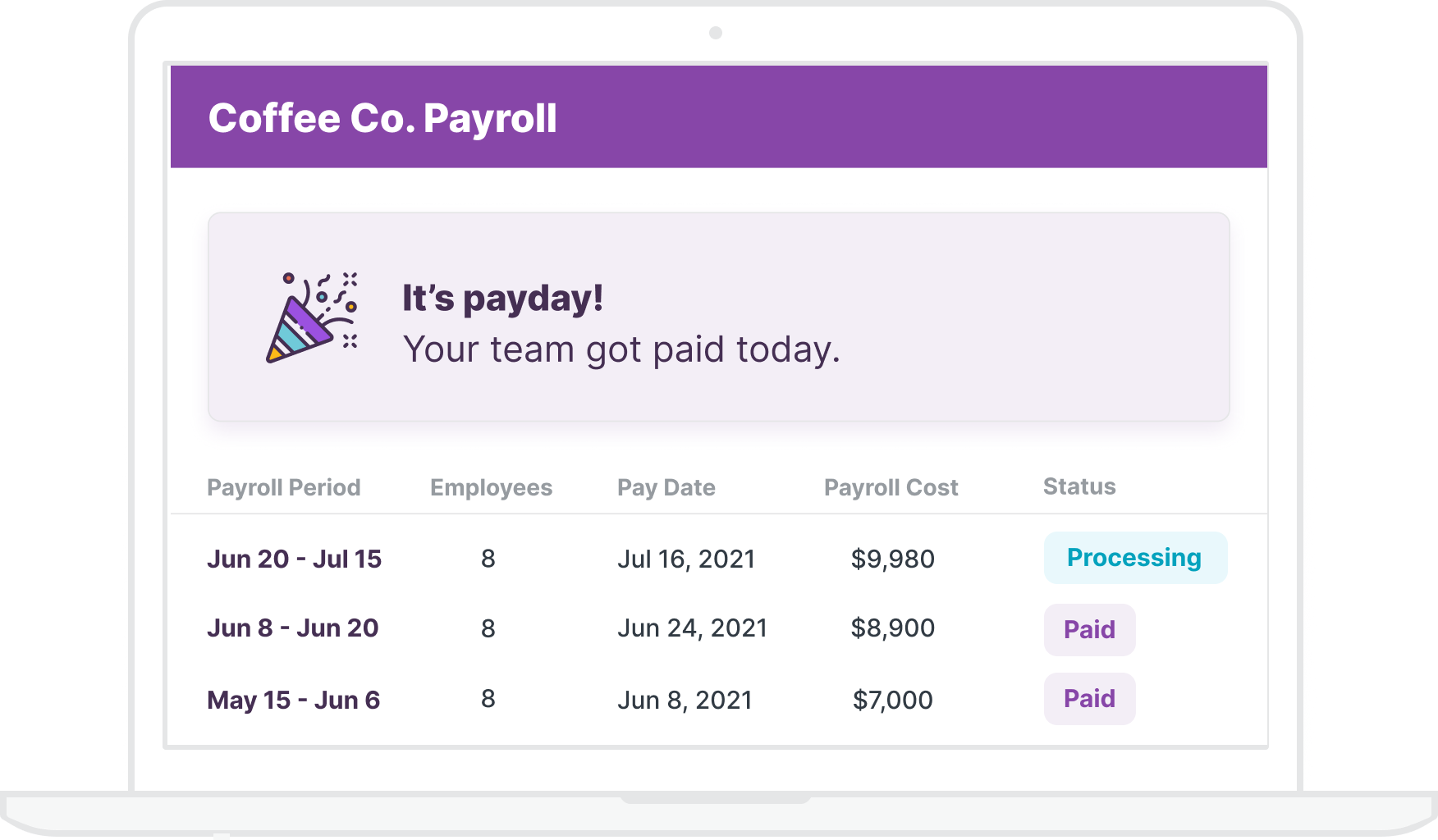

Running payroll isn’t exactly fun. But every business owner needs to do it if they want to keep employees happy (and paid).

The payroll process covers everything that goes into paying employees while staying compliant with labor and tax laws — like registering for tax IDs, accurately tracking hours, calculating and withholding taxes, and sharing pay stubs.

It’s easy for errors to sneak in that could lead to unhappy employees or even regulatory fines.

Payroll is a crucial yet complex task that often leaves managers scratching their heads. In this article, we’ll help you understand what payroll truly involves, how to do it right, and the perfect software to streamline the process.

No jargon, no complications — just actionable insights.

Auto-convert timesheets into wages, catch errors, pay your team, and file taxes all in one place.

What is payroll processing?

Payroll processing is managing the payment of wages to employees. It’s not just about cutting checks — the process includes tracking employee hours, calculating gross wages, deducting taxes and other withholdings, and finally, delivering payment and pay stubs to employees. It also involves record-keeping for audit purposes.

Payroll processing guarantees accurate and timely wages while keeping your business compliant with tax and labor laws.

Manual Processing vs. Using a Service

Manual processing gives business owners full control over every step. They track hours, calculate wages, handle tax deductions, and distribute paychecks on their own. But, the potential for human error makes it a less viable option for many businesses.

For example, incorrect tracking of employee hours can lead to overpayment or underpayment. And a single miscalculation or overlooked tax update can result in fines or penalties.

This is why most businesses opt for a payroll service provider. Payroll services handle all the math for you — accurately tracking employee hours, calculating gross wages, and deducting the right amount for taxes. This eliminates the risk of human error in calculations, reducing costly mistakes.

They ensure you’re always compliant. And digital record-keeping reduces the clutter of paperwork, making it easier to audit your payroll records.

The different elements of payroll

There are a lot of processes and tasks that go into running payroll — you need to collect employee information, set up a payroll schedule, calculate and deduct tax withholdings, and a whole bunch of other stuff that can quickly feel overwhelming.

Payroll schedules

A payroll schedule is essentially the calendar your business follows to pay its employees. It defines how often paychecks are distributed — weekly, bi-weekly, semi-monthly, or monthly.

For example, a bi-weekly schedule means employees are paid every two weeks, typically on a specific day like Friday. The payroll schedule you choose depends on factors like your business’s cash flow and employee preferences and should be in compliance with state and federal laws.

Payroll taxes

Payroll taxes are deductions from an employee’s paycheck that go towards federal, state, and local tax obligations. This can include income tax, Social Security, and Medicare.

For example, if an employee earns $1,000 in a pay period and their total tax rate is 25%, $250 will be deducted from their paycheck for taxes. It’s crucial for businesses to calculate and withhold these taxes to avoid penalties.

Here’s an overview of employment taxes in the USA:

| Tax Type | Description | Responsibility |

| Federal Income Tax | Withheld from employees’ wages based on their W-4 form. | Employer |

| Social Security and Medicare Taxes (FICA) | Withheld from wages. Employers match the employee’s contribution. | Employer & Employee |

| Additional Medicare Tax | Extra 0.9% tax on wages that exceed $200,000 in a calendar year. | Employer (Withholding only) |

| Federal Unemployment (FUTA) Tax | Paid separately by employers and doesn’t involve employee funds. | Employer |

| Depositing Employment Taxes | Employers must deposit withheld federal income tax, FICA, and FUTA taxes. | Employer |

Note: For the most accurate and current tax rates as applicable to exempt and non-exempt employees, refer to the relevant publications or visit the official IRS website.

Payroll costs

There can be quite a few costs associated with running payroll smoothly. But depending on the type of payroll system you use and whether you outsource these activities or not, your payroll costs can vary a great deal.

If you’re using a payroll service solution, you’ll have expenses like:

- A base monthly fee and fees for each employee you have on payroll

- 401k distribution

- Tracking employee time

- Workers’ compensation

- Direct deposit, state, and federal tax filings

- Paid leave and overtime pay

- Bonuses

Payroll summary reports

A payroll summary report shows you an overview of all your payroll activities. This includes employee details like net and gross pay and employer taxes. Maintaining and properly storing these documents is crucial as you’re required by the federal government to submit several payroll report forms, including Form 940, Form 941, W-2s, and W-3s.

You may also be responsible for a local payroll report, so check your local employment laws to cover your bases.

How to set up and process your payroll

If you’re the kind of manager or business owner who enjoys getting hands-on with the numbers, there are a few things to consider while setting up your payroll system. Before you get into the nitty-gritty of it, decide what your payroll policies will be and how you’ll handle the process.

1. Payroll process creation

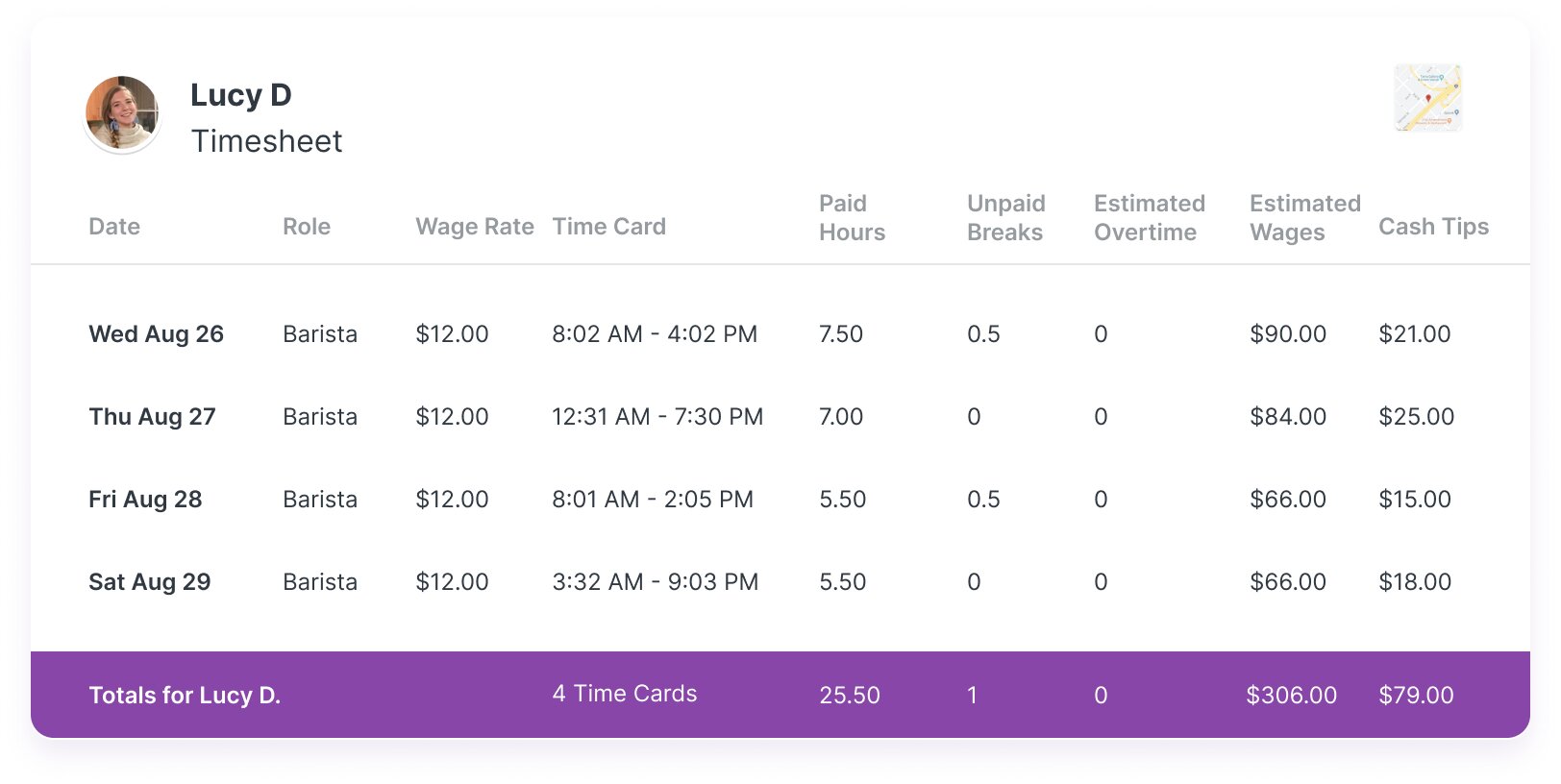

Step one in the manual payroll process is all about establishing a reliable system for gathering and documenting your employees’ work hours — timesheets. It’s a data table that you can use to track when a particular employee has worked during a certain period.

Some businesses use paper timesheets, while others use digital or punch clock systems. Your timesheet process should record start and end times, breaks, and overtime.

Here’s an example of a weekly timesheet for a manufacturing plant:

| Employee | Role | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 | Total Hours |

| Employee 1 (Assembly Line Worker) | Regular Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Overtime Hours | 0 | 0 | 0 | 0 | 2 | 4 | 6 | |

| Employee 2 (Quality Inspector) | Regular Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Overtime Hours | 0 | 0 | 2 | 2 | 0 | 0 | 4 | |

| Employee 3 (Forklift Operator) | Regular Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Overtime Hours | 0 | 2 | 0 | 0 | 2 | 4 | 8 |

In the above example, each employee records their regular and overtime hours separately, as these are often paid at different rates. This ensures that each employee is paid correctly for their work and that overtime is accounted for.

2. Timesheet review and approval

After your employees log their work hours into the timesheet, it’s time for the second step: review and approval. You need to verify that the hours logged align with your records and expectations, ensuring no discrepancies, like over-reporting or under-reporting of hours.

You’ll also need to cross-check that all overtime hours, if any, are correctly documented. Any discrepancies should be addressed and corrected before approval.

Depending on the size of your business, the timecard approval process can be single-tiered (requiring one person’s approval) or multi-tiered (requiring multiple approvals). For example, in a multi-tiered system, a direct supervisor might review and approve timesheets. Then, the HR department would conduct a final review and approval before processing payroll.

3. Pay calculations

When it comes to pay calculations, the method you use depends on if you’ve got part-time or full-time employees. Hourly employees are paid based on the number of hours they’ve worked during a pay period, while salaried employees receive a predetermined amount each pay period, regardless of the hours worked.

Here’s a quick comparison:

| Hourly Employee | Salaried Employee | |

| Payment Structure | Paid per hour | Paid a set amount annually |

| Example Rate/Salary | $15 per hour | $60,000 per year |

| Hours Worked in a Week | 45 hours (40 regular + 5 overtime) | N/A |

| Regular Pay Calculation | 40 hours x $15/hour = $600 | $60,000 ÷ 24 pay periods = $2,500 |

| Overtime Pay Calculation | 5 hours x $15/hour x 1.5 = $112.50 | N/A |

| Gross Pay | $600 (regular) + $112.50 (overtime) = $712.50 | $2,500 |

4. Tax and deductions calculations

After the gross pay of an employee is calculated, the next step in payroll processing is determining the proper amount to deduct for taxes and other deductions. This can be a complex process due to the various tax laws and regulations that must be adhered to.

Let’s continue the above example. We already calculated Gross pay, so now we can easily calculate the net pay after deductions:

| Hourly Employee | Salaried Employee | |

| Payment structure | Paid per hour | Paid a set amount annually |

| Gross pay | $600 (regular) + $112.50 (overtime) = $712.50 | $2,500 |

| Example deductions | Federal, state, local taxes, Social Security, Medicare, Health Insurance | Federal, state, local taxes, Social Security, Medicare, Health Insurance |

| Example deductions calculation | Let’s say total deductions come up to $162.50 | Let’s say total deductions come up to $600 |

| Net pay | $712.50 (gross pay) – $162.50 (deductions) = $550 | $2,500 (gross pay) – $600 (deductions) = $1,900 |

5. Make payments

Making payments promptly and correctly is a crucial part of maintaining trust and satisfaction among your employees. Ensuring everyone understands how their pay is calculated and what deductions are made can also help prevent any issues or misunderstandings.

Here’s how it works:

- Choose a payment method: This could be through direct deposit (where funds are transferred electronically to the employee’s bank account), paper check, or pay card (a reloadable debit card onto which an employer loads an employee’s pay). Direct deposit is usually the most convenient for both parties and ensures employees receive their pay promptly.

- Schedule the payments: Then, as per the established payroll schedule (weekly, biweekly, semi-monthly, or monthly), process the payment. If using direct deposit, be sure to initiate the transfer a few days in advance to allow time for the banks to process the transaction. If you’re issuing checks, ensure they’re printed, signed, and ready to distribute on payday.

- Deliver pay stubs: Along with their pay, provide employees with a pay stub — a detailed breakdown of their pay for the period. The pay stub should include gross pay, net pay, and details of any deductions, such as taxes and benefit contributions.

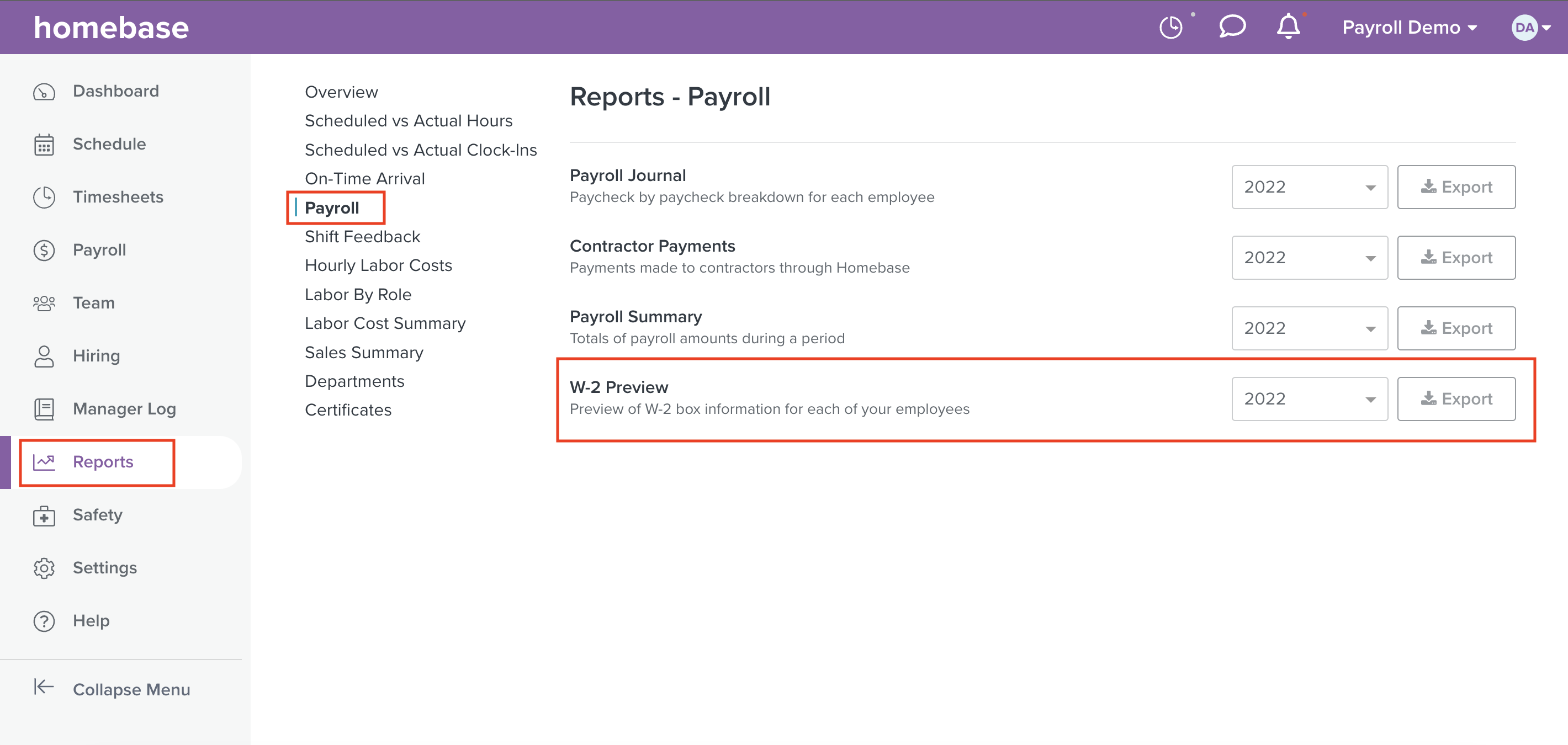

6. End-of-year reporting and data storage for compliance

At the end of each tax year, employers have the responsibility of preparing and distributing certain tax forms. The most common is the W-2 form, which details an employee’s earnings and tax withholdings for the year.

Apart from employee tax forms, you also need to prepare and file your business’s own tax returns. This includes paying any employer federal unemployment taxes (FUTA), and reconciling and paying any remaining Social Security, Medicare, and income tax withholdings.

Additionally, maintaining thorough payroll records is a must for legal compliance and internal tracking. Records should include employees’ personal information, timecards, wage information, and payroll dates. These records should be kept safe and secure yet accessible for at least three years, according to the Fair Labor Standards Act (FLSA).

Note: In case of audits from the Internal Revenue Service (IRS) or Department of Labor, having accurate and complete payroll records can make the process smoother. Remember, non-compliance can result in penalties, so keeping good records is essential.

How to streamline payroll with Homebase

There are many steps involved in carrying out the payroll process on your own, and they can be difficult and exhausting to accomplish, especially if you don’t use any HR services to assist you.

Payroll software specifically designed for small businesses like Homebase can save you the headache of having to remember every single payroll step yourself and running the risk of falling out of compliance, even accidentally. Here’s how Homebase can simplify your payroll and help you stay compliant with ease:

1. Implement a digital payroll process

When you shift your payroll online with a tool like Homebase, you boost accuracy and efficiency. Let’s say you’re running a medium-sized restaurant with a team of 20 full-time and part-time employees. Each week, your employees clock in and out at different times, maybe even in various roles, with different rates.

With the old way, you’d spend precious hours every week manually inputting timesheets, calculating wages, and figuring out taxes. One misplaced decimal or overlooked overtime can cause a payroll mess.But a tool like Homebase automatically tracks employee hours, meaning your timesheets are accurate to the minute. It even adjusts for overtime and paid time off. Now, your timesheets are accurate and ready for payroll without your manual input.

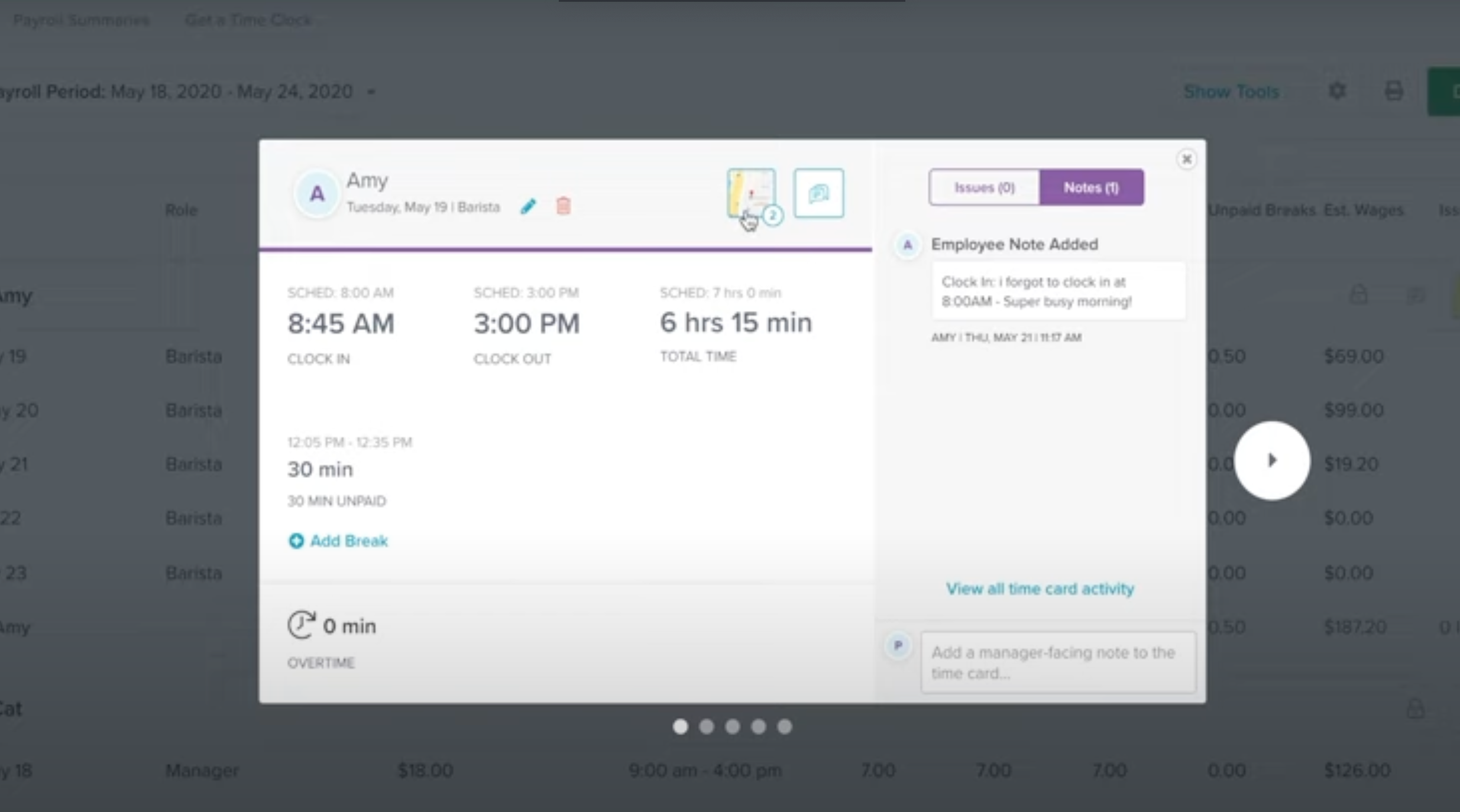

2. Approve timesheets

Let’s say it’s the end of the workweek, and your employees’ timesheets are populated with their clock-in and clock-out data. In a manual system, you’d be sorting through these, possibly matching them against schedules or cross-checking for errors. But with Homebase, these timesheets are already digitized and accurately populated.

You can select how often you want to run payrolls and the day when your payroll starts. Then you can confirm which payroll period you want to approve or select custom dates. You can sort, group, and customize the view. Each row magnifies to show the actual time your employees clocked in, breaks taken, previous edits made, and GPS snapshots of where your employees clocked in from.

Plus, once a time card is approved, it’s locked from future edits. Only managers and users with permission can edit approved time cards.

Want to learn more about approving timesheets with Homebase? See it in action:

3. Your automated solution runs pay and tax calculations

Managing pay and tax calculations can often be the most intimidating part of the payroll process. Why? Because the last thing any business wants is an unexpected letter from the IRS or a disgruntled employee because of a payroll tax miscalculation or incorrect payment.

Homebase automatically sends you notifications when an employee is close to overtime. YOu can also set up custom break and overtime rules that comply with federal, state, and local labor laws and FLSA rules.

Homebase calculates the correct tax withholdings for each employee, sends the correct payments, and forwards the withheld taxes to the right government agencies. Plus, the platform automatically processes tax filings, issuing 1099s and W-2s to your employees and contractors. So, instead of drowning in tax forms and calculations, you can focus on what matters most — running your business.

Seamless payroll in a matter of clicks

Payroll is the lifeblood of your business. Every employee, from your newest hire to your seasoned professionals, depends on it. It involves tracking accurate hours, precise tax calculations, and punctual payments. And the stakes are high.

Errors can lead to unhappy employees, hefty penalties, and a whole lot of unnecessary stress. But an all-in-one tool like Homebase can help your business set up a fully automated system for tracking time and paying staff.

Homebase can automatically calculate wages and taxes and send the correct payments to employees, the state, and the IRS. We also offer HR and compliance features and hiring and onboarding capabilities so you can communicate your policies easily to every new team member.And with our free plan, small businesses can access many of these high-impact features for up to 20 employees at a single location without any cost. Because with Homebase, you can control your and your team’s time on your own terms.

Auto-convert timesheets into wages, catch errors, pay your team, and file taxes all in one place.

The post How To Do Payroll: The Payroll Process Simplified appeared first on Homebase.

via Homebase https://joinhomebase.com/blog/payroll-process/

In 2016, California approved a statute to increase the minimum wage yearly starting in 2017. This Senate Bill (SB) planned for the hourly rate to reach $15 in 2023, with inflation adjustments up to a maximum of 3.5%. This period has now passed and the California minimum wage rate is at $15.50.

However, the cost of living has also increased, and a $15.50 hourly rate doesn’t allow people to cover all of their expenses. According to a Zillow study, a person making minimum wage would need 2.7 full-time jobs to pay for a two-bedroom apartment in Los Angeles.