|

Our friends at KitKat may have been on to something. Because let’s be real, we all love a good break. It’s the perfect way to reset, recharge, and become a better version of ourselves. Your employees are no exception. The best way to make sure you’re making the most of employee breaks? By implementing a break tracking solution. Keep reading as we dive into the world of break tracking and break down how you can start tracking breaks in your small business—pun intended. Reduce stress with automated break tracking for your team during every shift with Homebase. What is break tracking?Break tracking is the process of documenting when employees take breaks during their work shifts. It can refer to tracking breaks for each employee or the team as a whole. Typically with break tracking, you record details such as what time an employee starts and ends their break, the duration of their break, whether it paid or unpaid, and any other shift-related information that might impact the break. Breaks at work often fall into one of two categories; rest breaks and meal breaks.

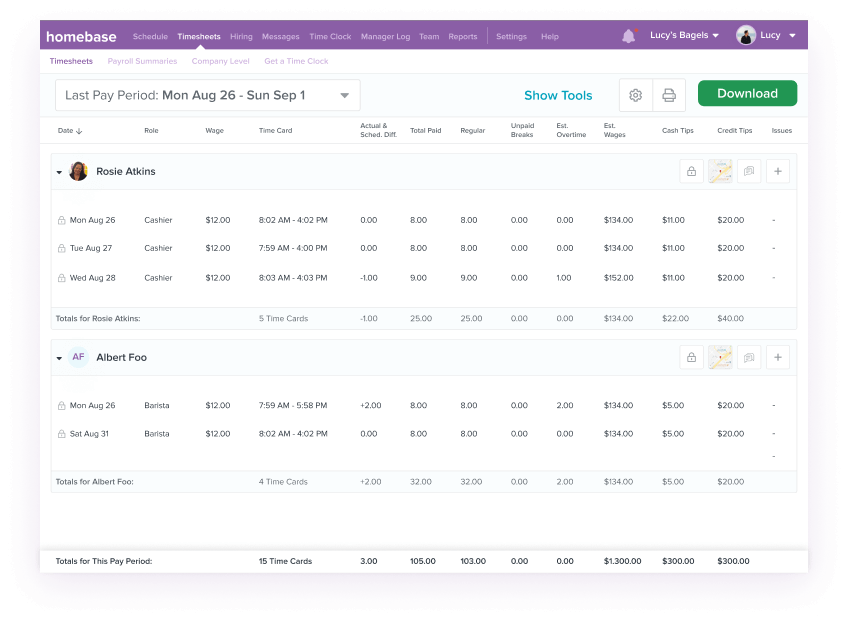

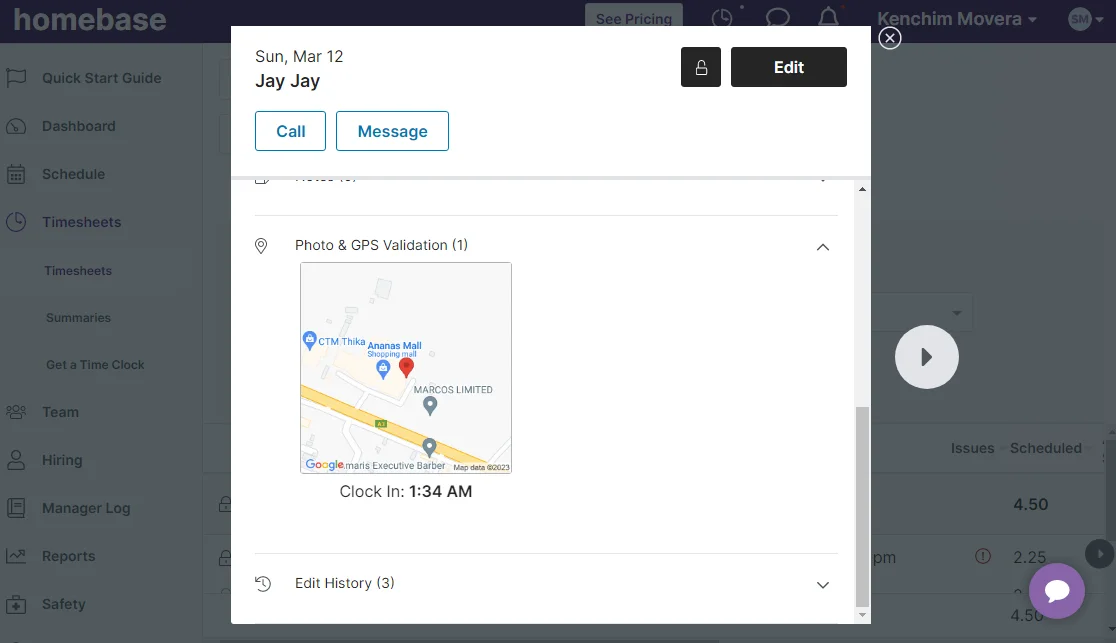

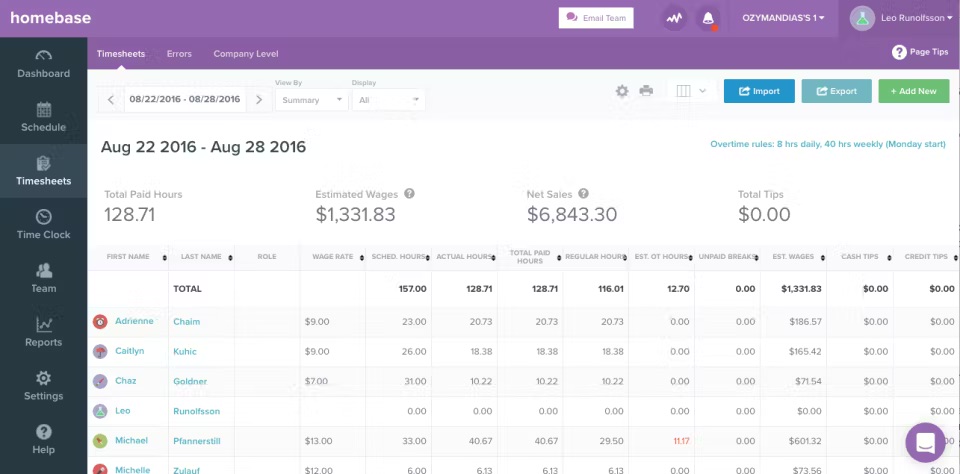

What are the benefits of break tracking?As a small business, you likely have a to-do list that feels like it’s a mile long (we can relate). Break tracking might feel like an unnecessary task to add to your daily to-do list. But in reality, break tracking can actually save you time, money, and even strengthen the trust and relationship with your team. Here are a few reasons you’ll want to prioritize employee breaks and break tracking. Better compliance with break-related labor lawsBreak tracking can help you follow the rules in more ways than one. Whether or not you have to provide your employees with breaks will depend on your local labor laws. Some industries and regulatory bodies may also have additional rules around breaks, for example, for drivers carrying passengers or property. Break tracking can help make sure employees get the breaks they’re entitled to. For example, in California, you’re required to provide a 30-minute break if a shift lasts over 5 hours. Meanwhile, Maryland’s Shift Break law for retail businesses says that a 15-minute break is required for a shift lasting 4-6 hours. You’ll need to provide a 30-minute break for shifts lasting more than 6 consecutive hours and a second break if the shift lasts longer than 8 hours. While there are no federal laws around providing breaks, there are important rules when it comes to paying (or not paying) for them. According to the U.S. Department of Labor, shorter breaks under 20 minutes are considered compensable work hours, which means employees need to be paid for that time. But longer breaks and meal times are not considered work hours and employees don’t need to be paid for longer breaks. By break tracking, you’ll know exactly how long each break is, so you can pay your team properly. Plus, you’ll be following the Fair Labor Standards Act (FLSA) rules, which require you to store time cards—including breaks—for up to 4 years. Break breakdown: This handy chart from the U.S. Department of Labor breaks down the mealtime and break rules by state. Faster and stress-free payrollPayroll can feel like a bit of a headache even in the best of circumstances. Toss in a bunch of paid and unpaid breaks and you might find yourself needing to take your own break. 33% of employers make payroll errors every year. And error-prone manual calculations are a surefire way to become a part of that statistic. When you’re not tracking breaks, you’re left guesstimating or manually calculating the unpaid and paid break hours for each of your employees. Or even worse, you might find yourself accidentally paying employees for unpaid breaks which can cost you hundreds, if not thousands, of dollars every year. By tracking breaks with an online time clock, you can automatically calculate the exact number of working hours, paid breaks, and unpaid breaks—no math required. So when payday rolls around, paying your team is easy and stress-free. Less surprise labor costsLabor costs are often one of the biggest expenses for small businesses. Staying on top of your labor costs is key, and that includes—you guessed it—tracking employee breaks. Breaks might feel like a small part of your payroll expenses, but even a few minutes here or there can add up quickly. The last thing you want is to realize that you’ve racked up hundreds of dollars in missed unpaid breaks, accidentally overpaid for a break, or employees have accidentally gone into overtime. Break tracking eliminates these less-than-ideal surprises on payday. You’ll also have a record of exactly when each employee clocks in and out for their breaks. So you can easily catch intentional and accidental time theft, like extra-long paid breaks or unauthorized skipped breaks. Breaks made simple: Easily store time card data and track paid and unpaid breaks with Homebase breaks. Improved employee experience and productivityPaid and even unpaid breaks can feel like a dent in your bottom line. But breaks are actually a win-win for both you and your team. A survey found that 88% of employees say they return to work feeling refreshed and energized after a break. Even if breaks aren’t mandated in your area, regular employee breaks can go a long way in improving employee happiness and productivity. And of course, we know that happy employees are more likely to stick around, reducing employee turnover. Implementing break tracking makes sure that employees never miss a hard-earned break and are getting paid properly for their time. It’s also a great way to keep your employees accountable for their working hours and build trust within your team. What is break waiving or break waivers?Break waiving is when an employee chooses to waive or not take a break—even when they’re entitled to one. Employees may choose to skip a break themselves or they might do so at the request of their employer. Break waiving can happen for many reasons. An employee may want to skip a meal break so they can earn an extra 30 minutes of wages. Or an employer may request an employee skip their break to cover an unexpectedly busy shift. Each state has different rules regarding break waivers. For example, according to the California Labor Code, breaks can only be waived if the work period is shorter than 6 hours. They can also only be waived if you and your employee both agree, AKA you can ask an employee to waive their break, but you can’t force them to. Just make sure to document all instances of break waiving, just in case you’re ever audited. It’s a simple step to help you stay compliant. Documented break waivers serve as a paper trail proving that you’ve offered mandatory breaks and the instances where you’ve mutually agreed to waive them. How to track employee breaksBreak tracking is a no-brainer for most businesses. So how can you get you and your team started? Here are some steps to help you get started with tracking breaks. 1. Implement a break tracking systemBreak tracking is simple—if you have the tools to do it. And while you could go old-school and manually track breaks with a time-tracking spreadsheet, we know you can do better. One of the best ways to do this is by using a time clock. Time clock apps, like Homebase, make it easy for employees to track their breaks and for you to review them. All your team needs to do is punch in when they start and finish their breaks and the software does the rest! The best time clocks can even help you automate employee schedules and breaks. Some can even help you set break rules, so you can calculate paid and unpaid breaks automatically. 2. Create an employee break policyCreating new employee policies can feel a bit like you’re being the work police. But it’s less about rules and more about keeping everyone on the same page. Your break policy should include details such as:

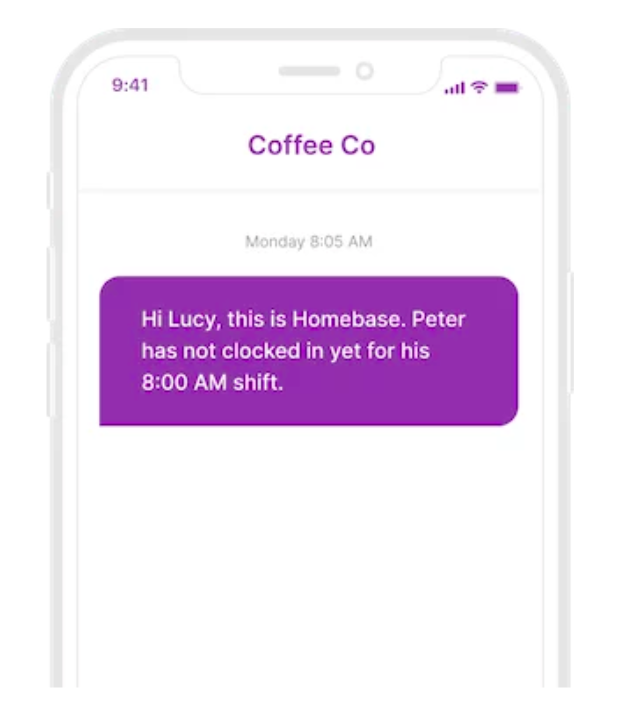

But don’t just stick a copy of the policies on the wall and call it a day. Make sure to take the time to clearly communicate the benefits of break tracking with your team, so everyone is on board. 3. Create employee break schedulesScheduling employee breaks ahead of time isn’t always necessary, but it can go a long way in making sure that you have the right coverage and that everyone gets a chance to take their break. The last thing you want is to have everyone on break at the same time, or worse—run out of time to give employees their breaks. 4. Review breaks and employee hoursOnce you have your team on the break-tracking train, it’s time to keep an eye on the reports. Are employees taking their breaks? Are they taking breaks when they’re supposed to? Are there better times for employees to take breaks based on your sales forecasts? If you set it and forget it, you won’t reap all the rewards of break tracking. Reviewing employee breaks from time to time can help you make sure employees are following policies and optimize them. Reviewing your employee breaks can help with workforce planning, managing labor costs, and even improving the customer experience. Break tracking done right with HomebaseReady to start tracking break time better? Homebase’s all-in-one employee management software and time clock can help you track breaks with ease.

Reduce stress with automated break tracking for your team every shift with Homebase. Employee Scheduling

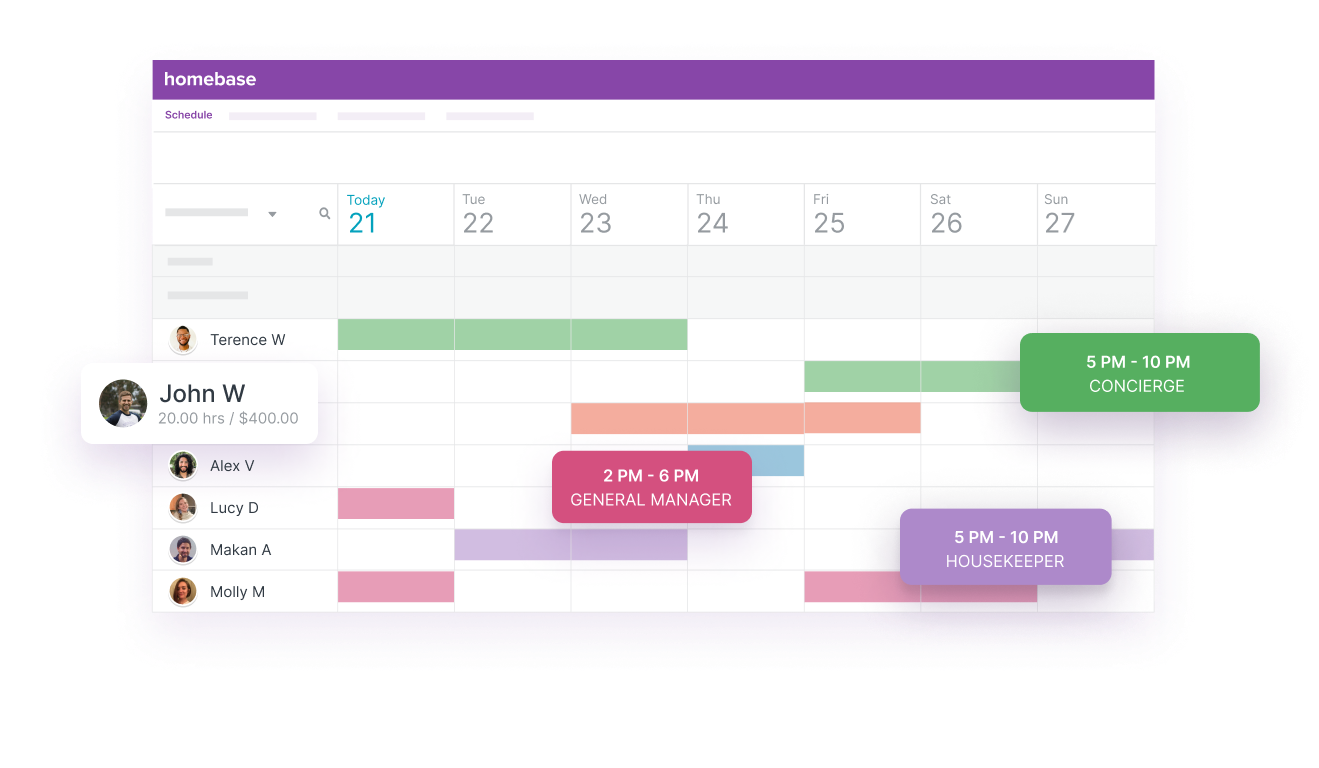

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase.

The post Everything You Need To Know About Break Tracking For Small Businesses appeared first on Homebase. via Homebase https://joinhomebase.com/blog/break-tracking-small-business/

0 Comments

Have you noticed other small businesses offering great employee work benefits and wondered if you should do the same? While it’s true that offering great work perks can help you attract and keep top talent, you need to choose the right ones. Choosing The Best Employee Benefits For Your BusinessIt can be tough to decide which work perks to offer. That’s why we’ve compiled a list of the top 12 modern employee work benefits perfect for small businesses like yours. We’ll also tell you which businesses and staff members they’re best suited for and give you some tips for implementing them. Let’s dive in. HR for people who don’t do HR. Homebase gives you modern tools and guidance to keep you compliant. 1. Early Access to WagesAnearly cashout option has widespread appeal. Letting your staff receive a portion of their wages before payday gives them the flexibility to deal with unexpected expenses like car trouble or burst water pipes more easily. Offering a Cash-Out OptionHomebase offers acash out feature as part of its platform. That means your employees can withdraw up to $400 in advance. The app then automatically withdraws that amount from their bank account on payday. Signing up is easy, but the best part is that there are no hidden fees, credit checks, or interest because it’s not a payday loan and doesn’t cost you anything — it’s simply a hassle-free benefit. 2. Health Benefits and Other AlternativesMany workers worry about how they’re increasingly responsible for thecost of healthcare instead of employers paying it themselves. This can be especially expensive for employees with young children or elderly family members who have a greater risk of health issues and high medical costs. Modern Health Benefit OptionsOffering better, wider, or more modern health insurance can differentiate your business from competitors. This perk can give your employees more security and lets them seek treatment sooner before minor issues become larger concerns. But you don’t have to focus on buying the best insurance. Here are some other examples of job benefits that let youtake care of employee health:

3. Mental Health ResourcesMental health is a high priority for 50% of employees, according to Mercer’s2023 Health on demand report. The same report said 42% of employees are more likely to stay at their current job because of mental health benefits. Promoting Good Mental Health Among Your StaffYou can promote mentalwell-being among your employees in many ways. Here are just a few of the most popular:

4. Flexible Work TimesIf you have a business where staff aren’t required on the premises at all times, you can offer your staffflexible work times. That means you can allow team members to come in anytime during a specific range of hours as long as they put in a full workday. So if you run an auto repair shop where customers only drop cars off, you could let your staff choose whether to work early or late shifts. Shifting Tasks for FlexibilityYou could also consider making your staff’s positions task-based instead of time-based. That means only requiring them to come in and complete their tasks for the day, however long or short it takes. When they’re done, they can leave without causing problems for your business. This would work for businesses like salons and spas when tasks like haircuts and treatments may differ in length. Flexible work hours are a popular perk for 18 to 30-year-olds who are more likely to be juggling school and work or have very young children. 5. Holiday Time OffIf your business slows down during periods like Christmas or Easter, consider shutting down for a few days instead of scrambling to find people who are willing to work. Productivity tends to go down anyway as your workers think about their holiday plans. Benefits of Closing Down PeriodicallyClosing down for holiday periods won’t only save you money on utilities and wages, but can also earn you the gratitude of your employees who have more time to prepare for the festivities, rest, and see their families. Before you offer this perk,ask your staff how they feel about it. If you get an enthusiastic reaction about having extra time off over the holidays, you may see a surge in productivity after your team members return from holiday relaxed and recharged. But if they would have preferred to work over the holidays and earn some extra money, they may be resentful.

6. Volunteer DaysAllowing your team to take a day off every year to volunteer can help boost morale and get them more involved in your local community. Plus, there are so many options that you can tailor your volunteering initiatives to your business. Different Types of Volunteering OpportunitiesIf you’ve got a shop, you could auction off your products for charity. Or if you’re a mechanic, you could offer free classes or mentoring programs for underprivileged groups. Here are some additional ideas you could try out:

7. Rewards for Great PerformanceOne of the simplest ways you can support your employees is by giving thempublic praise. This signals you notice their efforts and care about the work they’re doing. But you can elevate this even further by rewarding your employees for good performance, too. Communicating Praise with your TeamConsider posting your praise on your work chat or social media. Homebase’sshoutout feature lets you post praise for an employee’s good work on the app dashboard where everyone can see it. You can then accompany the acknowledgment with a reward like time off, a free meal, or bonus pay. Always be specific, so everyone knows what to do to get the reward. For example, instead of saying someone did a good job, specify that they helped increase sales by 30% in the past month. Another great way to reward great performance is to set up abonus payroll. This is when you offer your team extra pay for good work. For example, you can offer an annual performance bonus in December on top of your staff’s regular wages or award extra pay throughout the year for achievements like exceeding sales targets. 8. Career Development PlansPeopleKeep’s 2022 Benefits Survey Report revealed that around 72% of 18 to 41-year-olds consider professional development very important. And 62% of those in the 42-57 age range agreed with that as well. That means career development plans are something you can use to appeal to employees of all ages. Career Development ResourcesTry offering some of the following career development benefits:

9. Free Food and DrinkKeeping a small pantry or kitchen at your business can satisfy cravings for food or drink during a long workday. You can keep it well-stocked with free coffee, tea, and healthy snacks at minimal cost to you. And if you’re a cafe or restaurant, you can even offer your employees a certain amount of free food and drink or discounts on these. Partner up with Local BusinessesWhen you don’t have a kitchen or fridge on site, another option is to partner up with nearby businesses for discounts. Many shops and restaurants will deliver to your workplace even if it’s a construction site or outdoor venue. This perk comes with many benefits to your business. Employees don’t have to leave their workplace when they feel hungry or thirsty and it encourages healthy habits. You may also discover that employee productivity stays more constant when employees have access to drinks and snacks, especially toward the end of your team’s shifts. You can expand on this idea by throwing in a free lunch every once in a while and inviting all your staff to attend. Ask your team members to vote on where they’d like to eat to make everyone feel more involved. On big occasions like holiday parties or business anniversaries, you can accommodate family and friends, too. 10. Help with TuitionIf many employees don’t have degrees, see if they’d be interested in going to college part-time. Further education could improve their knowledge and skills, help them become more effective at their jobs, and broaden their career horizons. Plus, it’s a win-win situation for your team and your business. It’s more financially viable for employees to keep working for you and study part-time instead of quitting to join a full-time course, so you won’t lose a valuable employee. But help with tuition is a costly perk. Make sure your team is invested in the idea and be clear about how much you can contribute toward their classes. 11. Paid and Parental Leave PoliciesMost of the US workforce are parents, but surveys by the Bureau of Labor Statistics (BLS) show that only 23% of employees have access to paid parental leave. So you could make your business stand out to top candidates by making this perk part of your employee benefits program. Parental Leave FundsYou can create a parental leave fund for employees by using and extending a state disability insurance program. Basically, employees pay a percentage of their paycheck into these funds every month. Once they want to take parental leave, they can claim wage replacement for around two-thirds of their normal pay. Whatever you choose to offer, don’t get confused between employee benefits and rights. According to the Family and Medical Leave Act (FMLA), small businesses with over 50 employees must provide 12 weeks of parental leave to employees who meet the right conditions. 12. Retirement BenefitsPeopleKeep also found that employees of all ages think retirement plans are very important. And they’re an attractive perk for business owners too. If you match your staff’s contributions up to a certain limit, you may be entitled to tax deductions. In addition, starting a plan may also reduce the amount of tax you owe. But don’t worry too much about the details. Many third-party companies can set up a retirement plan for your business. Manage Employee Benefits Packages With HomebaseSmall businesses need to offer benefits tokeep their employees happy, but it’s important to choose the right ones that fit your team and budget. Managing employee benefits can also be tricky, but Homebase can help. With Homebase, you can use features like early cashout to help with emergency expenses, shoutouts to reward and praise employees, and scheduling tools to make handling paid time off easier. Plus, Homebase has a team ofHR experts who can make sure your benefits comply with state and federal laws.

HR for people who don't do HR.

Homebase gives you modern tools and guidance to keep you compliant. FAQs About Employee BenefitsWhat Legal Considerations Should Employers Keep in Mind When Offering Employee Benefits?Employers must comply with federal and state regulations when offering employee benefits. This includes adhering to the Affordable Care Act for health benefits, ensuring non-discriminatory practices in benefit offerings, and abiding by the Family and Medical Leave Act for parental leave policies. How Can Small Businesses Effectively Communicate Benefits to Employees?Effective communication about benefits involves clear, consistent, and accessible information. Small businesses can use staff meetings, employee handbooks, and intranet systems to ensure employees are fully aware of the benefits available to them and how to utilize them. What Are the Challenges of Implementing Flexible Work Arrangements in Customer-Facing Businesses?In customer-facing businesses, maintaining consistent service levels while offering flexible work arrangements can be challenging. It requires careful scheduling, clear communication with staff, and possibly staggered shift patterns to ensure business needs align with employee flexibility. Can Offering Mental Health Support Help in Reducing Workplace Conflict?Yes, providing mental health support can help in reducing workplace conflict. It equips employees with better stress management skills and promotes a more empathetic workplace culture, leading to improved conflict resolution and reduced tension. How Can a Small Business Determine the Most Cost-Effective Employee Benefits?Small businesses can conduct employee surveys to understand which benefits are most valued. Additionally, comparing the costs and potential ROI of different benefits, and consulting with HR professionals or benefit providers can help in making cost-effective decisions. What Are Some Innovative Non-Monetary Rewards for Employee Recognition?Innovative non-monetary rewards can include extra vacation days, flexible work options, professional development opportunities, public recognition in company communications, and personalized gifts or experiences that reflect the employee’s interests. How Do Employee-Led Training Initiatives Benefit a Company?Employee-led training initiatives can foster a collaborative learning environment, leverage the existing expertise within the team, and boost engagement by empowering employees to take an active role in their and their colleagues’ development. Are There Risks Associated with Offering Early Wage Access?While early wage access can be beneficial, it also poses risks such as potential dependency on early payments and the administrative burden it can place on payroll processes. Employers should ensure proper guidelines and limits are in place. What Impact Does Offering Health Benefits Have on Employee Retention?Offering health benefits can significantly improve employee retention as it demonstrates an employer’s investment in their staff’s well-being. It can make employees feel valued and more inclined to stay with the company. The post 12 Best Employee Benefits for a Modern Workplace appeared first on Homebase. via Homebase https://joinhomebase.com/blog/modern-employee-benefits-2/ Let’s face it—scheduling can be stressful. And if you’re new to creating work schedules, it can be a bit complicated to wrap your head around. But employee scheduling isn’t just something you can tuck away and forget about. It’s a key part of building a successful small business and managing a team. Lucky for you, whether you’re growing your team or new to scheduling—we’ve got you covered. Keep reading as we dive into everything you need to know about how to make a work schedule. We’ll even walk you through the process step-by-step, so you can start scheduling with confidence. What is a work schedule?A work schedule is a physical or digital document that communicates the hours and shifts that an employee is set to work. It can also refer to the set work hours for an individual employee. A work schedule serves two main purposes. The first is to let your employees know when they should come to work. But they also do more than that. They also help with resource planning and staying on top of labor targets to make sure you’re meeting your business needs Even if you don’t have a large team of employees, you probably still need a work schedule. This ensures you have the right staff when you need them. Plus, you can make the most of your team’s time on the clock. Type of work schedules for your small businessChoice, choices choices. When it comes to work schedules, you have so many options to choose from. While the different types of work schedules can feel overwhelming, it means you can choose the system that works the best for your small business. Here are some common types of schedules for small businesses and hourly teams:

Most businesses choose one or a combination of these types to meet their scheduling needs. Who’s responsible for making a work schedule?Work schedules don’t just magically appear out of thin air. (Although, sometimes we wish they would.) And while employee feedback should be considered, it’s up to employers to provide their team with a work schedule. In most small businesses, the responsibility of building a work schedule falls on a manager, team supervisor, or even the business owner themselves. In larger teams, this can often be a shared task among multiple managers. Whoever takes on the role of booking in staff should understand the key factors that go into making an effective schedule, like labor laws, labor budgets, and sales forecasts.

How to make a work scheduleIf you’ve never done it before, it can feel a bit daunting. There’s a lot to consider when it comes to making the perfect schedule. And if we’re being honest, it can feel a bit chaotic for even the most experienced manager. Fortunately, there are some tips and tricks that can take the stress out of scheduling. Here’s how you can make your next work schedule a success in eight simple steps. Step 1: Determine your labor targetsLabor costs can cost you a pretty penny, with labor costs making up as much as 50% of total costs for some businesses. So before you can schedule your employees, you need to know how much labor you need and how much you can afford. Here are some questions you can ask to help better understand your labor targets:

Step 2: Get to know your teamEvery person you hire is unique. So while it can be tempting to simply stick an employee where there’s an open shift, it’s best to schedule employees for shifts where you know they’ll make the biggest impact. For example, an employee who has excellent people skills is probably better off working a busy customer-facing shift. Meanwhile, a quieter employee who has great organizational skills might be more productive taking an inventory shift. So before you start scheduling, you should get to know your team’s skills, strengths, and preferences the best you can. You might learn this as you work with them or even through the hiring and onboarding process. Step 3: Gather employee availabilityBefore you can create your schedule, you need to know who’s available and when. This is especially true for shift work where hours can vary and employees may need to manage work around their existing commitments. For example, some employees may not be able to work on Saturdays for religious reasons. Meanwhile, other employees may be unable to work in the afternoons because they have childcare responsibilities. Of course, you have to put your business needs first, so not every request can be approved. But it’s best to accommodate wherever you can. Flexible scheduling can go a long way in improving employee engagement and making your employees feel valued. Step 4: Familiarize yourself with the FLSA and employment lawsEmployee scheduling doesn’t just come down to what your business needs. In the U.S., many labor requirements are enforced by the Fair Labor Standards Act (FLSA). So here are some labor laws should keep in mind when making a work schedule:

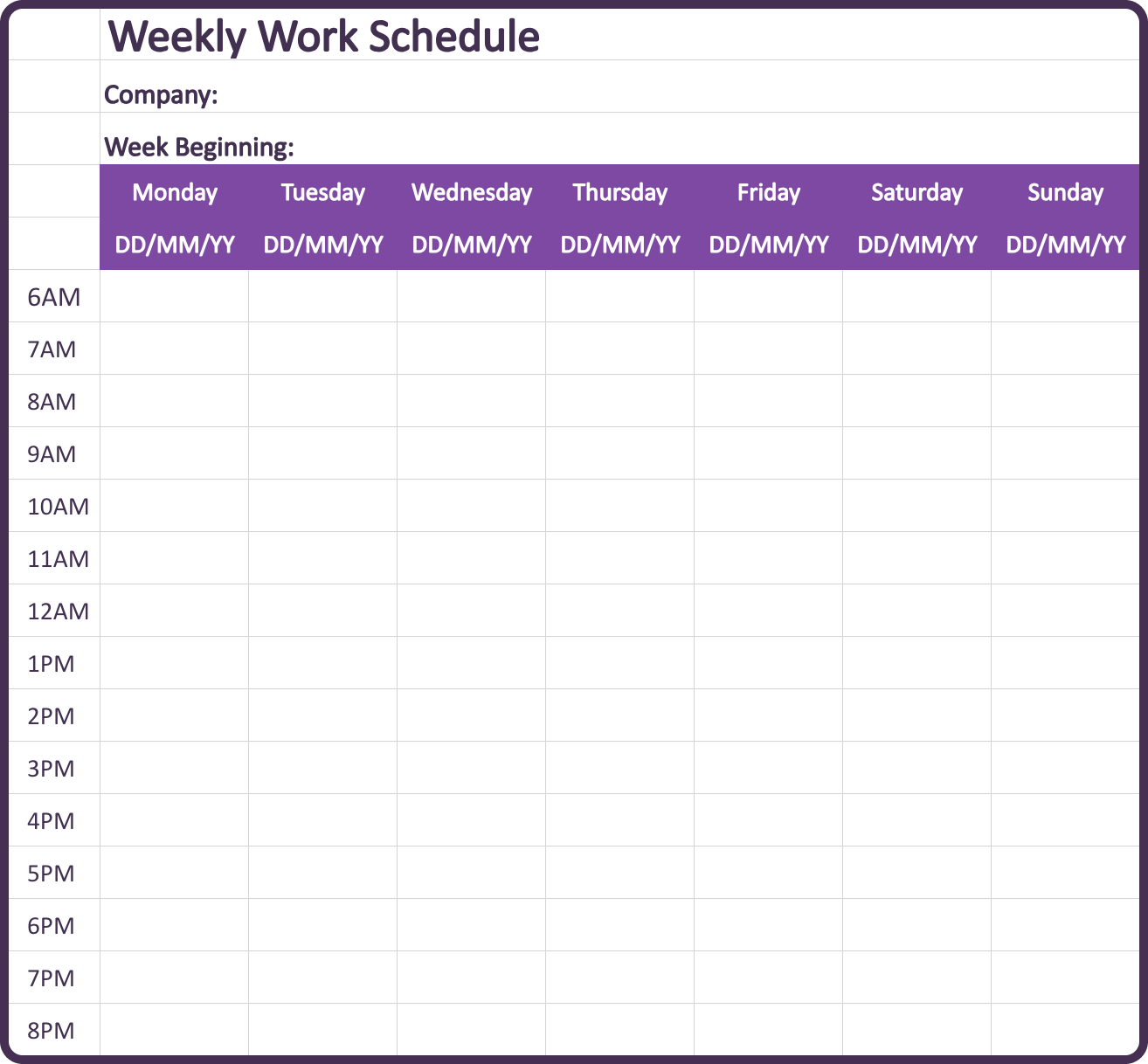

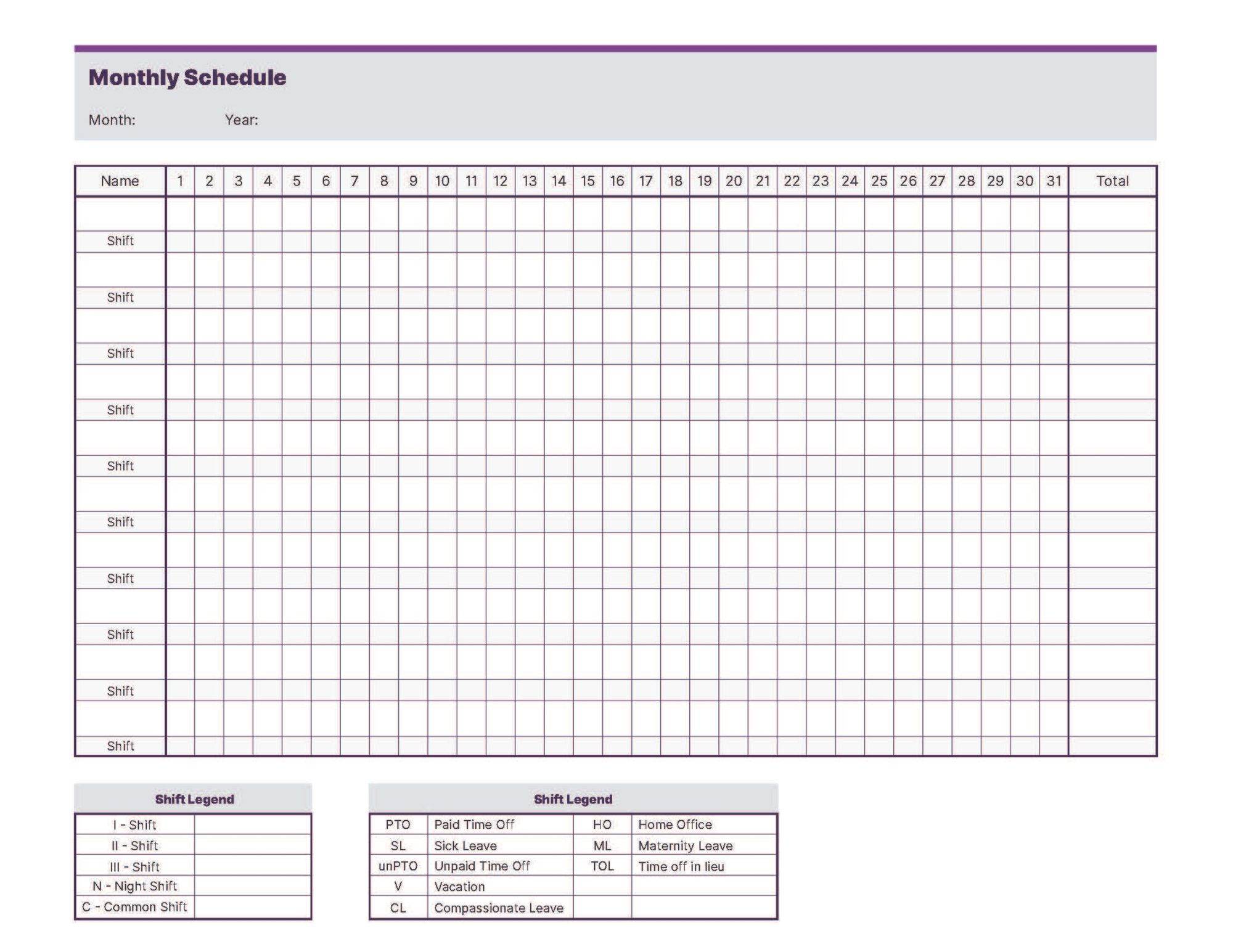

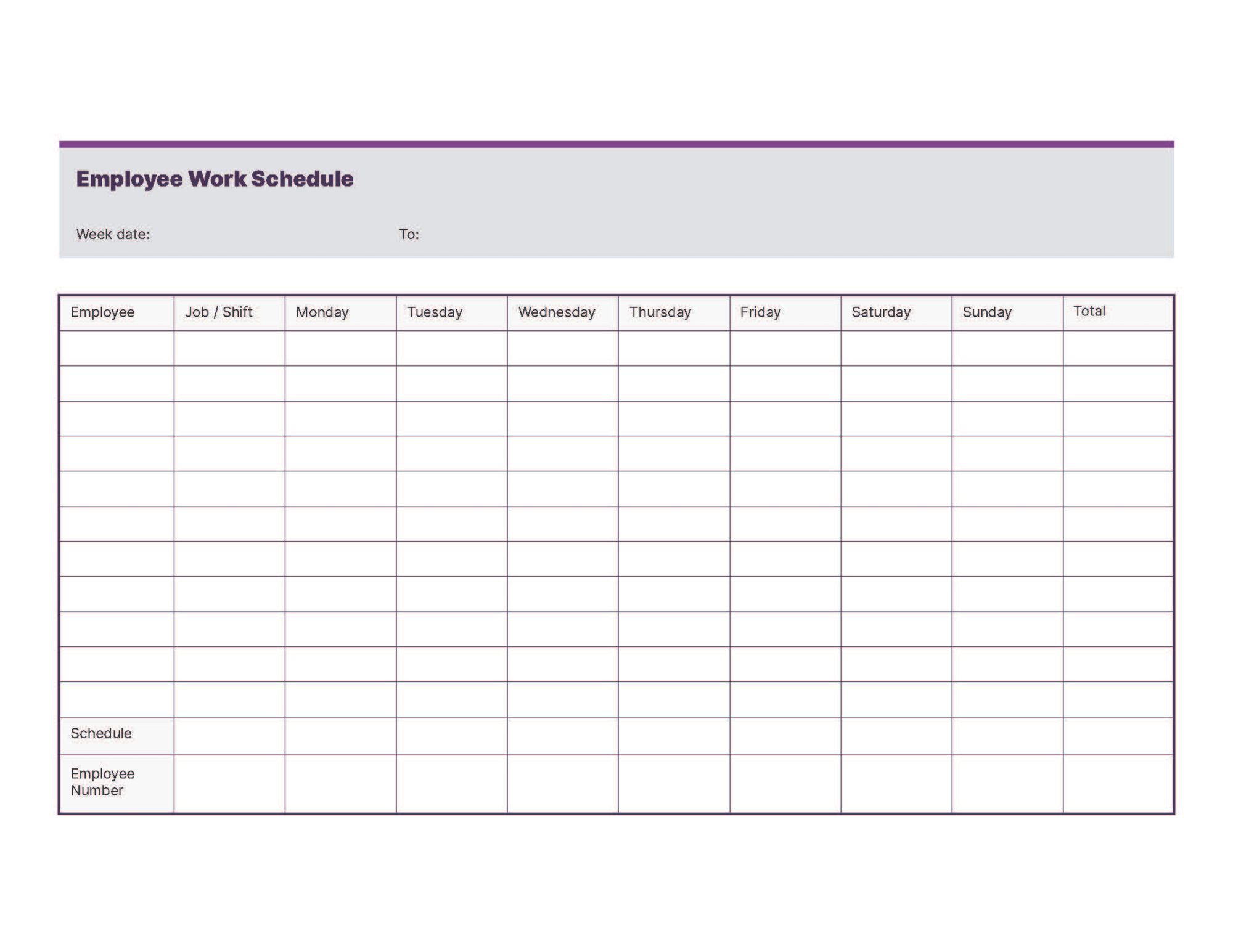

Step 5: Decide how you want to create your scheduleBack in the ‘good old days,’ you’d have to write out shifts and names in pen and paper. Fortunately, these days it’s a lot less complicated and most businesses opt to create things digitally. You can keep it simple by creating a template with Google Sheets. However, you can make it even easier by using an online employee scheduling software, like Homebase. These easy-to-use apps make anything small-biz related a breeze by helping automate and simplifying communication, so you can spend less time making schedules and more time growing your business. No matter what tool or software you decide to use, make sure to keep an eye out for features that can help save you time. Our favorites? Shift swaps, built-in blackout dates, and integrations with a time clock apps. Step 6: Create your scheduleReady, set, schedule! This is the fun part. It’s time to put all the blocks together from the previous steps and build something that works for your business. Every schedule will look a bit different but as a general rule, your schedule should include:

Tip: A schedule template can go a long way in taking the headache out of the process. Get a free drag-and-drop weekly schedule template from Homebase and build in minutes. Step 7: Review for common scheduling errorsMake a schedule once, check it twice. We’re only human—we all make mistakes. But with employee schedules, errors can cost you in more ways than one. At best, you might find yourself short-staffed. At worst, you might accidentally break a labor law. Being aware of common scheduling errors and checking for them can help you avoid potential issues. Some mistakes to look out for include:

Step 8: Share your schedule with your teamOnce your schedule is ready to go, it’s time to share it with your employees. If you’re using a scheduling app, you’ll likely have a feature that pushes the schedule out to the entire team. Otherwise, you can email the schedule or post it in the workplace. It’s best to share schedules in advance to give your team as much time to plan as possible—especially if things change drastically from week to week. Having a set cadence for when the calendar becomes available can also help manage employee expectations. For example, you might always release shift info 7 days ahead of time. Remember: If you need to make changes after you’ve sent it out, make sure to send an update to your team. Otherwise, your team might miss the changes. Make a work schedule with HomebaseSay goodbye to scheduling stress for good. Homebase’s free online schedule software helps you create a work schedule for your small business in minutes. When you make your schedule with Homebase, you can:

Plus, you’ll get access to Homebase’s suite of free small business tools, including an online time clock, a team communication app, and so much more.

The post How to Make a Work Schedule appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-how-to-make-a-schedule/ Navigating the complex world of team scheduling, especially when dealing with varying shifts in sectors like hospitality or healthcare, can be a logistical challenge (to say the least). It’s a tedious task that demands time, precision, and technological solutions. For businesses already using Microsoft Office, Excel can provide a practical and cost-effective way to create schedules for your team. To help you make the most of the software, we’re walking you through the step-by-step process of creating a team schedule in Excel. You’ll also find a free Excel template ready for you to try out. For teams with more complex scheduling needs that extend beyond what Excel has to offer, we’ll also explore an alternative scheduling solution specifically designed to handle the dynamic needs of your team. Ready to take the “ugh” out of sched”ugh”ling? Let’s get started. How to create a schedule in ExcelWhile Excel may be specifically designed for data entry and financial analysis, its capabilities extend far beyond that. The versatile platform can also be used to design custom schedules tailored to the specific needs of your business. Not familiar with the platform? That’s not a problem. With these step-by-step instructions, you’ll be whipping up your team schedule in no time. Step 1: Launch ExcelLaunch Microsoft Excel on your computer. If you don’t have Excel installed, you can use the online version or any other spreadsheet software that you prefer

Step 2: Insert header

Step 3: Title your columns and rows

Step 4: Input employee names

Once you’ve accurately labeled the columns and rows, it’s time to fill out the schedule.

Step 5: Save your workIt’s best practice to save as you go along to prevent your hard work from vanishing before your eyes. But it’s most important to save your file once you’ve completed your work schedule.

Step 7: Share and distributeDepending on your team’s preferences, you can share the Excel schedule by emailing the file, using cloud storage services, or printing physical copies. Provide a few ways to obtain a copy of the schedule to ensure it’s accessible for all members of your team. By following these detailed steps, you can easily make a work schedule in Excel that suits the unique needs of your team. Benefits of using Excel to make your work schedulesBeyond complicated formulas, Excel offers built-in templates and scalable features that simplify team scheduling. Don’t let the plain interface deter you; it just might be the low-cost scheduling solution you’ve been looking for. Saves timeExcel’s built-in functions and templates streamline the scheduling process, making it a highly efficient scheduling tool. By leveraging formulas for hourly calculations, copy-and-paste options, and utilizing templates for recurring schedules, managers can quickly create a schedule for their team. Flexible featuresWhether you need to adjust shifts, add or remove employees, or modify schedules on the fly due to changing circumstances, Excel is highly adaptable, making it suitable for all types of scheduling needs. Accurate calculationsOne of the key advantages of using Excel is its ability to minimize errors in scheduling. With integrated formulas and functions, you can automatically calculate the total hours worked and avoid accidentally overscheduling team members due to miscalculations. This level of accuracy is crucial for managing labor costs and ensuring compliance with local labor regulations. Identify scheduling patterns with data analysisBeyond basic scheduling capabilities, Excel allows you to track and analyze scheduling data over time. By organizing schedules in Excel, you can identify patterns, monitor employee performance, and make data-driven decisions to improve your workforce management. Easily shareableExcel also simplifies communication by providing easy sharing options for schedules. Whether through email or cloud storage, your team can access schedules from anywhere, fostering clear communication and reducing scheduling conflicts. ScalabilityWhether you’re managing a small team or a large workforce, Excel can be adapted to fit your scheduling process and meet the evolving needs of your business. So, if your business is affected by seasonal fluctuations, you can scale the process up or down as you go. Visual clarityWhile Excel may be better known for its formulas and calculations, it doesn’t do so at the expense of aesthetics. Customizable formatting, color coding, highlighting, and font adjustments allow you to enhance the readability of schedules, contributing to clearer communication and understanding. AccessibilityExcel also offers convenience and accessibility. While managers are able to create team schedules on their desktop computers, their employees are free to access the schedules on their multiple devices. This flexibility ensures that both managers and employees can effortlessly view and update schedules on the go and provides options for members of your team who may not be able to use certain devices. Cost-effectiveGiven its widespread availability, Excel eliminates the need for specialized scheduling software — making it a readily accessible and cost-effective tool for small businesses. The downside of creating your work schedule in Excel

Limited automationExcel schedules often require manual data entry and calculations. This can be particularly time-consuming for those with limited Excel experience and may result in human errors when managing large or complex schedules. Version controlWhile sharing Excel schedules is a fairly straightforward process, it can be challenging to maintain control over edits. Since Excel schedules don’t typically offer real-time updates, making last-minute changes can result in scheduling conflicts and confusion. Time-consuming updatesModifying schedules to accommodate changes in staffing or time-off requests can be tedious, especially when using large, established Excel schedules. Limited reporting featuresWhile Excel allows basic data analysis, it may not offer the advanced reporting features available in dedicated scheduling software. This can limit your insights into schedule-related data and prevent you from optimizing your resources. Security concernsStoring sensitive employee information in Excel files can pose security risks, especially if not adequately protected and shared. Additional security measures should be taken to ensure the confidentiality of employee data. Steep learning curveEffective use of Excel for scheduling requires some practice. First-time users may find that there’s a steep and frustrating learning curve, particularly when dealing with formulas and calculations. This can lead to wasted time, errors, and scheduling confusion. Compatibility issuesProblems with compatibility can arise when sharing Excel schedules with different software versions or with users who don’t have Excel installed. This makes it difficult to collaborate on the scheduling process and ensure your team is working off of the most up-to-date schedule. Is there a better way to create work schedules for your employees?While using Excel for scheduling may seem easy and convenient, it wasn’t originally designed for that purpose. As a result, it lacks the flexibility and real-time updates necessary to manage a dynamic team schedule. Homebase, on the other hand, was purpose-built to streamline employee scheduling, time clock management, and payroll integration, making it a more agile and efficient solution. The following user-friendly features make it easier to manage and schedule your team with Homebase. Streamlined employee schedulingHomebase offers intuitive drag-and-drop scheduling tools that simplify the process of creating and managing schedules. You can quickly build, customize, and share schedules, and notify your team of any changes (in real time). Time clock managementUnlike Excel, Homebase includes a built-in time clock (and GPS-enabled time tracking) that allows your employees to clock in and out from their mobile devices. This reduces the risk of time theft and ensures accurate time tracking and payroll. Payroll integrationWhile you may be able to whip up a nifty formula to calculate total hours worked in Excel, you’ll still have to manually input those hours into your payroll system, which is time-consuming and error-prone. Homebase seamlessly integrates with popular payroll providers like ADP, Gusto, and QuickBooks, saving you time, minimizing errors in wage calculations, and automating an otherwise tedious process. Real-time updatesHomebase eliminates the need to continuously distribute updated versions of your team’s schedule. With the ability to update your schedule and send notifications on the fly, you can rest assured that your team will be notified of any changes, even last-minute ones. Speaking of last-minute changes, your team can easily pick up or trade shifts directly in the app, eliminating those awkward yet frantic last-minute calls for coverage. Employee communicationWhile communicating across shifts can be challenging, Homebase’sbuilt-in messenger tool makes it easy to stay connected. Instantly send messages, notifications, and updates directly through the app. This makes it easier for your team to stay organized and on the same page. Say goodbye to the limitations of Excel spreadsheets and embrace the power of Homebase for your small business. Discover the benefits of Homebase for yourself and revolutionize your workforce management. Build, optimize, and share your team schedules in one easy-to-use app. Try Homebase for free. The post How to Make a Schedule in Excel: A Step-by-Step Guide appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-how-to-make-a-schedule-in-excel/ You’ve probably heard of an employee of the month program, or maybe you were even part of one. If managed correctly, these programs can be a great addition to an already successful employee recognition program or a great way to kick off your employee recognition efforts. The most basic programs often come with a certificate (see our employee of the month template below), but that’s just the beginning on how you can use them as a tool to recognize your employees. Finding ways to recognize and celebrate your employees is extremely important. Employee recognition is a main driver of employee retention, productivity, and happiness. Recognizing the hard work of your team members isn’t only about acknowledging them; it’s also about building a positive company culture and workplace environment. We’ve put together some valuable info on what employee recognition is all about, why an employee of the month program is a great start, and even added a valuable employee of the month template. Ready? Let’s go! What is employee recognition, and why is it important?Employee recognition refers to the different ways that a company recognizes and celebrates its team members for their contributions. Employee recognition can happen in various ways, but the main goal is always to show employees how much you appreciate their hard work. You can recognize your employees for many different reasons—from achievements, to milestones, to exceeding expectations. While you might make a point of saying thank you to your employees for a good day’s work, there are a lot of reasons to make it a more formal, systematic part of your business. A survey found that 37% of employees said more personal recognition is the number one factor that would spur them to produce better work more often. The same survey found those who feel recognized and appreciated at work are 2.2x more likely to drive innovation and 2.0x more likely to go above and beyond for their job. They’re more likely to be satisfied with their jobs than those who aren’t recognized. A workplace with a company culture that supports employee recognition will experience better retention rates for top talent, increase employee engagement, and encourage team members to perform at a higher level. Some of the common ways to show your appreciation to your employees include:

Recognizing top performersYou might read “employee of the month” and think that it’s a pretty outdated idea. And while an employee of the month program should be part of a wider recognition program in your organization, it’s a classic for a reason. Employee of the month is an award given to an employee to recognize someone who has been an exemplary employee during the previous month. It’s usually given out each month, so there is a chance to recognize 12 employees over the year. Companies who give out this award usually create an experience they can recreate monthly to recognize their top performer. This can involve a town hall meeting, awards presentation, company-wide email, and other elements to make the reward significant for the recipient. Is an employee of the month program a good idea?As long as employee of the month is done in a fair and fun way and is part of a more extensive recognition program, it can be a great tool in your employee appreciation toolbox. To make sure your employee of the month program is set up for success, stick to these four tips to avoid common pitfalls. Give the award to different people each monthDon’t let your employee of the month award become a tangible sign of favoritism in the workplace. Giving the award to the same person or people month after month will only demotivate your other employees and create a toxic work environment. If the same people are your top performers every month, consider what might be holding your other employees back. Dig into the issues and find creative ways to work as a team to uplift the other employees. Get input from your whole teamManagers and other team members in leadership roles will have a lot of great information to share when it comes to how employees are performing. By letting every team member have a say in who deserves the employee of the month award, you’ll see all the different ways your team members contribute to the business. You can even open it to customer input using a survey or feedback tool. The idea is to include everyone in the process. This will make it feel more equitable to your team and give you greater insight into what’s happening in every aspect of your business. Make your rewards bespoke to the individualWhile it makes complete sense to have a repeatable process for employee of the month, don’t forget to tailor your reward to the person. For example, if you have a more introverted employee, throwing them a party won’t be as fun for them as it may have been for the extrovert who won the previous month. Make sure you take the individual into account so that the award feels special for each person. The employee of the month should be part of a bigger employee recognition programDon’t let the employee of the month program be the only way you recognize your employees. Remember, only one person is “winning” each month. If this is the only thing you’re doing, it can be highly demotivating for your other employees. The best kind of employee recognition is timely, frequent, and meaningful. This should be a tool you use, but it shouldn’t be seen as the only thing you need to do to make your employees feel appreciated. How do you choose your employee of the month each month?How are you going to choose an employee to be rewarded each month? The most important thing is establishing some criteria for employee of the month. You want to define it as much as possible so that all employees understand how the winner is being selected. This will help avoid any claims of favoritism. As mentioned above, having all employees vote or submit feedback to help make the decision each month is a great idea. Outline the criteria that all voters should consider before making their choice. Here are some factors you can consider including in your criteria:

Once you’ve selected the criteria that make the most sense for your business, you can create a sliding scale for judging people’s performance across the categories. It could be as simple as “from 1 to 5,” or you can assign descriptive ratings such as:

This ensures everyone is graded on the same scale using the same criteria. How can you celebrate and recognize your employee of the month?You’ve done it—selected your first employee of the month! But how do you celebrate them? In addition to a nice certificate (see our simple employee of the month template certificate below), there are tons of great ways to show your appreciation to your employee of the month. Find something that resonates with you, your team, and your business. Here are ten employee of the month ideas to get you started. 1. Offer career development opportunitiesWhether you offer the opportunity to each winner or hold a winner-wide event at the end of the year, career development incentives can be a great way to help employees continue on their path toward success. You can bring in career development experts or experts in your field to talk about how employees can reach their personal career goals. 2. Host a monthly celebrationHosting a monthly lunch or dinner celebration to honor the employee of the month is a great way to get your whole team involved. Everyone will enjoy a free lunch, and you can find a personality-appropriate way to celebrate the employee of the month. This gives the entire team something to look forward to and helps get everyone on board with the employee of the month program. 3. Offer a PTO top-up for the winnersVacation days are a strong currency for all employees. Winning an additional PTO day or two is a great way to motivate employees to strive to win employee of the month. Tip: there may be logistics involved in this depending on your business structure. Make sure to do your research if you decide to to incorporate PTO into your employee of the month program. Explain how it can be redeemed in a way that makes it as easy as possible for winners to use their time off while not putting you and the rest of your employees out. 4. Donate to a charity of their choiceWho doesn’t love to give back? Choose a set amount of money to be donated to a charity of the winner’s choice each month. This is an excellent way for the employee of the month to be rewarded while making a difference in their community. 5. Give winners a one-time bonusWhile you might feel weird giving out a cash bonus to your employees, cash is the most practical gift. And, it can make a big difference for your employees. Even a $100 bonus can significantly impact someone’s life. 6. Give winners a gift card of their choiceIf you feel too strange about handing out cash bonuses, consider giving out gift cards instead. Giving your employees a choice is important when picking a gift card. While one employee might be happy to get a gift card to a gas station, the employee who takes public transportation will likely be less excited about it. 7. Pay for them to take a night offWhile PTO is amazing, take it to the next level by paying for them to do something on their night off. You could have a list of experiences for your employees to choose from. This is also a fun way to highlight other local businesses and can even be a great way to cross-promote if you speak with the other business owners. Some ideas include:

Brainstorm ideas that are local to you with your team to get a list that gets people invested. And be sure that the night out is for two so the winner can bring someone along for the adventure. 8. Shout out your employees on social media and your websiteNever underestimate the power of a public thank you. Take to your social media, website, or company newsletter to talk about the impact and importance of the employee of the month. Take the time to interview them and ask about their experience working for your business to include in the caption. Be sure to include a photo they’ve approved and highlight all the good they’ve done over the past month. If you’re feeling lost on what to include, you can use the same question for all employees and create a generic employee of the month template for your monthly social posts to save time and keep it easy. 9. Create company swag just for winnersIf you’ve already got some amazing company swag, think about personalizing it for employee of the month winners. For example, if everyone on your team wears a uniform, look into having one embroidered or silk-screened with their name. And if you have swag that’s more for fun than uniform, put together a gift basket with some items that are only given to winners. 10. Give them a certificate or trophyDon’t underestimate the importance of physical representation of their hard work. A certificate to recognize the employee of the month gives you a tangible award to frame and hand to the employee when you announce they’ve won. Make it feel official by having a certificate template that you use each time. Be sure to include your company logo, brand colors, and fonts. It’s also a nice gesture to include a personalized letter for the employee highlighting why they’ve won. Not creative? Not to worry. Our downloadable employee of the month template below is a simple way to start!

Employee of the month downloadable template How to recognize and support your employees every day of the monthAs mentioned before, recognizing your employees frequently, promptly, and in meaningful ways is essential to a successful employee recognition program. An employee of the month template is a great place to start, but with Homebase, you can do more. With our communication app, you can shout out team members for a job well done privately or in group messages with the entire team. Homebase also tracks performance metrics like on-time arrivals, so you can easily monitor who’s in the running. From employee of the month templates, to digital high fives, to making even bonuses and extra PTO a breeze, Homebase is your all-in-one solution for managing your team. Behind every great business is a great team. And behind every great team is the tools needed to support them. Try Homebase for free. The post 10 Ways to Recognize an Employee of the Month appeared first on Homebase. via Homebase https://joinhomebase.com/blog/employee-of-the-month-template/ Increasing productivity and efficiency in your workplace all depends on one thing: time management. Time management is all about effectively organizing and planning your day to complete all the necessary tasks on your must-do list. When your time management skills are top-notch, you’re more productive. Excellent time management skills are only one part of becoming a time management expert. Finding the right time manager app to support you is essential. To help you work smarter, not harder, we’ve put together a guide to show you everything you need to know about time management, including the top time management apps for 2024. Tick tock—the clock’s ticking, so let’s dive in. What is time manager software?Time manager software, or time tracking software, allows employers to track employees’ time working. Some time manager apps also allow you to track which tasks and projects employees work on during their shifts. Many businesses use time manager software to track start and end times for their employees. A lot of different industries benefit from using time manager software, including freelancers, contractors, hourly workers, and those who use billable time, like accountants, house cleaners, and lawyers. Why is time management important for businesses?Whether it’s something you’re consciously aware of or not, time management can significantly impact your business. Suppose you have employees who are great at their jobs and keep customers happy, but consistently run behind on their inventory duties or show up late. In that case, it will majorly impact your business and the relationships you’ve built with your customers. Time management isn’t about pushing your employees to work harder and longer. It’s quite the opposite—time management is about encouraging your employees to work smarter. With good time management skills, you organize workloads and shift management to let employees finish their work without racking up overtime. By managing time well, employees can improve productivity, become more efficient, and complete tasks during their shifts. Time management can also help improve job satisfaction—when you can get your work done on time, you stress less, which has a ripple effect through all aspects of your job. 6 key benefits of good time managementThe many benefits of good time management can positively affect you, your employees, and your business. We touched on some of them above, but let’s take a look at six key benefits that time management skills can provide to your business:

Why businesses need a time management appEmployers can’t underestimate the benefits of time management. But how can you, as a business owner, help your employees improve their time management skills? The most efficient and effective way to start building time management skills in your team is to start using a time management app. A time management app allows you to reduce stress, increase productivity, boost confidence, and complete essential work responsibilities on time. And with the right app, the power to do that (and so much more) is right at your fingertips. Not only does a time management app help you accomplish everything on your to-do list, it also saves you time and money in the long run. A time management app can help you eliminate the inefficient use of time and resources, meaning you can take that time and resources and reinvest them elsewhere in your business. What to look for in a time manager softwareFinding time manager software that meets your needs is essential. Software that doesn’t match your business needs will give you more issues than it solves. The bare minimum is a reliable app that fits your budget and comes with everything you need to make work more efficient at your business. Look for these five features to get the right time manager software for your business. Consider ease of useIf you’re expecting your entire team to use the time management software, it’s important to find a solution that’s easy to use. Look for a system with a clean design and intuitive interface that is simple to use. You need to use time management software for it to be effective. To ensure your team is using it, the barrier to use needs to be low. Look for a time manager solution that’ll be quick and easy for employees to use every time they clock in and out of their shifts. Connects to your payroll systemA time management system that connects directly with your payroll system can help you streamline your payroll processes. Look for a time management system that can automatically generate employee timesheets. Then, these timesheets can be fed directly into the integrated payroll system. An integrated system will help you save time as you and your employees won’t have to calculate hours and input them into another software system manually. Having your time management, timesheets, and payroll live in the same place can keep things transparent for you and your employees. Additionally, automating payroll helps minimize mistakes introduced by human error when calculating payroll. Integrates with other business toolsWhile an ideal time management system will connect directly with payroll and other business tools, you and your team may already be comfortable with certain business tools you plan to continue using. If this sounds like you, finding a time manager app that integrates with other business tools is key. Think about the software and business tools that are currently helping your business run smoothly— consider your point-of-sale, marketing tools, communication tools, and more. Once you’ve got a list of your essentials, look for time management software that integrates with your specific business tools. Helps you manage your compliance requirements for local labor lawsWhen it comes to time tracking and keeping track of hours worked, there are local, state, and federal regulations to keep in mind. Using a time management system that keeps track of hourly wages and hours worked can help ensure you comply with local labor laws. Another thing to keep in mind is that laws are often changing. Look for time manager software that alerts you when there are changes to labor laws. That way, you’ll always be keeping compliancy top of mind. Includes a mobile app for on-the-go useWhen we walk about ease of use, we’ve got to talk about mobile apps. Even for people who aren’t glued to their phones, not all employees work from one location, like contractors, landscapers, or delivery drivers. A time management system with a mobile app means most of your employees will be able to access it. A mobile app also lets you and your employees access the system no matter where you’re working from. This is essential for remote teams who are constantly on the move, but it’s also a great feature for most small businesses. A mobile app means you can easily access, view, and edit time entries, no matter where you are. 5 recommended time manager apps for 2024You can run your business like a fine-tuned machine with the right time manager tools in your toolkit. If you’re still on the fence or unsure which time manager app is best for your business, let’s look at our top five picks for 2024. TodoistTodoist is one of the more robust offerings on our list. You can use Todoist to reach personal and business goals with personal and business accounts. Create and track tasks, assign tasks to others, and quickly prioritize and communicate with your team. Todoist integrates with tools like Gmail and Slack, helping streamline your team communications. The intuitive interface makes it easy to use. And, it’s available on iOS, Android, macOS, Windows, and more, so you can use it on almost any device and easily move from your phone to your computer. If you’re looking for a solution that tracks clock-in and clock-out times, Todoist may not be the right fit as it is strictly a task management app. A free plan is available with limited capabilities—paid plans start at $4 per month. AsanaAnother task management software, Asana, is designed to improve your team’s time management. It streamlines team collaboration so your team can manage projects and tasks and see what everyone is working on. Asana has a long list of apps and programs it integrates with, from Microsoft Teams and Salesforce to Google Suite and Canva. It doesn’t have a built-in timesheet or payroll integration. Asana doesn’t track hours worked and can’t create monthly work schedules based on shifts. Instead, it’s a good choice for businesses that need a project management solution, and is best for office-based workers. ClockifyClockify is a time tracker and time management app perfect for contractors, freelancers, and other solopreneurs. It lets you track your time on different tasks and breaks it down by task, project, and client. When you track your work hours in Clockify, you can calculate billable hours, schedule tasks, and generate reports to help you create client invoices. Clockify has over eighty integrations, including QuickBooks, Trello, Asana, Jira, and many more. There are some limitations with Clockify for small businesses—it’s harder to collaborate with team members, and tracking clocking in and out isn’t possible in Clockify. TogglToggl is a time-tracking software that benefits from additional features and integrations that expand its capabilities. It creates accurate time reports with easy-to-use filtering and sorting options for data. Toggl has a drop-and-drop scheduling feature that is simple to use, and the reporting dashboards provide insights into project, team, and date-specific time entries. It also integrates with popular business apps like Evernote, Google Calendar, and Asana but doesn’t have a built-in invoicing tool or any integrations with invoicing tools. Toggl is free for up to five users; paid plans start at $10 monthly. HomebaseHomebase, one of the most comprehensive time management apps on the market, allows employees to clock in and out of their shifts and automatically converts that data into timesheets. This streamlines the process of tracking hours worked, breaks taken, and overtime, ultimately making it easy to run payroll. But Homebase goes beyond time tracking and time management. It has a whole suite of tools that help your small business run smoothly. Plus, it’s specifically created for small businesses owners as a whole.

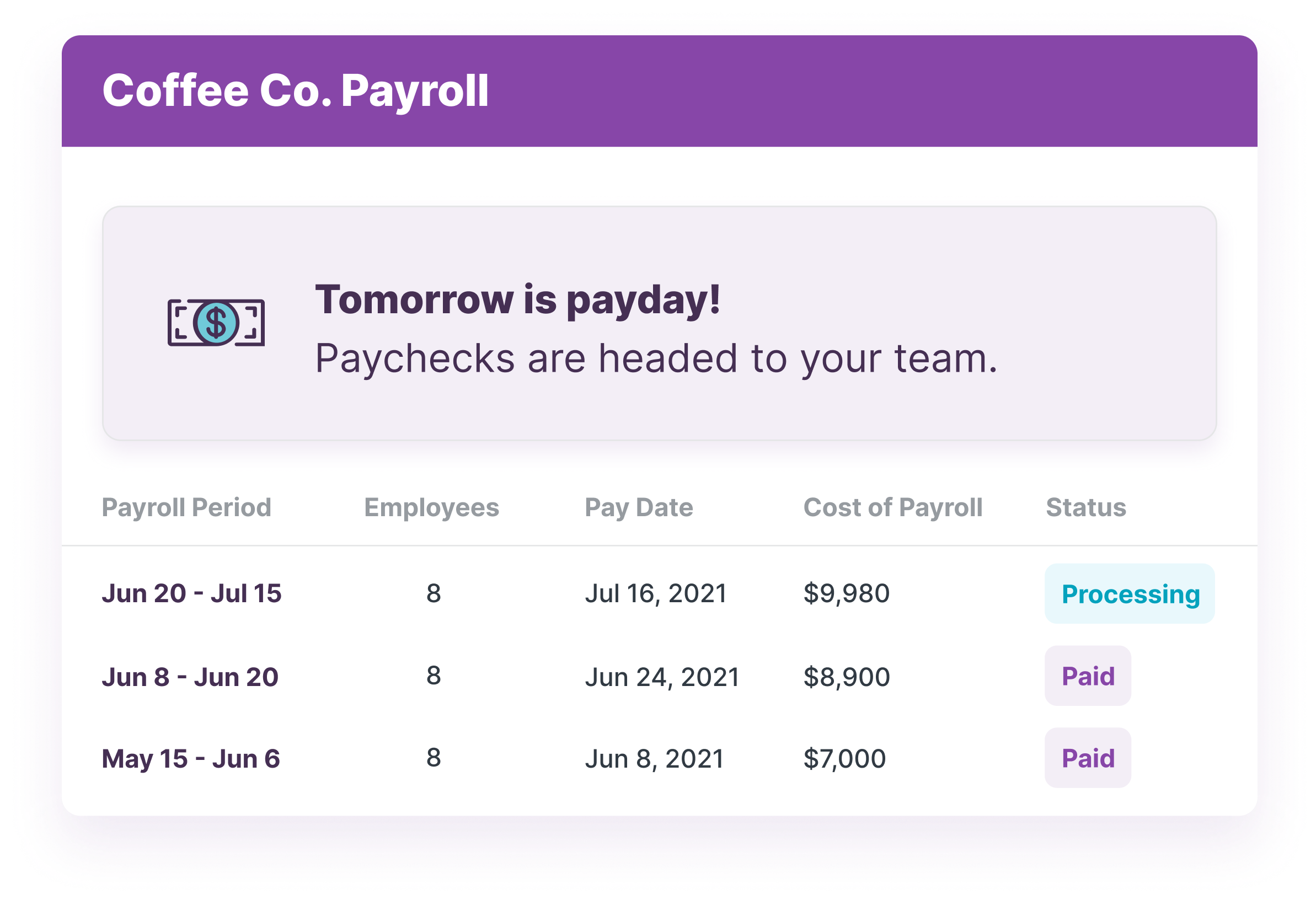

Homebase offers various services at different price points, Including the basic or Free plan for one location and up to 20 employees with basic scheduling and time tracking, employee management tools like Messaging, point-of-sale integrations, and access to email support. Paid plans start at $24.95 per month per location. Having a time manager app is a no brainer, but having a time manager app that integrates with your other much-needed tools and software? Well. Now that’s a gamechanger. Work with the software tool created specifically with small businesses in mind. Get started with Homebase today for free. The post The Complete Guide to Time Manager Apps (2024) appeared first on Homebase. via Homebase https://joinhomebase.com/blog/the-complete-guide-to-time-manager-apps-2024/ As a small business owner, you know your business is growing when you’re investing in a free payroll app. Adding employees to your business as an entrepreneur is great for scaling, but it can also mean added work to ensure you’re accurately and efficiently paying those employees. Even for seasoned small business owners, payroll can be a pain. But payroll doesn’t need to be a time-consuming, pull-your-hair-out exercise. With the right automated payroll software, like a free payroll app, you’ll be able to streamline your payment process, comply with taxes, and ensure your employees are paid right—and on time. Ahead, we’re going to dig into what exactly payroll for your small business is, why you’d use a free payroll app as an option, and the top 5 free payroll apps to consider for your small business. Let’s go! What is payroll for a small business?Payroll is the process by which a small business compensates—or in another word, pays—its employees for a set period or given date of time worked. Small business owners and managers must accurately calculate the amount of money for each employee at the establishment. Employees have historically received physical checks or direct deposits into their banking account from payroll. Payroll must have the following elements to be completed:

In a small business, payroll is often handled by one person, like the owner or a manager (or let’s face it: whoever’s reading this article). Typically in larger companies, payroll is the responsibility of an accounting manager or the human resources department. But for a small business, many of these roles are merged into a couple of people to handle, which can be a bit hectic and time-consuming—especially if owners are leaning toward using paper records for payroll. Payroll is a business’s most important—and often priciest—expense in order to run operations smoothly. Some good news? Payroll is also a deductible, which can contribute to the overall gross income, also known as adjusted gross income, which may lower tax costs or contribute to a refund. Why use a free payroll app for small businessesIt may seem obvious in the digital age that using a free payroll app is a smart business decision, but not everyone has jumped onto the technology train to streamline operations. What if you’ve got a good payroll system that works for you? It’s like the saying goes: if it’s not broke, don’t fix it. There are a myriad of reasons why a free payroll app will be good for your small business. Below are a few common, important considerations and benefits to switching to a free payroll app. Keep costs lowAt the absolute top of the list for a free payroll app is to help keep your overall business expenses lowered. We want to save money where we can, right? Automate your entire payroll process to reduce any costly errors that will save money and time. Many other businesses, typically those bigger than the average small biz, source out payroll to other businesses. But that comes at a steeper cost. A free payroll app won’t cost nearly as much as contracting out the work to another business supporting its own employees. Save timePaper payroll records are time-consuming: Manually tracking hours worked, who called in sick, which employee was on vacation, and don’t even get us started on shift switching. A free payroll app can automate all of this for your small business and your staff. Error reductionSwitching from paper to digital records not only saves manual time, it also reduces any manual errors that can occur from doing calculations and tracking employee hours worked. Payroll apps can house all kinds of data as well so that calendars are synced and you and your employees know exactly how many hours have been worked that need to be paid out. TransparencySome free payroll apps can hold all of your employees information, like hours and shifts worked. Because you and your employee now have all the same info, this makes things more transparent (and less error prone) than referring back to a stained schedule on a bulletin board. It also means that employees see info sooner. The benefit there is that they may be able to remember anything that might constitute an error more easily. SecurityA smart payroll app also includes sensitive info, like banking accounts, social security numbers, and confirms to your employees you’re paying them correctly and on-time. Not only that, it keeps that payroll information protected. Manual pay info in ledgers or even just on a company laptop are a lot easier for other people to see, change, and abuse. Keeping your employees’ info safe shows that you value their privacy, and that they can trust you. ReliabilityWith automation, a small business owner, or whoever manages payroll, can be assured that employees will be paid on-time, and the amount they should be owed for time work. It takes the worry out of trying to complete complicated tasks on-time, especially when you don’t have to wait for any information: it’s all there at your fingertips, when you need it most. Data syncingA free payroll app doesn’t just need to keep your employees’ payroll information: it can do so much more. Sync and house your employee data with this software, like employee birthdays, emergency contacts, and any completed employee certifications, while being able to send messages or alerts to your team to remain connected. Employee friendlyFree payroll apps can be extremely employee-friendly and easy to use. Employees are able to see their own schedule, pay stubs, deposits, and W-2s. These apps can let your employees know when they are paid. It, too, can empower employees to keep track of their PTO or sick days, and help keep track of any shift trades. Manages compliance complexitiesA payroll app is ready-made to manage any tax or compliance complexities when paying employees from deducting mandatory state and federal taxes to any additional local taxes, and keeping up with percentages or increases. A payroll app will also ensure any time card or timesheet and payroll records are FLSA-compliant. Best free payroll apps for small business in 2024There are a lot of free payroll apps out there, but we did the research to help you find the best of the best. Read on for our favourite five picks including a bonus option that—in our humble opinion—has everything a small business needs for payroll and beyond. 1. eSmart PaycheckeSmart Paycheck is useful for employers who need to do payroll calculations, generating paychecks to print, with federal and state tax considerations included. Key benefits:

Key considerations:

2. TimeTrexTimeTrex is a great tool to use for both payroll and scheduling. It’s also cloud-based, like other free payroll software options, and has integration capabilities with programs like QuickBooks and Sage. Key benefits:

Key considerations:

3. ExcelPayrollExcelPayroll is an app that is primarily used with Microsoft Excel with pre-formulated Excel functions. The free payroll app can handle up to 50 employees. Key benefits:

Key considerations:

4. HR.myLike the name of the app suggests, HR.my is focused primarily on human resources solutions. It’s limited, but it does offer free unlimited payroll processing. Key benefits:

Key considerations:

5. Payroll4FreePayroll4Free is an option for businesses with fewer than 25 employees. For a free app it has a lot of great features, and is ideal for businesses on a budget that aren’t intending to grow past 24 team members. Key benefits:

Key considerations:

Choose Homebase as your free payroll appHomebase is the free payroll app that can do it all for your small business. Homebase is a user-friendly free payroll app for small business owners, managers, and employees. Payroll automationInstead of shuffling papers to find accurate information on how many hours your employees need to be paid for you, you can do it all in a few clicks on your screen. Homebase can easily change timesheets into pay for your employees with accurate calculations. The app will file any taxes, too, including W-2s and 1099s. Data you can trustHomebase is synced with all the employee data you’ll need to ensure they’re paid accurately and on time. Every time an employee clocks in for their shift, and the second they clock out, Homebase tracks it for your business. Instead of using paper to keep up-to-speed on shifts, like swapping or overtime hours, Homebase gets an accurate read on where your employees are and for how long. The data you get for Homebase is directly from your employees. Homebase ensures your workers have self-service capabilities like onboarding and signing digital payroll forms so you don’t have to manually enter their data. Homebase helps you avoid mistakes like forgetting to put in breaks, PTO, or vacation days. It tracks all of this employee data for you so that when you run payroll biweekly or monthly, you’re getting the best, complete portrait of how your employees spent their time, and how much they need to get paid. Compliancy assistanceIt can be all too easy to get lost in the compliance sauce if you’re trying to handle everything involved with payroll by paper records. With Homebase, the app stays up-to-date on what the overtime and break policies are for each state so you can ensure your employees are getting the time off they need, or recording any additional time worked past their scheduled shift for pay. Homebase will also keep all of your employee records and time cards are FLSA compliant, and remain there for the minimum three-year period. Streamlined operationsHomebase makes it easier for you to handle all the administrative parts of your business. Payroll is one of the biggest expenses for any business. Any errors can cost your money, and erode trust with your employees. With Homebase, processes are automated, employees have more control and insight into their pay stubs, scheduling, and timesheets, and how those all intersect with the other, resulting in their paychecks.Get started for free today. The post Top 5 Free Payroll Apps for Small Businesses appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-top-five-free-payroll-apps/ When your small business team members are scattered around the workplace and juggling dozens of different tasks, a texting app can make it easier to check in with your team throughout the day and share work-related news and updates from anywhere. A tool like WhatsApp may seem like your best bet for team communication: It’s a straightforward, cost-effective app that lets you text individual team members, create group chats, and share files, images, videos, and other media. But choosing WhatsApp to keep in touch with your team means you might be missing out on business-specific features and integrations that can keep your everyday operations more efficient. Plus, it could mean putting your business and your team at risk when it comes to security, compliance, and well-being. Let’s take a closer look at how WhatsApp works, explore its pros and cons, and provide suggestions on effective, budget-friendly team communication alternatives you should consider instead.

Stay in sync and work better together.

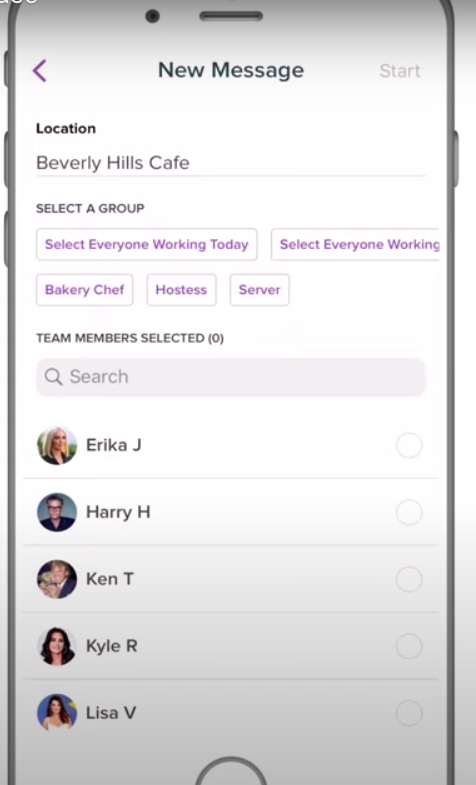

Stop chasing down phone numbers with our built-in team communication tool. Message teammates, share updates, and swap shifts — all from the Homebase app. Why WhatsApp might fall short for your small businessWhile WhatsApp may be a convenient way to stay in touch with your busy small business team, it may not be the best option for your future. You may find that it’s hard to keep administrative control over group chats, which means that essential news and updates can easily get lost and employees may start to feel information overload. If you’re worried about compliance, you might also become frustrated with how difficult it is to save and keep track of essential employee data on WhatsApp, especially across various group and individual chats. For instance, it will be hard to ensure new hires remember to sign and return paperwork over the app as your team gets bigger. Also, consider that WhatsApp isn’t designed with small business communication in mind, so their customer service team may be unable to help you address your business-specific technical issues. Homebase’s team communication feature is a better choice for small business owners and their hourly employees. With Homebase team chat you’ll simplify day-to-day communication with an app that can:

Stay in sync and work better together.