|

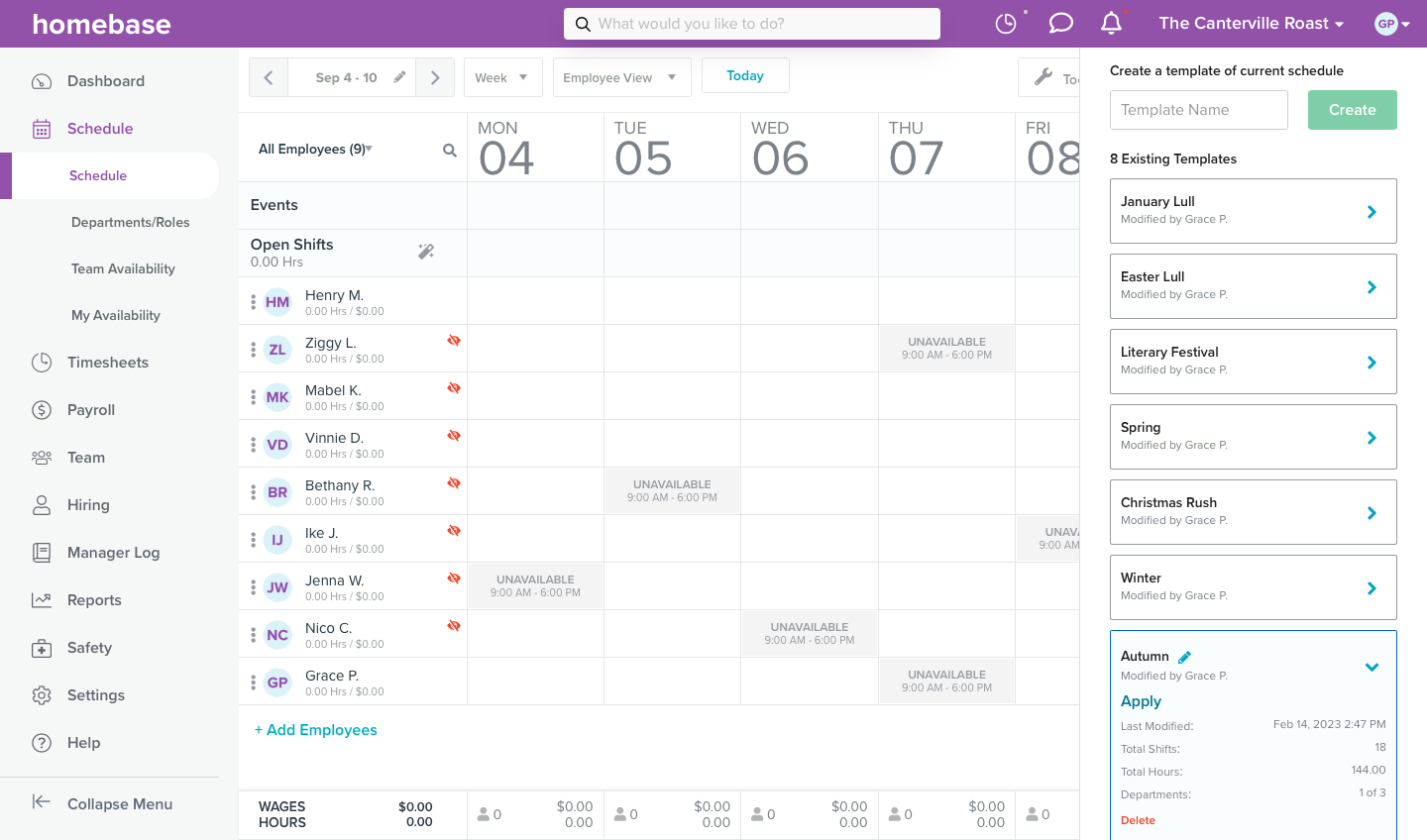

Sorry, Dolly Parton! Working ‘9 to 5’ isn’t everyone’s reality. And it doesn’t need to be for your small business if you need employees for longer shifts. For small business owners, hospitality workers, medical staff, and other workers in a variety of industries, shifts are often creatively scheduled and the hours tend to be much longer. There are a lot of small businesses that use a 12-hour shift schedule for their employees. Of course, there are a lot of benefits of the 12-hour shift schedule, along with some valid concerns solved through labor regulations around scheduling. These longer shifts can help streamline operations, decrease employee absenteeism, and keep a sense of continuity. Let’s dig into what a 12-hour shift schedule is, which industries it shows up the most in, and some key considerations before getting started with it. What is a 12-hour shift schedule?A 12-hour shift schedule is exactly what it sounds like: an employee is scheduled to work for 12 hours in a row. This type of shift means an employee starts at a particular time. For example, if an employee starts at 7AM, and their end time is 12 hours later, they’d work a full 7AM – 7PM shift. The traditional office job hours of 9-5, five days a week, aren’t common for every worker. Twelve hour shifts are sometimes necessary for those working in other industries to provide continuity of care, or for workers like long-haul truckers, where you’re trying to maximize your working hours. Common 12-hour shift jobs and industriesYou’ve very likely come across someone in your day-to-day who’s working during their 12-hour shift. Ever spoken to a nurse in an emergency room, waved to the driver of an 18-wheel truck, or talked to someone at 911? These folks are all commonly 12-hour shift workers. Below is a list of common 12-hour shift jobs and their industries. MedicalDoctors, nurses, and many medical staff work a 12-hour shift. Nurses, for example, can work two back-to-back shifts from morning to evening or evening to morning with a day or two off in-between. The medical industry is the most common one to have the 12-hour shift schedule because patient care isn’t fixed. There needs to be total coverage in a 24 hour period at medical places like hospitals or urgent care. Public safetyA common industry that uses a 12-hour shift schedule is public safety. This can include police officers, paramedics, firefighters, or emergency medical technicians. Public safety may also include correctional officers for prisons or jails, as well as security guards or officers wherever security needs to be. This may include condos, retail spaces, or museum. HospitalityFor the most part, traditional hospitality workers work shorter, more intense shifts, but it’s possible for small businesses—particularly those just starting up and in need of shift coverage—to use a 12-hour shift schedule. Some of those roles may include servers, bartenders, back of the house staff like cooks or dishwashers, and front of the house associates like managers of a restaurant or hotel. ManufacturingThose who work in manufacturing or in a warehouse often have 12-hour shift schedules, too. This can include workers at product factories, or working in a warehouse to pack up goods to be delivered to our homes. In some cases, particularly in bigger production roles like automotive, these shifts may be regulated by union rules. Why would a small business use a 12-hour shift schedule?There’s merit in adopting a 12-hour shift schedule rather than sticking to the usual shift management your small business may be used to. The 12-hour shift isn’t without its considerations and possible disadvantages, which we’ll get to, but a 12-hour shift schedule may lead to better productivity and output, and an increase in employee morale. Business continuity and increased productivityWhen you’ve got at least one person working a 12-hour shift schedule, that employee should be able to work toward or complete their tasks within that time frame without having to pass it off and explain what’s going to someone else. With a total of two shift turnovers per day, there’s also the possibility for a lot less miscommunication between workers about what needs to be done and less work or productivity disruptions. Decrease in employee absenteeismTwelve hours is a lot of time with a lot of (potential) money. If your employees are scheduled for shorter shifts, they may feel compelled to take those days off and not worry about losing four hours of pay. A 12-hour shift schedule could be more compelling for your employees to show up. After all, if they’re getting paid $15/hour, a four hour shift is $60; a 12-hour shift would be $180 in their pocket. More hours, yes, but that’s an enticing paycheck. The downside? A 12-hour shift is more detrimental if your employee decides to not show up. And, it could be a lot harder to find last-minute coverage. Easier, faster schedulingTwelve hour shifts allow for easier scheduling for employees. Later on, we’ll dig into the common schedule types for 12-hour shifts, but for now, know that shift coverage doesn’t need to be broken up for multiple employees. Instead, there are typically just one or two shifts each day. Scheduling tip: A fast and easy way to automate your scheduling is to use Homebase. Homebase’s scheduling can use templates and auto-scheduling, which is perfect for set 12-hour shift schedules over the course of a couple of weeks or a month. Lowered turnoverBecause the 12-hour shift schedule requires more days off in-between, particularly for full-time hours, employees have longer weekends, and—no kidding!—better work/life balance because days off actually mean days off. There’s an incentive to remain at a job that, while on paper may seem harder because of a longer shift, encourages and promotes time off when it’s scheduled. Better employee moraleHaving more days off is a key way to improve employee morale, which is what the 12-hour shift allows. The 12-hour shift schedule delineates work and home time in a much more direct way. Elimination of double shiftsDouble shifts are a hospitality industry mainstay. Often, servers work a brunch or lunch shift, wait a few hours, and return to work a dinner shift. With a 12-hour shift schedule, you can eliminate double shifts by having an employee there for the peak hours. This helps cut down on additional scheduling and shift swapping, which can be a headache come payroll if you’re not using the right software. It also may reduce employee travel time to and from work—or having to remain because there’s often no point going home in-between shifts. What are some 12-hour shift schedule examples?Not all 12-hour shifts are scheduled the same way. They can be scheduled differently based on method or industry. In some cases, there are rotating shifts that can last for about two weeks before another schedule is put into place that has different shift days and times. Below are a few common 12-hour shift schedule examples to help your small business form the schedule that works best for you. 4 on, 4 offThis schedule has the most consecutive time off for regular recuperation from the long shifts. This type of schedule doesn’t necessarily need to follow a 28 day period or longer, and can just be the set schedule. Teams, usually in two shifts, work for four days or nights. Then, they enjoy four days or nights off from work. DuPontThe DuPont shift schedule allows for employees working a 12-hour shift to have seven consecutive days off in a 28 day schedule. Teams work for four successive night shifts, followed by three days off. After that, there are three more consecutive day shifts, followed by one day off. Finally, three more night shifts, three days off, and you end the month with four days shifts and a full week off. 2-2-3The 2-2-3 schedule gives every other weekend off, making it a popular one. Employees work two days on, two days off, and then three work days on, followed by two days off, before their full weekend off. With this scheduling method, employees know their maximum working days are three and no more. 5-5-2-2 or 5-2-2-5The 5-5-2-2 or 5-2-2-5 is a good one to help employees make the most of their time off, giving up to five days off in a row. Workers are scheduled for five days on, five off, two on, two off, etc. Five days off can help workers who have kids to care for, like to travel, or just value consecutive days off. Key considerations with scheduling 12-hour shifts12-hour shifts have a lot of benefits, both for your business and your employees. However, there are a number of considerations that employees and employers need to be aware. Keep the below in mind when you’re implementing and executing on a 12-hour shift schedule. 12-hour shift schedule concerns

Don’t forget about labor laws for 12-hour shiftsFor the most part, no federal or state law caps the amount of hours an employee can work. That means employees can work up to 24 hours. There are, however, course some exceptions:

Easily schedule 12-hour shifts with HomebaseScheduling shifts doesn’t need to be a headache. Homebase takes the complexities out of scheduling employee shifts for you by automating through optimizations like shift templates, auto-scheduling, and scheduling based on sales or trend forecasts. You’ll be able to share the schedules as you go, with text or in-app reminders to your employees. With 12-hour shift scheduling, a small business needs to plan ahead. Homebase helps you set rules and keep your team’s availability requests, so you’ll have coverage where you need it. Get started for free today. The post What You Need to Know About 12-Hour Shift Schedules As a Small Business appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-twelve-hour-shift-scheduling-guide/

0 Comments

In the small business world, time is money, so it’s crucial to manage your team’s hours effectively. Thankfully, you no longer have to rely on manual time log systems. The only downside? With a wealth of software options at your fingertips, it can be challenging to sift through them all to find the best employee time log system for you and your business. Good news! We’ve done the legwork of narrowing down the list to the top 5 options so you can make an informed decision. Follow our handy guide to learn more about the best employee time log systems in 2024, and discover the best fit for your small business. What is an employee time log system?Employee time log systems monitor and document the number of hours each employee works. Small businesses track work hours by requiring employees to clock in and out at designated times, like starting and ending shifts and scheduled breaks. But as more businesses turn to hybrid work models and adopt unconventional schedules, tracking employee attendance has become more complicated. With advanced time log systems that facilitate the process of tracking employee hours, business owners can streamline schedules, stay organized, and even reduce time theft. Having a system that works will transform your small businesses’ operations from chaotic and stressful to smooth and productive. Why you should use an employee time log softwareIf you’re still stuck in the past—using outdated paper systems or punch clocks—it’s time to greet 2024 with an automated framework. Employee time log software will not only keep track of hourly workers’ time, but it can also generate useful data. You can use these data reports on attendance patterns, performance, and more to spot potential issues and inefficiencies. Take your employee time log system by the reins and steer it toward advanced software tools. Here’s why:

Best employee time log systems in 2024We’ve rounded up five of the best employee time log systems to use in 2024. By comparing each software’s key features and price points, and identifying what kind of business it’s ideal for, you’ll be able to pinpoint the best fit for your business’ unique needs. If you use employee time logs as windows into the modern workday, you’re setting your business up for increased productivity, efficiency, and—best of all—success! Let’s dive in. 1. Connecteam: Best for businesses with larger teamsConnecteam is a cloud-based employee time tracking software. It’s ideal for multi-location businesses where employees have different types of schedules, like construction companies, retail stores, or catering companies. If your business employs some remote or shift workers, use this software option for a user-friendly platform that customizes your time and attendance management systems. Key features:

Price: Pricing varies based on the features you need, ranging from the free Small Business Plan to the Expert tier at $99 per month. 2. Toggle: Best for small teams and freelancersToggl is a popular tool that streamlines time tracking procedures, project management, and hiring processes. Known for its simplicity, this time log software is ideal for independent contractors or business owners who manage a small-scale team of employees. Best used to boost employee performance and accountability, Toggle helps to ensure everyone gets paid accurately and on time. Key features:

Price: Pricing starts with the free plan, ideal for freelancers and small teams of up to 5 people. The Premium plan is the most expensive at $18 per user per month. 3. Clockify – Best for small businesses that need flexibilityClockify is a solid option for small businesses or startups looking for comprehensive access to the software’s core features. A cloud-based employee time tracking app, it’s user-friendly interface tracks your workers’ attendance, projects, tasks, and activities using various methods. Plus, Clockify’s intuitive and polished dashboard helps streamline processes and workflow. Key features:

Price: Clockify offers a Free plan with plenty of features, but if your business requires more advanced options, the paid tier starts at $3.99 per user/month, and goes up to $11.99 per user/month. 4. ClickUp – Best for team managementClickUp is a team and project management tool with time-tracking capabilities. It offers a customizable workspace that’s easy to navigate, as it doesn’t require any code or add-ons. Employees can log time on tasks, set goals, and prioritize deadlines, which helps teams stay organized and manage their daily workload while improving productivity. Key features:

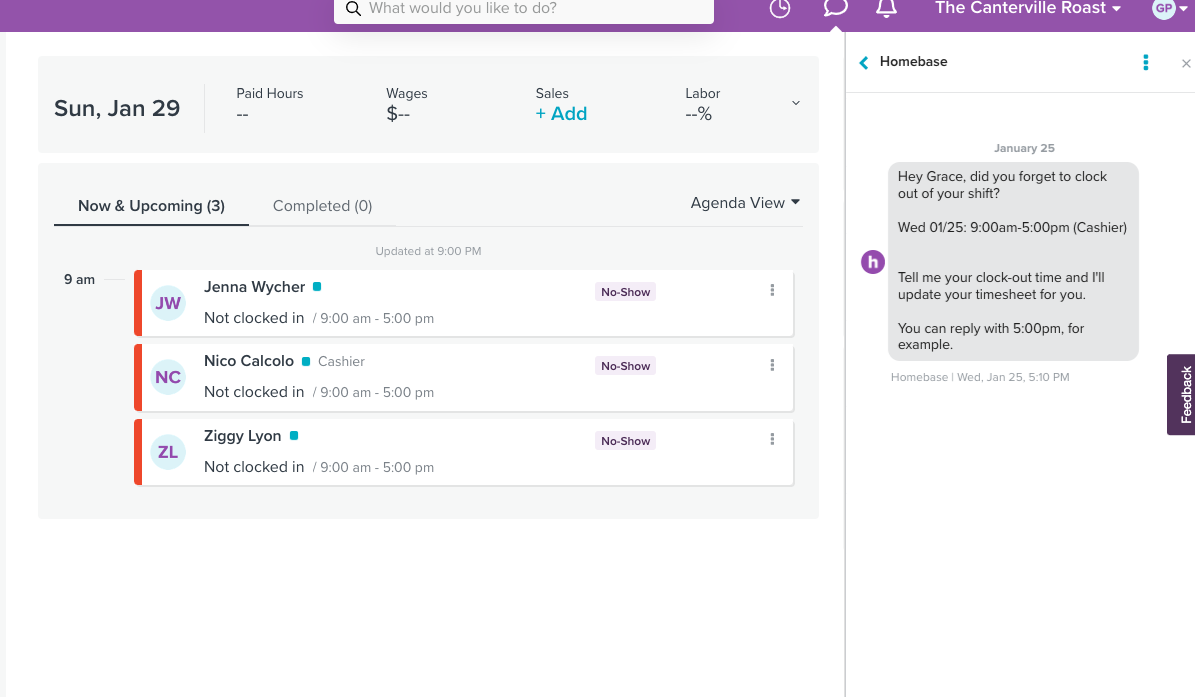

Price: ClickUp’s Free Forever plan is best for personal use. But depending on your needs, you can sign up for the Unlimited plan for $7 per member/month or the Business plan at $12 per member/month. 5. Homebase – Best all-in-one employee time log systemAs a workforce management app designed for small businesses, Homebase offers one of the most user-friendly employee time log systems. Whether you’re running a business in the retail, hospitality, education, or beauty industry, this all-in-one tool can take the hassle out of managing your team’s activities. Their intuitive interface simplifies employee scheduling and time tracking, letting employees clock in and out of their shifts across devices. This data is automatically converted into free timesheets, streamlining the task of tracking hours worked, breaks taken, and overtime due. Key features:

Price: Homebase’s Basic plan includes timesheets, time clocks, a schedule builder, hiring tools, POS and payroll integrations, and a messaging feature for up to 20 employees at one location—and it’s completely free! If your business wants to level up on the advanced features, check out Homebase’s available paid plans:

Why you should use Homebase for all of your employee time log needsChoosing the right employee time log system for your business is all about finding the right balance between your diverse needs and the software’s functionality. If you want a platform that can do it all for a reasonable price, Homebase should be your go-to choice. Named one of the best free employee scheduling softwares of 2023, Homebase can help you navigate your business’ path to success. With Homebase, you don’t have to juggle multiple different tools to run an efficient team. You can manage everything from time tracking, scheduling, payroll, and more—all in a single, user-friendly interface. Bonus: it’s free for up to 20 employees. Accounts are also super easy to set up, which is a real plus for busy business owners who are always on the go. Whether you’re a small business owner with a team of hourly workers or a manager in a company poised for growth, Homebase can be the tool that allows you to scale up your business. It’s time to focus more on innovation, and less on tedious admin tasks. Is your business struggling with its employee time log system? Homebase can help. Our modern tools make it easy to manage scheduling, time clocks, payroll, team communication, hiring, onboarding, compliance, and more. Get started for free. The post 2024’s Best Employee Time Log Systems appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-best-employee-time-log-systems-2024/ Sales are both an art and a science. The art comes in building strong customer relationships, understanding their needs, and using that understanding to close deals. The science involves using proven sales techniques and processes to guide customers through buying. Here are some tips for mastering the art of sales:

People buy from people they know, like, and trust. Building strong customer relationships is the foundation of successful sales. Take the time to get to know your customers and understand their needs. Listen to them, ask questions, and show that you genuinely care about their success.

To close deals, you must understand your customers’ needs. What challenges are they facing? What are their goals? How can your product or service help them achieve those goals? You can tailor your sales pitch to their specific situation by understanding your customers’ needs.

You can use many different sales techniques to guide customers through buying. Some standard methods include objection handling, closing techniques, and upselling. Use the right strategies at the right time to keep the sales process moving forward.

Customers can sense when a salesperson is being dishonest. Be authentic and honest in your interactions with customers. If you don’t know the answer to a question, say so. If your product differs from the right fit for a customer, be upfront about it.

Customers want to know that they are getting value for their money. Make sure that your product or service provides real value to your customers. Provide case studies, testimonials, and other proof points to demonstrate the value of your offering.

The sales process continues when a deal is closed. Follow up with your customers after the sale to ensure they are happy with their purchase. Use this as an opportunity to build an ongoing relationship with your customers.

The art of sales is constantly evolving. Keep learning new techniques and approaches to stay ahead of the curve. Attend sales training courses, read sales books and blogs, and seek mentorship from experienced salespeople. Sales are about building strong customer relationships, understanding their needs, and using that understanding to close deals. By building authentic relationships, providing value, using the proper sales techniques, and staying on top of the latest trends, you can master the art of sales and achieve success in your business. The post The Art of Sales: How to Close Deals and Build Strong Customer Relationships first appeared on Joseph C Odierno Buffalo | Business & Entrepreneurship.via Joseph C Odierno Buffalo | Business & Entrepreneurship https://josephodiernobuffalo.com/the-art-of-sales-how-to-close-deals-and-build-strong-customer-relationships/ If you’ve considered opening a small business, we’ve got a good feeling that 2024 is your year. Despite worries over inflation and high-interest rates, the U.S. economy continues to grow. And while entrepreneurs are concerned with inflation (78%), interest rates (65%), and commodities prices (63%), there’s still good news to be had. Sixty-six per cent of small businesses in the U.S. are currently profitable, and 76% feel that they’ll continue to stay open and profitable through the current socio-economic situation. If that’s the inspiration you’ve been looking for, well, you’ve come to the right place. Starting a successful business in 2024 is about starting on the right foot. With the seven steps we’re sharing, you’ll have everything you need to get your business off the ground and on its way to becoming profitable. What’s a good small business to start in 2024?When you’re thinking about what kind of business to start, you need to consider about two main factors:

If you can solve a problem for people while doing something that you enjoy, you’ve found the perfect recipe for a successful business. Of course, having a great idea and passion for your business is the ideal place to start—but where do you go from there? What do you need to start a small business?Whether you’re opening a brick-and-mortar retail store or a service-based business, all businesses need to start at the same place. Taking time at the beginning to get all of your ducks in a row is the best way to build a solid foundation and will help you ensure your business will survive long term. No matter what kind of business you’re thinking of, when you’re starting out, there are some basic things you’ll need to get started. Important things to think about:

How to start your small business in 7 stepsEvery business is different, that’s for sure. But there are some things that every business will need to do to get started. These seven actionable steps will help you start your next small business. Step 1: Clarify your business ideaIf you’ve decided you want to start a new business, but you still need to figure out what that business should be, brainstorming business ideas is the best place to start. As mentioned above, finding something you’re passionate about that also fills a need in the market is a great starting point for any business. The final element is something that you can monetize. You may be passionate about books but aren’t a great writer. So, you pivot to opening a bookstore… One problem: your small town already has two independent bookstores. The solution? You decide to open a bookstore in another town. Now, you’ve found something you’re passionate about that fills a need and is profitable. If you don’t have a set idea of what kind of small business you want to open, try answering a few of these questions:

The answers to these questions can show you where to focus your business. And if you already have a business idea, these answers can help you expand on that idea. Whatever idea you have, always ask yourself if it’s something that’s needed and if you’re good at it. Step 2: Conduct market researchA critical step in starting any business is market research. Market research shows whether your idea can become a profitable, successful business. It gives you insights into how your business will perform and can help mitigate some risks associated with starting a new small business. Market research is made up of two types of research, primary and secondary information:

While gathering primary information is more time-consuming and expensive than secondary information, the best market research uses both primary and secondary information. Market research helps your business in a variety of ways:

Step 3: Create a business planNow that you’ve tested your idea through market research, it’s time to take everything you’ve learned and create a business plan. A business plan is a written document that defines your business and outlines your business strategy, future goals, and how you plan to reach those goals. Think of your business plan as the map that’ll get you from Day 1 to Day 1,438 as a business owner. Every business should have a business plan. A lot of people assume that business plans are only for those looking for outside funding from investors or a bank. But every business can benefit from a business plan—it can help you expand on your business idea and uncover any potential issues you may have overlooked. Even if you’re not starting out, but say, looking at a second location, a business plan is an important step to validate your decisions. Business plan essentialsEvery business plan is different, but you can feel confident that you’ve created a well-rounded business plan if you include the following sections:

Step 4: Finance your small businessNow that all your ideas are on paper, it’s time to think about how you’ll finance your small business. Depending on the type of business you’re opening, you may be looking at anywhere from a few thousand dollars to a few hundred thousand dollars to get started. The average cost for a small business to start and run for their first full year is $40,000. No matter what your start-up costs are projected to be, don’t let this stop you yet. There are lots of funding options available to small businesses, including:

Step 5: Decide on your business structureChoosing a business structure isn’t a decision that should be made lightly. How you structure your business will affect the tax you owe, your daily operations, and the personal risk you assume, and may have other legal implications down the road. Here’s a rundown of the most common business structures: Sole proprietorship is the most common business structure for solo entrepreneurs. In this business structure, the company and the owner are considered the same. Therefore, if the business fails, the owner is personally responsible for all business debts. Partnerships are used when starting a business with more than one individual. A partnership requires a partnership agreement, and partners have limited liability for the debts of the LLP. Limited liability companies or LLCs can be owned by one or more people/companies and limit your personal liability for business debts. They’re one of the easiest business structures to establish. Cooperatives are businesses or organizations that run to benefit those using the services. Industries that fall into this category include, but aren’t limited to, health care, retail, restaurants, and agriculture. Corporations are more complex from a legal and tax point of view. Because of this, they’re more common in larger companies but can still be used by small businesses. Consider speaking with a lawyer or accountant before deciding to ensure you’re making the best decision for your business. Step 6: Dig into the legal must-havesIt’s important to dot your i’s and cross your t’s when it comes to the legal ins and outs of a small business. And there are a lot of i’s and t’s to keep track of. When you’re starting a new small business, make sure you have the following in order before you begin operating:

Step 7: Get the right tools to run your small businessFinding the right tools to run your small business is key to helping your business run smoothly. The right business tools will save you time and money and make you a desirable employer. The tools you need will depend on your small business, but looking for tools that automate repetitive tasks and lessen your workload is a great place to start. With Homebase, you get everything you need to take control of your business. Designed for hourly work, Homebase will help you schedule your team, track their hours, and run payroll seamlessly. You’ll also have a team communication app that keeps you and your employees on the same page. Homebase even has expert H.R. guidance to help you comply with government regulations without an in-house H.R. team. Homebase is the all-in-one management app that simplifies running your small business. Get started now for free. The post How to Start a Small Business in 2024 in 7 Actionable Steps appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-how-to-start-a-small-business/ Everyone from individual taxpayers to small businesses has likely heard about gross income or total annual income. This is the total amount of money you’ll make from working. While it’s important and a helpful indicator of how much money you may have made, gross income is just one part of the income big picture. As a small business owner, you’ve likely heard of Adjusted Gross Income (AGI.) AGI is the gross income of your business for the year minus adjustments. It’s the amount of money the IRS determines as your income tax liability for the year, which just means how much you may owe. AGI is important for small business owners to understand what adjustments (or deductions) need to be accounted for during tax time. Ahead, we’ll dive into what exactly AGI is, what a small business needs to calculate AGI, and how to do it. We’ll also share one great app that’ll make the process a lot easier, and a lot faster, saving you time, money, and more than a few headaches. What is adjusted gross income?Adjusted gross income (AGI) is a business (or person’s) total income that has been adjusted for any specific payments made throughout the year. These deductions impact how much income is deemed taxable by the government, which may mean a lowered business income tax payment. Your deductions may include:

These are just a few examples of why or where deductions can be made. It’s important to note the Internal Revenue Services (IRS) determines each business’s specific adjustments, so you’ll want to check with a professional to ensure you’re following their rules. TL;DR? AGI = total annual income – eligible deductions AGI is different from regular gross income. With gross income, which can be salary or hourly wages paid (including tips), the amount is set before deductions. Your annual gross income is your overall total for the year before any deductions or taxes. AGI works sort of in reverse where deductions are considered first, and then the amount after those deductions becomes the taxable income. For the most part, AGI is what you’ve earned for the year after all eligible deductions have been applied. These deductions impact how much taxable income you actually have that the government is eligible to say you need to pay taxes on. The lower your AGI is, the lower your taxable income is, too. Important note: not all deductions are eligible across the board so it’s important to understand and research this, or have payroll and tax software that can help automate the process for you and your business. Modified Adjusted Gross Income (MAGI)There’s a subsection of AGI that may be relevant to your tax preparation. That’s Modified Adjusted Gross Income (MAGI). MAGI is defined as any AGI after any tax-exempt interest income and specific tax deductions. Some government programs and tax calculations need the MAGI number specifically. Both AGI and MAGI are linked to the other. To get the MAGI number, you first need to understand what your AGI figure is after total annual income minus deductions. Some deductions will then be added back for your MAGI number—this can include tuition, for example. In some cases, your AGI and MAGI numbers will be very close. For the most part, MAGI is used to determine contributions to Roth investment accounts. If your taxes are relatively uncomplicated, this won’t likely be a factor. Why does a small business need to calculate adjusted gross income?AGI is an important indicator for your small business. It helps you know how much you’ve made, or how much you may owe in taxes, based on eligible deductions. These deductions are costs you’ve already put into your business. For example, you may be a start-up small business with a different set of needs than an already established small business. If you’re in this position, you may be eligible for first-year adjustments and credits that only appear at this time. But you’ll need to calculate AGI for more than just your business; AGI needs to be calculated for your employees, too. They have eligible tax deductions that need to be accounted for. Your AGI is important to determine your AGI bracket. If you have a higher AGI, you may need to have funds allocated to pay those taxes, after deductions are taken into account. If your AGI is lower and falls in a different spot of the taxation bracket, your business may be eligible for other credits or adjustments. You need to know how much you’ve put into your business and where to see what’s eligible for adjusting your overall gross income. AGI can impact how much you owe in taxes or if you’re in the position for more adjustments. It’s important to calculate AGI so you know where you stand at tax time. How to calculate adjusted gross incomeNow that you know what AGI is, and what it means for your small business’s taxes, let’s figure out how to calculate it. Below we’ve got you covered on everything you need to calculate your business’s AGI. 1. Find your income statementsLet’s start with the easiest part of calculating AGI: collecting your income statements. Your income statements include a W-2 for pay, like salary and wages, and if you’re self-employed, anything that might need to be reported there. But your income can be broken down into two specific categories: taxable income and non-taxable income. These also contribute to your overall annual income. Let’s start with taxable income. Your taxable income can include something as easy to figure out as business income, severance, or unemployment benefits. If those occurred in the same tax year as your small business began its start-up, which is your primary taxable income as a business, you’d need to claim those as taxable income. Other taxable income you may need to include are:

For non-taxable income, this refers to payments made to you that you won’t be taxed for. They don’t fit into the categories above but they still need to be reported to the IRS and included on your tax return. Non-taxable income includes:

To keep things neat and tidy at tax time, keep separate folders for taxable and non-taxable income online and offline, creating subfolders relevant to you. Ensuring you have receipts, income statements, and forms—and any other document referring to your taxable or non-taxable income—ahead of time will make calculating your AGI a lot easier when you need to. An app like Homebase can help streamline and take the fuss out of complicated tasks. It’s an easy way to skip the paperwork and automate calculation, payment, and tax filings, keeping everything you need in one place. 2. Determine your total annual incomeYour next time in calculating AGI is to figure what your total income is. You do this by adding up all of the money you’ve made in a year. Include bonuses you’ve given yourself, or have been given to you. If you’re a salaried employee, a lot of this is already done for you on your income statement. Small business owners will be able to do this through their payroll software. Homebase, for example, can calculate all wage and tax deductions for you, as well as any other nuances like additional costs and schedules. Bonus: payroll information, like how much an employee’s salary is and how much to pay them, is automatically processed. If you’re an hourly or wage worker, especially with multiple jobs, you’ll need your wage amount, hours worked per week, and then multiply that by 52 to see the total annual income. 3. Take the sum of your deductionsNow that you’ve collected all of your income statements, taxable income, and non-taxable income, it’s time to look through what deductions and adjustments there are for your AGI. It’s absolutely crucial to keep records of all receipts, payments, documents, anything that may impact an adjustment. This is what you’ll refer to in order to calculate the overall sum of adjustments that need to be made. It’s likely that adjustments may change each year. Small business owners paying taxes will have similar deductions to make each year, but it’s good to know some of the different categories of deductions that can be made in case you qualify one year for that credit. Some deductions include:

Any deduction must qualify and meet certain requirements set out by the IRS. Do extra research if you’re unsure about a deduction, and if it’s eligible for inclusion for your AGI. 4. Subtract your deductions from your total annual incomeNow that you have your total annual income amount and eligible deduction amount, you’ll be able to determine your AGI. AGI = total annual income – eligible deductions AGI calculation exampleLet’s look at an oversimplified example (since hey, we all know there are a lot more expenses to running the business than just the below). Pretend your business earned $300,000 last year. You paid out $150,000 in wages, plus $36,000 in rent. Your business’s gross income = $300,000 Your deductions = $186,000 That means your AGI, or new total taxable income, is $114,000. This is a fairly easy and uncomplicated example of how to get AGI but if you have all of the receipts for eligible deductions, plus all of your income statements, including both taxable and non-taxable, you’ll be able to easily follow the formula. Homebase makes calculating your adjusted gross income easierIf this is all seeming a little complicated for you, not to worry: we’re here to help. Homebase makes calculating adjusted gross income easy for you and your employees. With Homebase’s automated payroll process, you’ll be able to clearly see timesheets become wages and hours worked—and so will your employees. This makes calculating total annual income for your employees a lot easier. Homebase is enabled to calculate federal taxes and specific state taxes, and send payments to employees, states, and the IRS all in one easy system. Homebase saves you time and energy by simplifying data entry, reducing errors, and streamlining the process to calculate AGI. Plus, Homebase even submits new hire reporting and files W-2 forms for you. And just because we know how complicated managing a small business can be, Homebase even stores your time card and payroll records to help you stay compliant with FLSA record-keeping rules. Understanding adjusted gross income and what it means for your small business, doesn’t need to be a headache. Knowing about AGI helps you figure out what you’ve really made after you take all the things that’ve gone into your business into consideration. As the saying goes, it’s just death and taxes. The post What you need to know about Adjusted Gross Income (AGI) appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-adjusted-gross-income-tax/ Paper employee schedules are so 2001. It’s time to ditch the paper work schedule in favor of a digital one. Fortunately, creating a digital employee work schedule is easier than ever before—and you can even do it for free. One of the most popular scheduling solutions? Creating a work schedule template using Google Sheets. To help you streamline your business’ scheduling process, we’ve put together a step-by-step guide for how to make your own work schedule template using Google Sheets. Plus, we’ll share some of our favorite alternatives so you can level up your employee schedules for good. What is a work schedule template?A work schedule template is a pre-formatted digital document that helps you create your employee schedules. Think of a template as a foundation for your weekly schedule. Instead of creating a brand new schedule from scratch every week, your template does the heavy lifting. All you have to do is plug in your employee hours and shifts, and voila! You have a work schedule that’s ready to go. Why create a schedule template in Google Sheets?Creating an employee schedule isn’t rocket science, but it can get a bit chaotic at times. By creating a template on Google Sheets that you can reuse, you can keep your scheduling, well… on schedule. Here are some of the top reasons why you should consider creating an employee schedule template in Google Sheets:

The pros and cons of creating a work schedule template in Google SheetsGoogle Sheets is a solid choice for creating a work schedule template. But of course, no software is perfect. Let’s look at some of the biggest pros and cons of using Google Sheets to manage your small business work schedule. Pro 1: Easy to useOne of the top reasons Google Sheets is so popular is that it works similarly to any other popular spreadsheet tool. Does Microsoft Excel ring a bell? Even if you’ve never used Google Sheets, you likely already have some idea of how to use the program. This means there’s little to no learning curve for most managers or business owners. But if you or someone on your team is new to spreadsheets, don’t worry! There are a ton of guides and tutorials online—like this one—that can break down the Google Sheets basics. Pro 2: Seamless collaborationIf you have multiple managers working on the same schedule, Google Sheets makes collaboration easy. Google Sheets is cloud-based, meaning everything is saved and updated in real time. You can share the same live document with multiple people. And anytime one person edits a sheet, it’s immediately updated for everyone else who has access. Multiple people can even work together on the same document at the same time to get your schedule out the door even faster. Once your schedule is ready, Google Sheets also lets users leave comments right in the document, so your team can let you know if there are any conflicts or concerns about the upcoming schedule. Pro 3: Cost-effectiveAs a small business, every dollar counts. So we’re all for sharing free tools to help your business grow. Google Sheets (and the rest of the Google Workspace tools) are a great way to improve your productivity and operations—without breaking the bank.

Con 1: Limited direct integration with other business softwareManaging your team goes beyond simply posting a schedule. Once your schedule is complete, you need to make sure everyone is working their assigned shifts. And of course, you’ll also need to make sure they’re paid for the hours they’ve worked. So while Google Sheets is great for creating a schedule template, it doesn’t integrate as easily into other dedicated small business tools, like your payroll software. This means you’ll either need to manually match them up yourself or invest in other ways to transfer that information. Con 2: Less small business-specific featuresGoogle Sheets is a powerful tool, but at the end of the day, it’s still only a spreadsheet software. Unfortunately, this means it lacks many of the specific features that small businesses need to create a truly seamless scheduling experience. Some features that are notably missing from Google Sheets include:

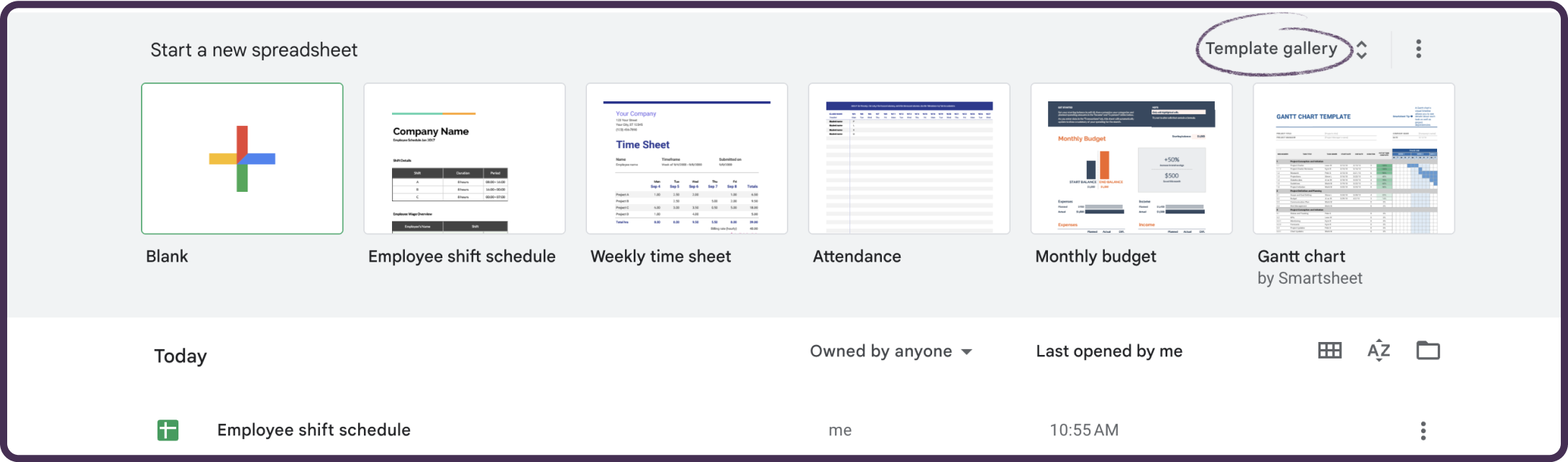

Con 3: No automated notifications for your teamSince Google Sheets is web-based, any updates you make are instantly available to anyone who has a link to your schedule. But it doesn’t automatically update your team with these changes. For example, if your employee checks the schedule Monday morning but you update the schedule Monday afternoon, they’ll likely miss any schedule changes. With Google Sheets, you’ll need to manually send out updates or request your team check in on the schedule regularly—otherwise, you might find your team accidentally showing up for the wrong shifts or not showing up at all. Create a schedule template in Google Sheets: A step-by-step breakdownMaking a schedule template in Google Sheets is simple. While you can create a template yourself, Google Sheets makes it easy with a pre-formatted schedule template that’s ready for you to customize to your team’s needs. Here’s a step-by-step guide to creating your first schedule template in Google Sheets: 1. Go to Google SheetsThe first thing you’ll want to do is head over to Google Sheets. If you’re not logged into your Google account, you’ll be prompted to do so. You can use a business Google account or a personal one. Don’t have a Google account? You can sign up for a free personal account which will give you access to Google Sheets and other apps, like Google Docs. 2. Open the Schedule template in Google SheetsOnce you’re logged in, you’ll be directed to Google Sheets. At the top of the page, you’ll see a section called “Start a new spreadsheet” with several different options to choose from. From here, you’ll click “Template gallery” at the top right-hand corner of this section.

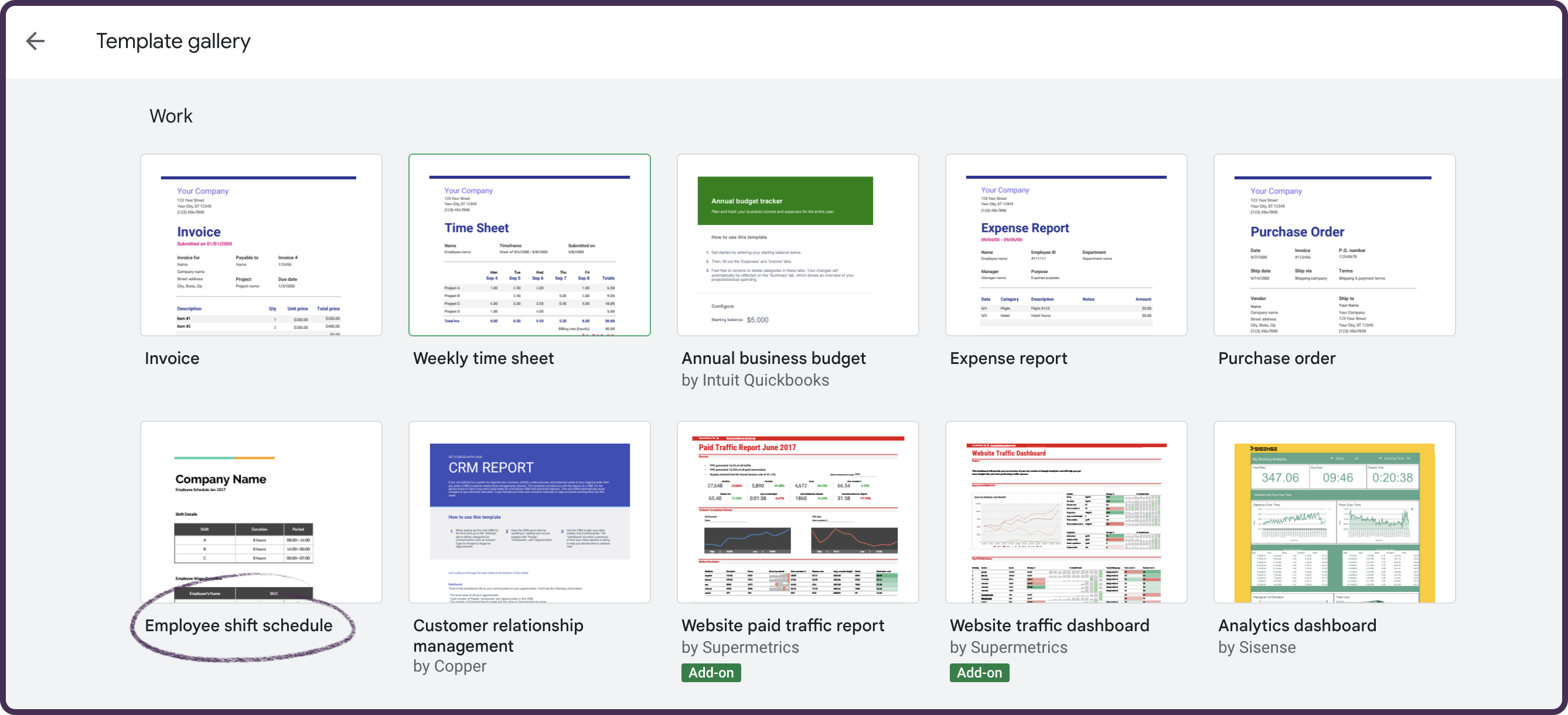

This will open up a large selection of templates you can choose from. Under the Work category, you’ll select the template “Employee shift schedule”. This will open up a new Google Sheets document with a fresh template for you to work with.

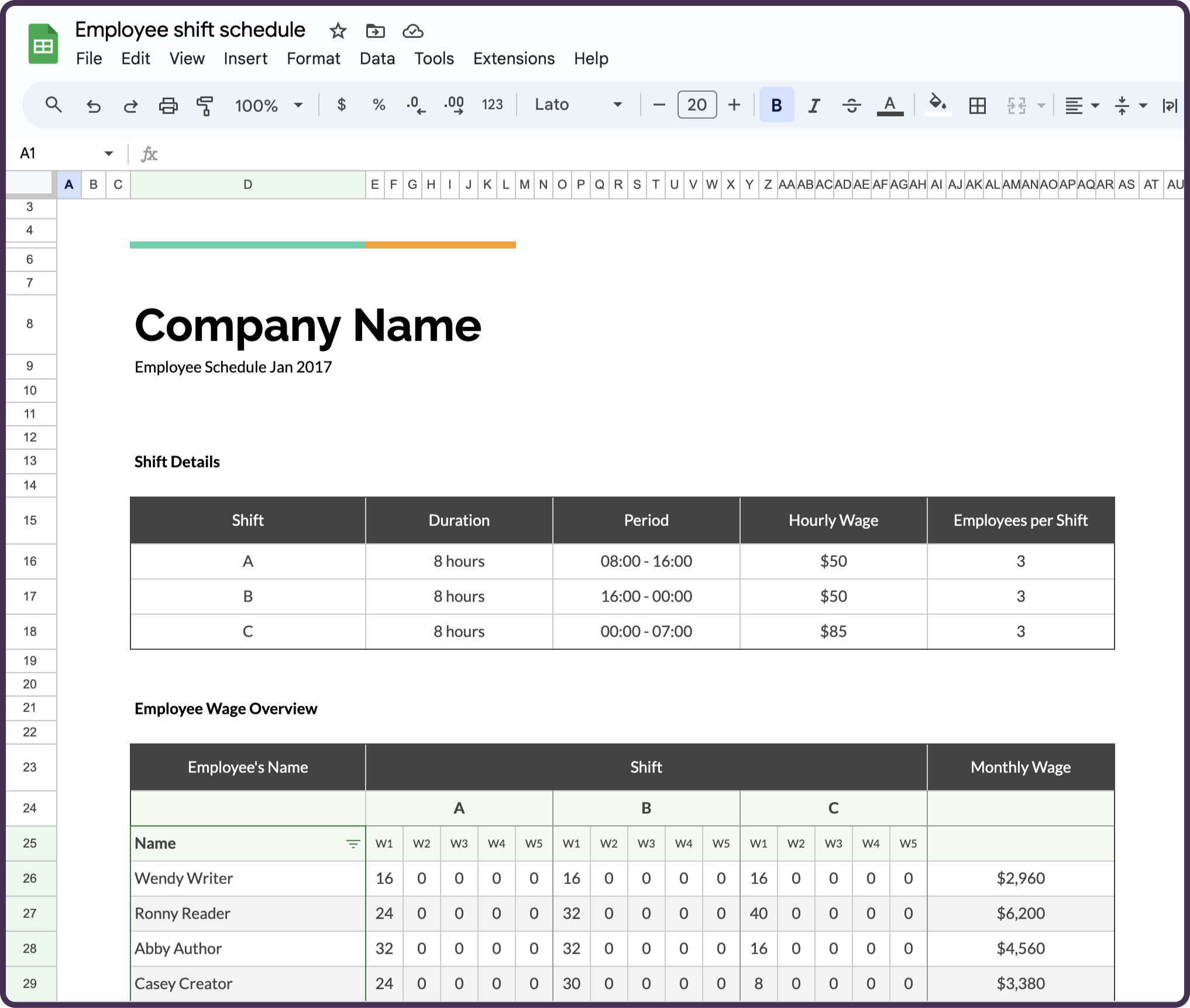

4. Input company, shift, and wage detailsWhen your document opens, you’ll be put on the Overview page. Here’s where you’ll want to update some key information that will impact the rest of your schedule.

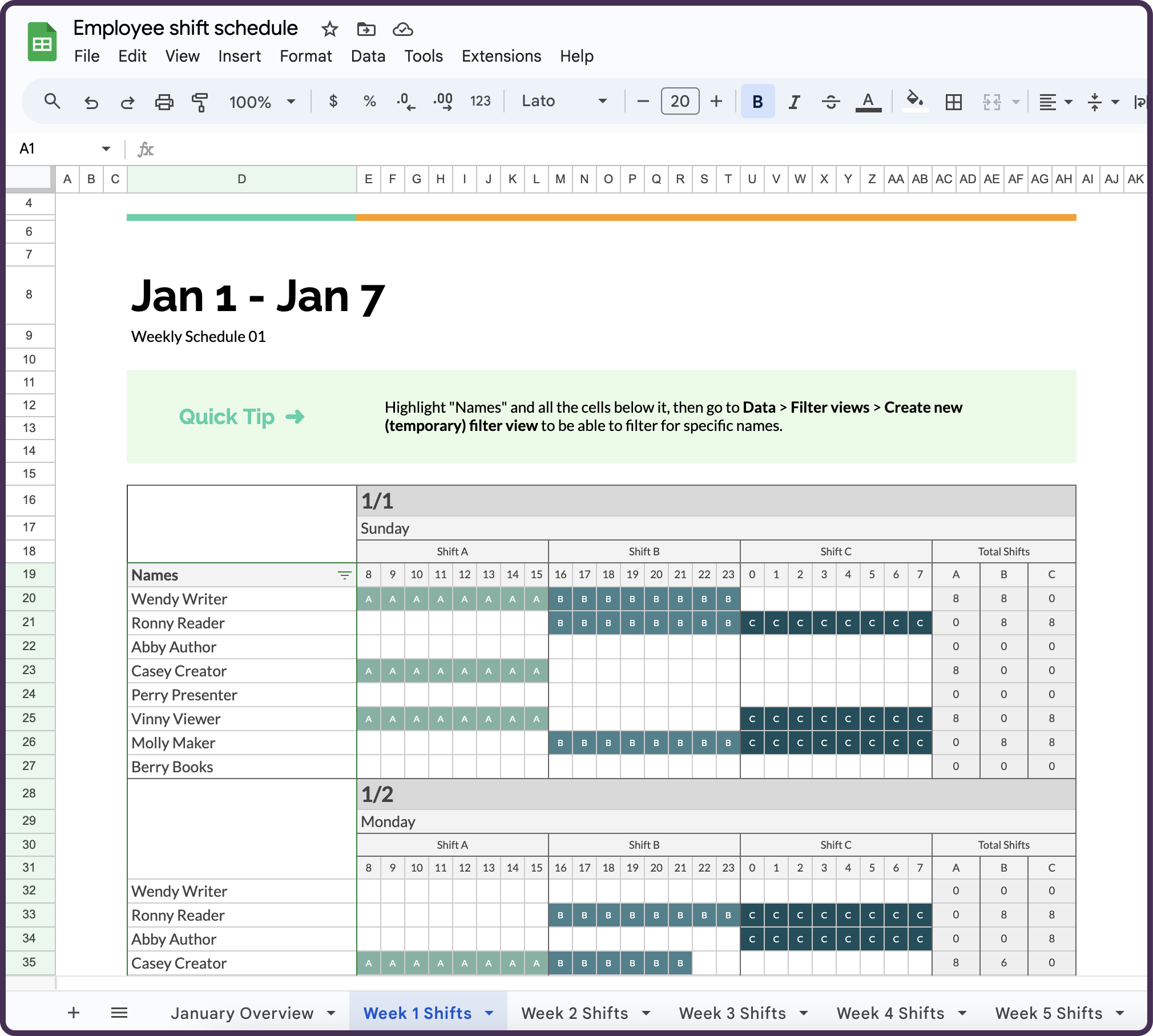

5. Fill in your weekly shift detailsNow that you have your basic details filled in, you’ll want to navigate to the tab “Week 1 Shifts”. You can find all the tabs at the bottom of your screen.

Here you’ll be able to update your weekly schedule based on your employee availability, business needs, and business hours. You can simply replace the names in the template with those of your team and start to fill in the shift hours. The Google Sheets Employee Shift Schedule will help you calculate the total shift hours in the column on the right. This is a great first step to staying on top of your labor hours. Tip: Keep your list of employee names in the same order as the Overview page. This will make sure that your Monthly Wage calculations on the Overview page are accurate. 6. Repeat for the following weeksOnce you’ve filled out Week 1, you’ll just want to repeat Step 5 for the following weeks in the month. The template allows you to schedule up to five weeks at a time, so you can tackle all your scheduling in one go. 7. Share your scheduleOnce your schedule is locked in, Google Sheets makes it easy to share your schedule with all your employees in just a few clicks. At the top right corner, there’s a blue “Share” button. This will open a pop-up where you can add your employee email addresses. You can also select if you want your team to be able to edit the schedule or only view the schedule. 8. Rinse and repeatCongrats on finishing your first employee schedule template! But we have more good news. Now that you have a template that’s been customized to your business, scheduling gets easier from here. Unless you have new employees or significant changes to your schedule overview, you’ll only need to update the weekly shifts going forward. Once you’re ready to create next month’s schedule, simply head to the “File” menu at the top left of your Google Sheets page. Click “Make a copy” and you’ll have a new schedule you can edit for the next month! Work schedule template alternatives to Google SheetsGoogle Sheets is a great solution for a work schedule in a pinch. But if you’re looking for a long-term scheduling solution, a dedicated scheduling software can take your work schedule templates to the next level. Homebase’s free online scheduling app is a scheduling software that helps you create work schedule templates in minutes. Homebase is built specifically with small businesses in mind, so you know you’re getting all the features and support you need. With Homebase’s online scheduling app you can:

Best of all? It’s free.

The post How to Make a Work Schedule Template using Google Sheets appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-schedule-template-google-sheets/ It’s a busy Wednesday morning at your coffee shop, and you’ve just found out that two of your baristas are off sick. At the same time, your assistant manager is requesting a last-minute day off next week. Suddenly, the intricate staff rota you spent hours crafting is in disarray. Whether you work with full-time or hourly employees, managing staff schedules is a crucial task. And the challenges multiply when you try to handle them manually, leading to potential errors and impacting employee morale. There are practical tips and proven strategies to navigate this complex process. We’ll show you how automation can take some of the load off and empower you to build your own effective, top-notch staff schedules.

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. What makes a good staff rota?A staff rota is like a plan that tells everyone who should work and when, as well as what they need to get done. Basically, it covers three important aspects:

For employees, a good rota is fair, predictable, and respects their time and needs. Specifically:

On the employer side, a good staff rota keeps the business running smoothly. Here’s what makes it good:

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. 6 tips to create an effective staff rotaYou need to keep everything in balance: your business needs, the fairness of the shifts, and staff preferences. But with the right approach, you can create a staff rota that keeps your business running without any issues and your team happy. 1. Collect employee availability

One of the keys to a well-balanced, well-organized staff rota is making sure it reflects employee availability. Start by asking team members about their preferred working hours and days. With a tool like Homebase, you can easily capture this information in a structured, centralized way. Team members can input and update their preferred hours and days directly in the app. Homebase provides a conflict warning system that flags any potential scheduling issues, like assigning shifts to someone outside of their stated availability. This helps reduce misunderstandings and ensures the rota is designed to fit the team’s preferences. Remember, everyone’s different — some people prefer early mornings, while others are night owls. Some might want to work weekdays, and others might be available only on weekends. Also, ask about any regular commitments that might affect their availability, like school runs or evening classes. Online scheduling and time tracking tools are a great way to handle these challenges. Homebase’s employee scheduling tool gives your staff autonomy over shift swapping, so they won’t be overwhelmed or bored due to understaffing or overstaffing. Plus, the team communication app lets you set up alerts and send team members reminders to take their breaks and clock out of work on time so you avoid expensive overtime and extensive rounding. 2. Have a policy for last-minute days offEven when you plan out your schedules with employee availability, you’ll always have to contend with last-minute days off, whether for personal reasons, medical reasons, or vacation. Small businesses need to have a policy prepared that can inform how they’ll deal with those situations. For example, your policy could state that for non-emergency situations, employees should provide a certain amount of notice for a day off — maybe one week. However, in the case of unexpected events like sudden illness or urgent family matters, it’s understood that notice might not be possible. And for such situations, you need to have a contingency plan. This could involve establishing a pool of part-time or flexible workers who are able to step in and cover shifts at short notice. Or, you might have an agreement with full-time staff that they can swap shifts among themselves in these circumstances. 3. Plan out your staff rotas well in advanceEver experienced that last-minute panic when you realize that you don’t have enough employees scheduled for tomorrow’s rush or someone’s been double-booked? Planning your staff rota ahead of time is key to dodging these stressful moments and keeping your operations running smoothly. Begin by taking stock of your business needs. When are your busiest periods? When are things quiet? Ensuring you’ve got the right number of staff on hand at the right times can save you a lot of problems down the line. Next, try to create your staff rota at least two weeks in advance — and even earlier if you can. This gives you plenty of wiggle room if you need to make changes and lets your team know when they’re working well in advance, which leads to happier employees and fewer no shows. When you’re assigning shifts, try to keep your team members’ preferences and availability in mind as much as possible. This shows your team that you value their lives outside work and can help cut down on last-minute changes. 4. Make sure your rota is easily accessibleKeeping staff rotas on a piece of paper on the wall is a recipe for disaster — it can easily get dirty, lost, or misplaced, and no one can check it unless they go to work. Spreadsheets or Google Docs aren’t much better as they often have to be viewed on a desktop or aren’t designed for smartphones. Instead, use a platform like Homebase that has a fully functional mobile app. That way, employees can access their schedules at any time and even get alerts when new timetables are ready. When your staff can easily check their shifts, it saves time, reduces confusion, and leads to a smoother way of doing business. 5. Stay compliant with labor law regulationsWhen creating your staff rota, it’s important to keep labor law regulations firmly in mind. For example, the Fair Labor Standards Act (FLSA) sets federal law on timesheets like minimum wage, overtime pay, and recordkeeping. For example, according to FLSA, if a non-exempt employee (often hourly wage earners) works more than 40 hours in a workweek, they’re entitled to overtime pay at a rate of at least one and a half times their regular rate of pay. So, when you’re assigning shifts, make sure you’re not scheduling any non-exempt employees for more than 40 hours in a week unless you’re prepared to pay them overtime. Remember, labor laws aren’t just legal requirements — they’re meant to protect employees’ rights. Homebase’s HR and compliance features are designed to help small businesses follow the laws and regulations that apply to them. Our platform also gives you access to HR experts who can help with personalized advice and audits of your internal company practices. Not to mention, you can also get access to a digital library of guides, training, and templates. 6. Decide on communication guidelines

An employee suddenly can’t make their shift and sends you a text message. Another emails you about a vacation request. Yet another sends you a DM on social media about swapping shifts. Juggling these multiple channels of communication can quickly become a chaotic mess. To avoid this, establish a primary communication method for all rota-related issues. So, if a staff member decides to switch their shift with a colleague, they can use Homebase’s team communication app to notify you about the change. Once the shift change is approved, Homebase sends out notifications to everyone involved. This way, all the people involved will be kept in the loop, and there won’t be any disruptions to your small business operations. Strategic ways to build your scheduleA well-built staff rota minimizes gaps in staffing, reduces confusion, and promotes a harmonious workplace. Here are a few different approaches to building your schedule and finding the right one for your small business. Pen and paperThe pen-and-paper method remains a popular approach to scheduling for many small businesses. There’s an undeniable comfort in physically writing out a schedule, and for some, this method provides a sense of control and simplicity that digital platforms can’t replicate. Pros

Cons

Create an online documentAn online document or spreadsheet is a popular upgrade from the traditional pen and paper method for creating staff rotas. Platforms like Google Docs or Sheets are easy-to-use platforms that many small businesses use to transition their scheduling process online. You can share the link with your team members, who can access it anytime, anywhere. And when changes need to be made, you simply adjust the spreadsheet, and the updates will be instantly available for everyone to see. Pros

Cons

Dedicated tools like HomebaseHomebase is a dedicated rota-building tool that’s designed to streamline the scheduling process and adds a level of sophistication that other methods lack. Our app encompasses a range of advanced scheduling features that are tailored specifically to handle staff rota requirements. You can simply enter your employees’ availability, preferred hours, and roles into the scheduling tool. Homebase then assists you in building an optimized rota, flagging any conflicts or potential labor law infringements. Homebase can even account for forecasted business needs. And once the rota is ready, all you have to do is publish it, and your employees will receive instant notifications about their work days. They can also swap shifts with manager approval right within the app. Pros

Cons

Run a better team with smarter scheduling.

Optimize your schedule and keep your team in sync with Homebase. Make staff rotas a breeze, not a battle with HomebaseNavigating the maze of staff scheduling can often feel like a Herculean task — balancing employee availability, business needs, and labor law regulations, all while trying to create a fair and effective rota. But it doesn’t have to be that way. The key is to simplify and streamline the process with a platform like Homebase that translates time tracking data into timesheets automatically, helping you calculate and pay wages accurately. Beyond our powerful time clock and timesheet tools, which can be managed on a smartphone so employees can clock in or out of work anywhere, we also offer hiring and onboarding features so you can easily add to your team and communicate your policies to all new hires. Plus, Homebase is free for up to 20 employees for basic scheduling and time tracking features and employee management tools like messaging, point-of-sale integrations, and access to email support. It’s not just about managing time — it’s about enhancing productivity and harmony in your workforce. The post 6 Tips to Create an Effective Staff Rota appeared first on Homebase. via Homebase https://joinhomebase.com/blog/tips-to-create-an-effective-staff-rota/ If you’re looking to fill an open role at your small business, finding candidates can be easy. But are they the right candidate? That’s a little trickier. You can go through the interview process, meet them, and conduct skills tests, but that doesn’t always tell you the whole story about their past history. Conducting a background check on your candidates is an easy way to get a full story on a candidate before you extend them a job offer. Here’s everything you’ll need to know about conducting a pre-employment background check. What is a background check for employment?A background check for employment is a screening tool that employers use to identify if a candidate’s past history is accurate. It surfaces any issues from the past that might affect their performance in the role they’re applying for. Conducting a background check before employing a candidate isn’t mandatory, however, it can protect small business owners from potential risk. 8 types of background checksThere are many different types of background checks employers can run on a potential candidate. The type of check employers should conduct is dependent on the role they’re hiring for and the company policy already set in place. Here are a few examples of different types of background checks an employer can conduct. 1. Pre-employment criminal background checkA criminal background check is a background check that screens public records to see if a candidate has any sort of criminal background. A criminal background check can include things like court orders, arrests, any record of incarceration, and felony or misdemeanor convictions. Depending on where you’re located, criminal background checks are only allowed to go back a certain number of years. For example, it’s illegal to search for criminal records beyond the past seven years in the state of California. When you’re conducting pre-employment background checks, be sure to stay compliant with local and federal laws like these. 2. Pre-employment credit checkA pre-employment credit check is when an employer runs a full credit check before a candidate is hired. This type of background check isn’t as common, as most employers don’t need to know a candidate’s previous financial history before employing them. However, it’s common for candidates to receive a credit check if they’re applying to more finance specific roles, such as in banking. It’s important to note that a pre-employment credit check doesn’t include the candidate’s actual credit score. This information is private to the candidate and should never be used for consideration for employment. 3. Pre-employment MVR checkA motor vehicle record (MVR) check is a record of an individual’s past driving history. It’s most commonly requested by potential employers and might be one part of the entire background check process. If you’re looking to hire somebody who operates a moving vehicle as part of your business, it’s best to implement an MVR check as part of the background check process. 4. Pre-employment medical check-upA pre-employment physical is a standard medical exam employers require before a candidate starts a new job. Don’t confuse this with a human performance evaluation (HPE), which evaluates more specific physical skills a candidate might experience in the role. For example, a candidate might have to go through a HPE if their job requires much more physical labor or specific type of physical dexterity. A firefighter would be a good example of a someone who should take a HPE before being hired. Pre-employment physicals are more to evaluate the general health of an employee. These aren’t as common anymore as an individual’s health records, since this can be a violation of the Health Insurance Portability and Accountability Act (HIPAA). Employers may opt not to conduct a pre-employment medical checkup because they don’t want to run into issues regarding discrimination. Some candidates also might not want to disclose certain disabilities or health issues if they’re concerned about employer discrimination. 5. Pre-employment drug screeningDrug testing in the workplace has gotten more complicated in recent years due to the legalization of marijuana in some states and privacy laws surrounding HIPAA. However, it could be a necessary part of a background check for roles that require operation of heavy machinery or moving vehicles. In some instances, it might even be required by insurance providers to help minimize the amount of risk a business can run into. If you plan to implement a pre-employment drug screening, it’s important to implement a consistent policy to ensure that there’s no possibility of discrimination when it comes to completing a drug test. 6. Social media checkA study by The Harris Poll finds that almost 71% of US hiring decision makers agree that checking out a candidate’s social media profile is an effective way to screen applicants. Social media screening is a much more common practice, but isn’t necessarily part of an official background check. The most common way employers conduct a social media check is by doing an unofficial search for the candidate on common social media sites to see what information is readily available to the public. 7. Education verificationAn education verification check confirms the validity of a candidate’s academic history listed on their resume or application. This is a common part of a standard background check to ensure that a candidate has any credentials that are necessary as part of a job listing. For example, if a prep chef lists that they went to culinary school on their resume, an employer can add an education verification to see if their certificate or degree is completed. 8. Employment verificationAn employment verification is similar to an education verification. This confirms the validity of whether or not a candidate was previously employed at the roles they say they were employed at. Employment verification is a pretty simple process and doesn’t require any major background check programs or software—a simple call or email to the previous employer is usually sufficient enough. Pros and cons of conducting a background check for employmentConducting background checks takes time, some investment, and careful consideration for what you’re looking for in a candidate. While the outcomes are beneficial, there are some things to consider to prevent any issues. Pros of conducting a background check

Cons of conducting a background check

What does a background check include?Depending on how you source your background checks, what you include is dependent on how the check is initiated. For the most part, employers can pick and choose what information they want to include in a pre-employment background check. The most common aspects of a background check include a criminal background check, employment verification, education verification, and a drug screening check. However, it’s up to you as an employer to decide what to include in your hiring process. What should an employer look for in a background check?Background checks are a tool to verify a candidate’s identity. However, background checks can uncover information about a candidate that you might not receive through the interview process. Here are some things you should look out for. The good

The bad

How to conduct a pre-employment background checkConducting a pre-employment background check is fairly simple once you establish the groundwork. Here are five simple steps to implementing a pre-employment background check. Step 1) Implement a background check policyThe first step of implementing a background check is to establish a background check policy within your employee handbook. This should include who receives a background check, what information you’re looking for, and when during the interview process this background check occurs. When implementing this policy, it’s important to retroactively run background checks for your existing employees. That ensures everybody receives fair treatment. This also minimizes the risk of discriminating against specific candidates and provides everybody the same opportunity. Step 2) Identify the needs of the specific roleSome roles may require specific types of background checks over others. Looking to hire delivery drivers? You may want to include a MVR check along with a standard background check. If you do choose to provide special checks for different roles, that’s okay. Just be sure to outline those differences clearly within your background check policy. And of course, clearly communicate this with your candidate. Step 3) Find the right service to conduct the background checkAfter identifying your specific needs for the role, find different background check services that specifically check for those needs. There are hundreds of different third-party background check services that you can use for your hiring process. The best ones are the services that can sync with your hiring platform so you can streamline your process and ensure everything is securely stored in one place. Step 4) Alert your candidate of the background checkConducting a background check without alerting the candidate is against the law depending on where you’re located. Be sure to provide your candidates with written consent before beginning the actual process. This helps document that both parties did their due diligence before the check was enacted and minimizes any risk your business might receive for conducting a check. Step 5) Review results with candidateIf you don’t find any red flags within the background check, that’s great! Reviewing the results with your potential hire might not be the best use of your time in that case. However, your candidates should have the opportunity to contest any information within the background check. Provide your candidates with the option to receive a copy of their results for their records, so they have the ability to ensure their report is as factual as possible. Streamline your hiring process and stay compliantGet Homebase to help track hours, calculate overtime, and store important information. You can rest easy knowing you’re covered on federal, state, and city compliance rules. Looking for someone to help establish your background check process? Get advice from Homebase HR pros to help customize your hiring and compliance policies. The post 5 Steps to Conducting a Background Check for Employment appeared first on Homebase. via Homebase https://joinhomebase.com/blog/blog-employee-background-check/ Mastering Scheduling in 2024: Weekly Planner Templates for Small Businesses (with Free Downloads)11/17/2023 For small business owners, time isn’t just money, it’s the heartbeat of success. Every shift scheduled, meeting organized, and inventory check completed gets you one step closer to reaching your goals. Unfortunately, even the best intentions won’t help you stay on top of your ever-evolving list of priorities, especially if you’re among the 82% of people without a dedicated time management system. With so much at stake, you need a scheduling and planning solution that helps you navigate the daily demands of running a business with precision and efficiency. In this guide, we’ll delve into the effectiveness of weekly planner templates for small businesses. Plus, enjoy three free templates, so you can start crossing items off your to-do list today. What is a weekly planner template?A weekly planner is a tool for managing tasks, appointments, and goals within a specific week. It typically features sections for each day and additional space for notes. In a way, weekly planners are like the Swiss Army knives of time management. While useful on their own, unlocking their full potential requires a grasp of the various attachments and functionalities they offer. To better utilize your weekly planner, separate your planner entries into two main buckets: calendar events and to-dos. Calendar events are your fixed commitments like meetings and scheduled shifts. These events create the backbone of your planner. Once those are in place, sandwich in your to-do’s, which tend to be a bit more flexible. To stay organized, include supporting details like locations, deadlines, and timing. And, it never hurts to sprinkle in important personal dates like birthdays and anniversaries—just in case your memory takes an unintentional personal day A template, on the other hand, is essentially a pre-made design serving as a starting point for commonly used documents or materials. Essentially, it’s a master blueprint, laying the foundation for a seamless and efficient creation process. When you merge the versatility of a metaphorical Swiss Army knife with the precision of a master blueprint, you get a weekly planner template. This is a pre-designed scheduling layout that captures the basic structure found in traditional weekly planners. Key features include hourly time slots, to-do lists, and space for notes. Ultimately, you’ve now got a comprehensive tool for effective organization. Whether filled out digitally or in print, these templates offer a structured format that can be personalized to align with your small business’s specific goals and priorities. It streamlines the planning process, allowing you to save time, maintain consistency, boost productivity, and improve the organization of tasks and responsibilities. How a weekly planner template can grow your small businessSmall business owners are essentially the human embodiment of an internet browser with forty-five tabs open at all times. At any given moment, you’re contemplating better ways to schedule their team, wondering if you placed that last-minute inventory order on time, and brainstorming ways to improve the customer experience. And just like perpetually keeping forty-five tabs open, contemplating too many tasks at once significantly slows down your processing speed. Now, imagine if there was a way to close some of those less important tabs and laser-focus on what matters. It turns out that spending as little as 10-20 minutes planning out your day helps you do just that, saving you up to two hours by guiding your attention to what truly matters. Weekly planners provide the perfect space to prioritize tasks and optimize your workweek for growth. Here are some examples of how utilizing a weekly planner template can help you optimize your work week and transform your business. Schedule marketing contentSmall businesses rely heavily on effective marketing. With a weekly planner template, you can schedule and organize your marketing content, ensuring a consistent online presence and engagement with your audience. This consistency leads to increased brand awareness and customer engagement, allowing you to attract more customers and drive business growth. Keep track of appointmentsMissing crucial meetings or appointments can lead to missed opportunities and hinder your business’ growth. With dedicated time slots to schedule meetings, tasks, and project management, a weekly planner helps you proactively manage your commitments, so you don’t miss a beat. Map out capacity for the weekSmall businesses often operate with limited resources. Using a weekly planner, you can efficiently allocate your team’s time and resources to different tasks and projects. This optimizes your capacity and ensures that you’re making the most of your available resources, which is essential for long-term growth. Breaking bigger tasks into smaller piecesLarge projects or long-term goals can feel overwhelming. A weekly planner template allows you to break down these bigger tasks into manageable steps, assigning them to specific days or even weeks. This approach makes complex tasks and projects more achievable. By keeping your team focused on gradual progress, you can slowly chip away at the tasks they dread most (like quarterly inventory checks), with a bit less resistance. Set and track goalsBusiness growth doesn’t happen by accident, it’s the result of setting intentional goals and doing small things every day to reach them. Making a habit of regularly checking your weekly and monthly goals gives you the push you need to stay on track. This also helps you see if your daily tasks are helping or hurting your bigger goals. Stick to this regular reflection so can stay more focused and crush your goals. Prioritize high-impact tasksWith a never-ending list of tasks and responsibilities, it’s all too easy for an entire day to pass without making headway on your high-priority tasks. Using a weekly planner template helps busy business owners identify and prioritize these tasks so they don’t slip through the cracks. By intentionally spending your time on tasks that truly matter and delegating lower-value tasks that don’t, you can optimize your time and propel your business forward. Manage work-life balanceSmall business owners often grapple with the elusive work-life balance. Between the constant demands of running a company and the responsibilities of home life, it’s easy to feel overwhelmed. Jotting down all your responsibilities in a weekly planner allows you to be fully present in each moment, instead of worrying you’re neglecting one area while attending to the other. Remaining organized as a small business owner is vital, and a weekly planner plays a crucial role in achieving this. It ensures that tasks aren’t just scheduled, they’re tracked and completed. The end result? An accountability tool that supports your productivity and sets the stage for significant business growth. 3 free weekly planner templates you can use in your business

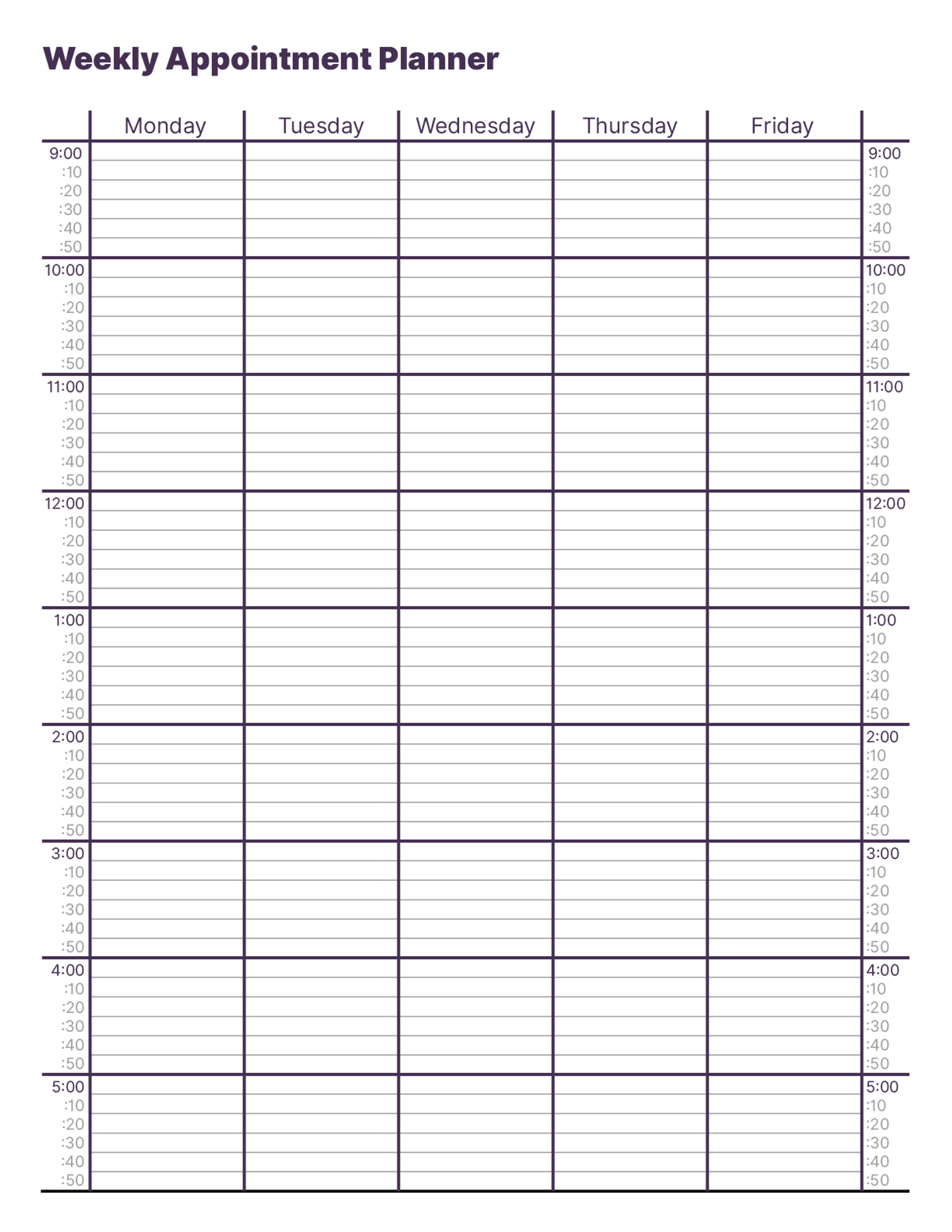

Weekly appointment planner templateThis weekly appointment planner template is for the detail-oriented. With each hourly time slot meticulously broken down into ten-minute increments, you can thoroughly plan out your day. Utilize these hourly slots to schedule meetings or shifts, and feel free to pencil in your to-do lists wherever they fit best. Don’t forget to allocate time for 10-minute breaks to ensure a balanced and productive day!

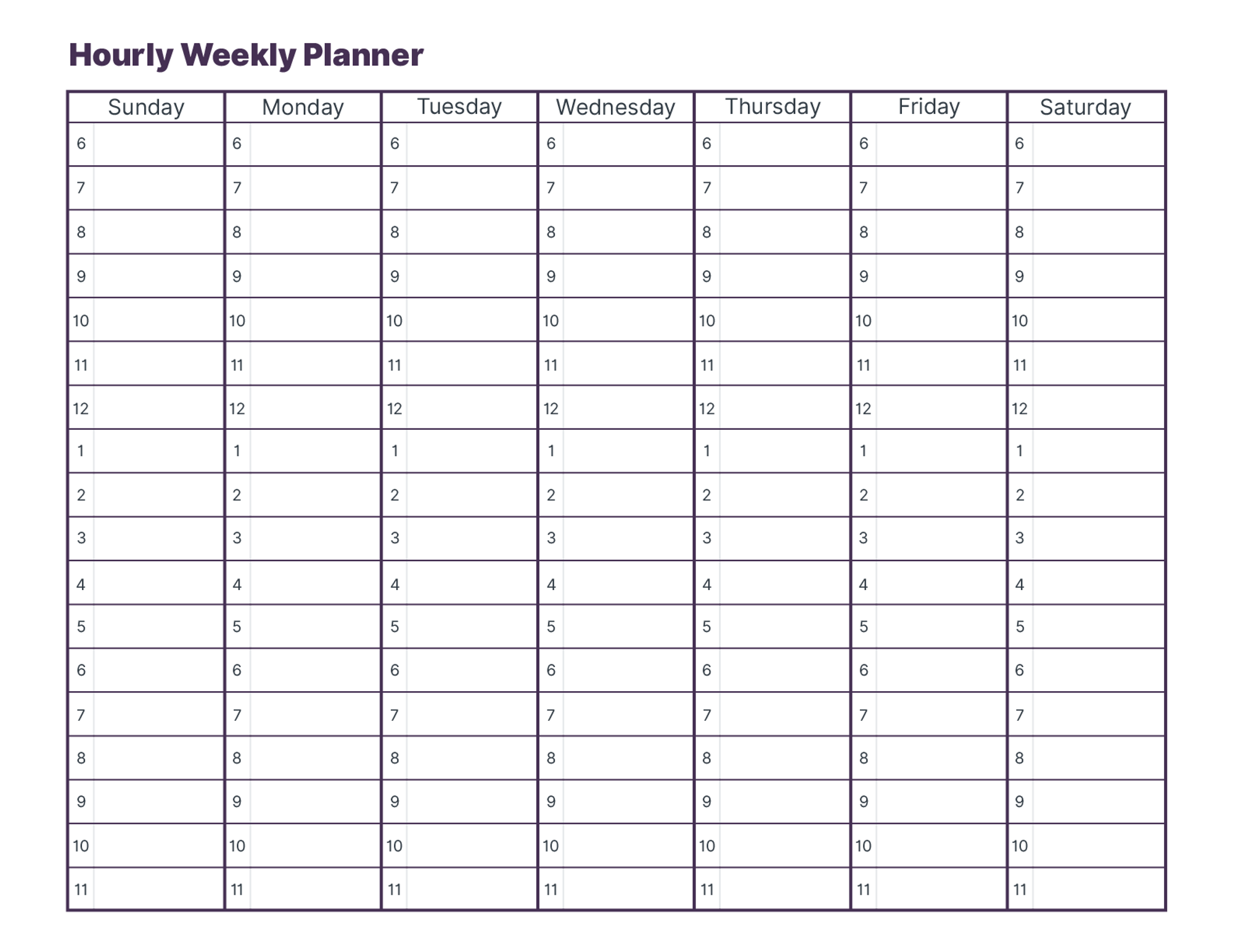

Weekly appointment planner template (download) Hourly weekly planner templateThis hourly weekly planner template is designed with shiftwork in mind. Offering detailed hourly timeslots from Sunday through Saturday, this planner ensures that weekend shifts are given the same level of consideration as the workweek. Because when it comes to shift work, weekends are for working too.

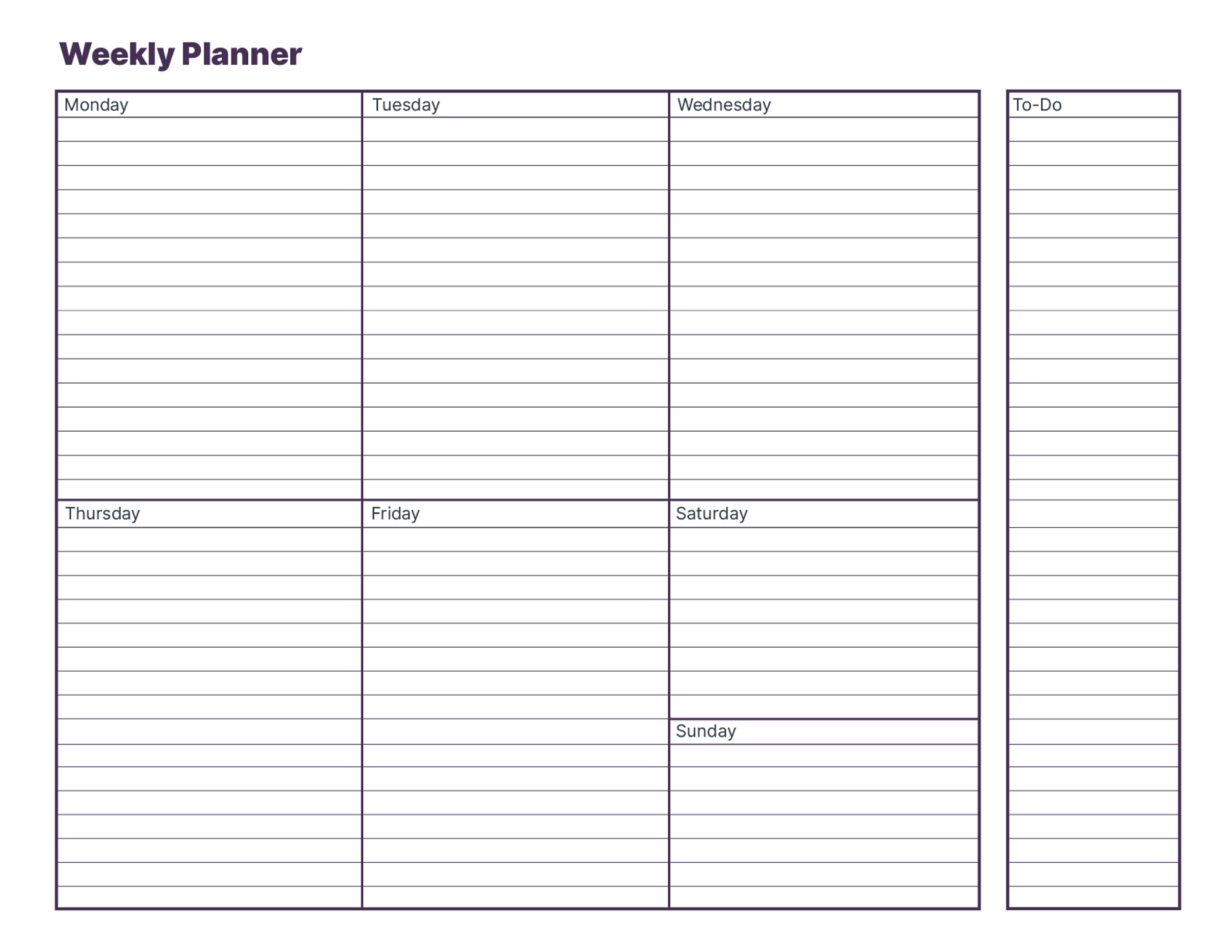

Hourly weekly planner template (download) Weekly planner templateThis weekly planner template caters to those who value flexibility in scheduling their days. Free from rigid hourly time slots, this planner empowers you to pencil in your top priorities as you see fit. With a dedicated section for your to-do list, you can focus on accomplishing tasks throughout the week rather than feeling pressured to check them off daily. So, if your days tend to get away from you, this template gives you a bit more wiggle room to get things done on your own schedule.